AUD/USD Price Forecast: No changes to the sidelined mood

- AUD/USD’s recovery managed to revisit the 0.6500 region on Wednesday.

- The US Dollar could not sustain the initial optimism, despite mixed yields.

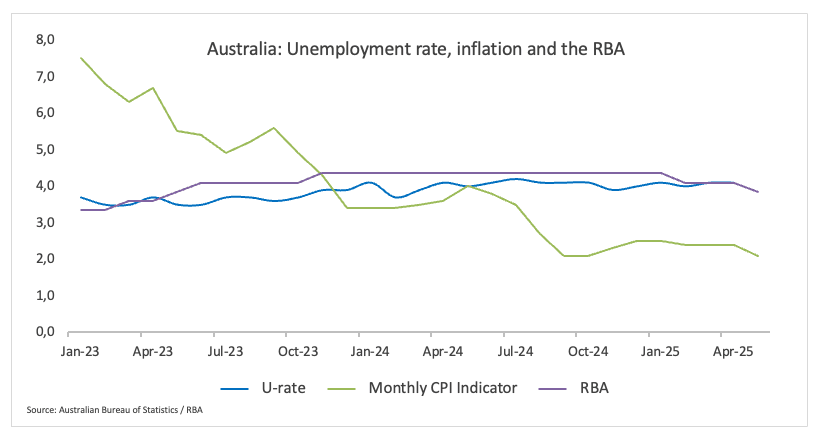

- Australia’s Monthly CPI Indicator eased to 2.1% in May (from 2.4%).

On Wednesday, the Australian Dollar (AUD) fluctuated between gains and losses against the US Dollar (USD), causing AUD/USD to oscillate around the crucial 0.6500 region after two consecutive daily gains.

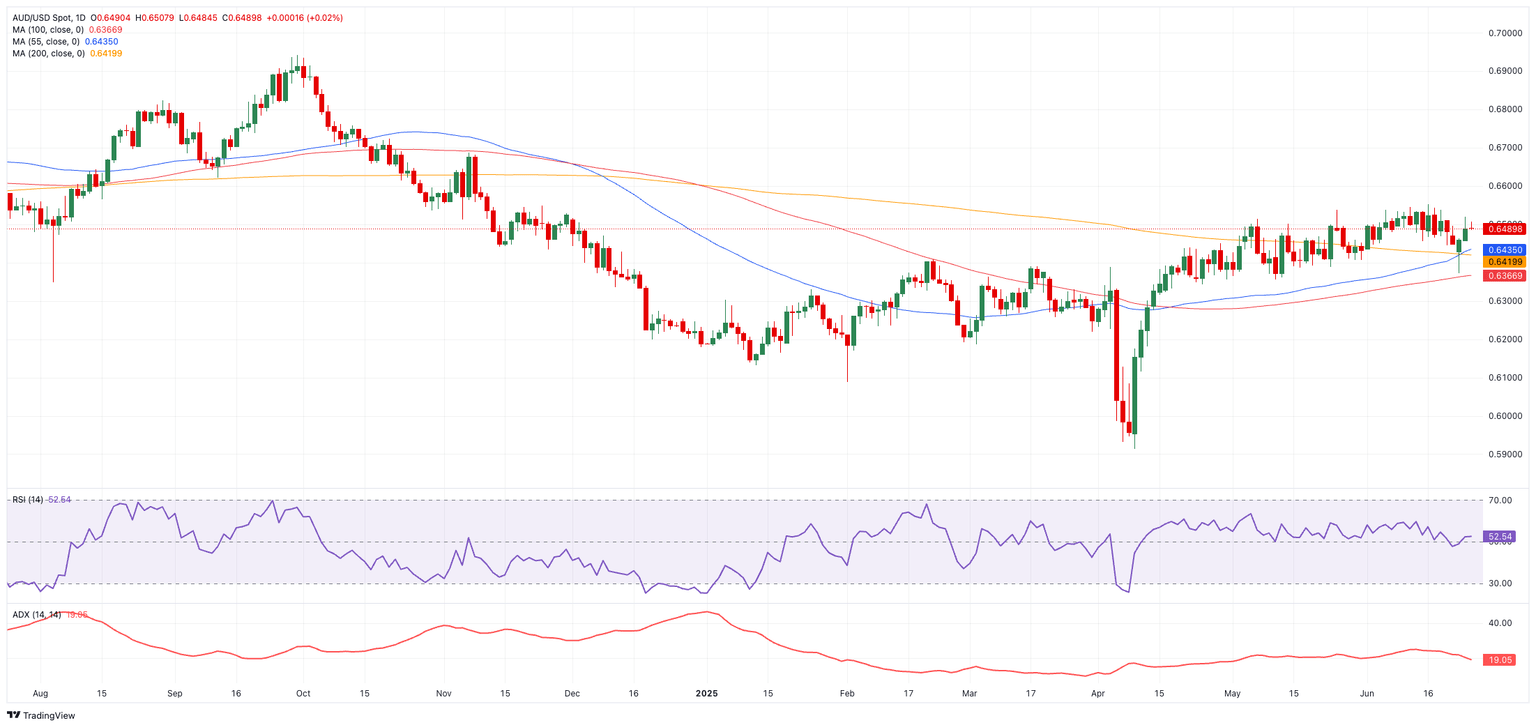

Furthermore, the pair breached its crucial 200-day simple moving average (SMA) near 0.6420, paving the way for the ongoing recovery to continue, at least in the immediate future.

Domestic macro and overseas

Australia’s Monthly CPI Indicator came in at 2.1% in May, down from 2.4% in the previous month and hitting the lowest level so far this year. The measure remains within the RBA’s 2%-3% target, despite the bank is expected to remain laser-focused on developments in the labour market.

Regarding the domestic business activity, preliminary PMIs released at the beginning of the week showed that both the manufacturing and the services sectors are expected to remain within the expansion territory in June at 51.0 and 51.3, respectively.

Australia’s fortunes remain closely tied to demand from its biggest trading partner.

Beijing’s May data showed an uptick in industrial production, retail sales and service-sector growth, supporting year-on-year expansion above 5%.

However, concerns linger over a slumping property market and the tapering of stimulus measures, casting doubt on momentum into late 2025.

At its latest meeting on June 20, the People’s Bank of China (PboC) left its 1-Year and 5-Year Loan Prime Rate (LPR) at 3.00% and 3.50%, respectively. The central bank also pumped CNY300 billion into financial institutions via a one-year medium-term lending facility on June 25, ensuring abundant liquidity in the banking system.

Diverging monetary policies

The Reserve Bank of Australia’s (RBA) decision in late May to trim its cash rate by 25 basis points to 3.85% came along guidance toward a gradual path down to 3.20% by 2027 and was regarded by market participants as a dovish cut.

Minutes from that meeting published early in June showed that the RBA weighed a 50-basis-point “insurance” cut to counter mounting global trade risks from higher-than-expected US tariffs but, deeming Australia’s economy and labour market still resilient, opted instead for a conventional 25-point reduction to 3.85 %, a move already warranted by progress on domestic inflation and reinforced by global uncertainty.

In contrast, the Federal Reserve opted to leave rates unchanged at its latest meeting, reiterating expectations for two half-percentage-point cuts by year-end yet acknowledging internal debate over the pace and timing of any easing.

Fed Chair Jerome Powell cautioned that US goods inflation could rise this summer as President Trump’s tariffs feed through to consumer prices, underscoring the Fed’s delicate balancing act amid ongoing trade tensions and geopolitical uncertainty.

Financial markets are pricing roughly a 70% probability that the RBA will trim rates again at its July 8 meeting, but most analysts expect policymakers to wait for second-quarter inflation data and decide in August.

Interest-rate futures suggest that interest rates will trough near 2.85%–3.10 % early next year, a level viewed as broadly neutral.

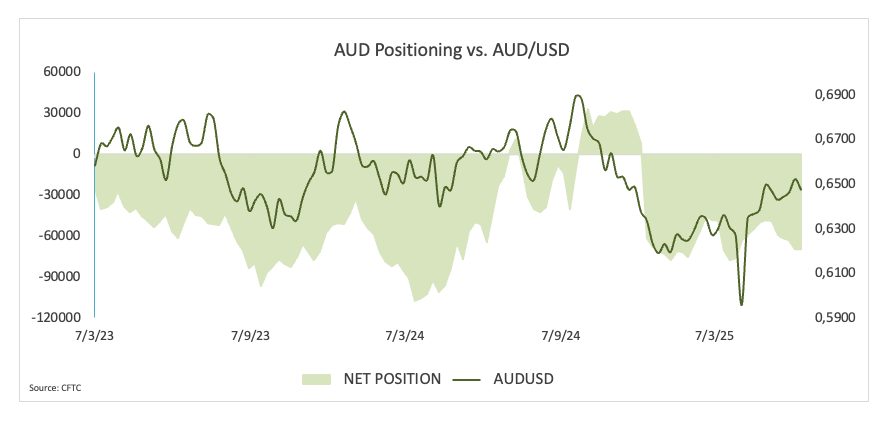

Speculative Positioning

Speculators trimmed their net short positions in AUD/USD to two-week lows around 90.5K contracts in the week ending June 17, according to the latest report from the Commodity Futures Trading Commission (CFTC), suggesting traders appear to have taken a breather regarding their bearish bets on the Aussie. The move, in addition, came with a decent pullback in open interest to around 147.4K contracts, the lowest level in nearly two years.

Technical Outlook

On the daily charts, immediate resistance sits at the YTD peak of 0.6551 (June 16). A decisive break above that could see the pair challenge November 2024 high at 0.6687 (November 7) and the 2024 ceiling at 0.6942, all preceding the psychological hurdle at 0.7000.

On the downside, initial support looms at the June base of 0.6372 (June 23), seconded by the May trough of 0.6356 (May 12). The loss of the latter could put a test of the 0.6000 threshold back on the investors’ radar, ahead of the 2025 base at 0.5913 (April 9).

Momentum indicators remain constructive: the Relative Strength Index (RSI) has climbed toward 52, paving the way to further upside impulse, while an Average Directional Index (ADX) around 21 signals a moderately strong trend.

AUD/USD daily chart

Near-term outlook

The Australian Dollar continues to hold its position in a consolidative phase for the moment. A significant deviation from this trend in either direction would require a robust and external catalyst: A potential game-changer emerging from China appears to be a distant prospect, while significant and lasting advancements in US trade policy also seem unlikely in the near future.

That said, it remains possible that the current rangebound sentiment will persist in the near term.

Back to monetary policy: No significant impact is anticipated from the RBA, as investors have begun to factor in another rate cut later in the year, although a strong easing bias is not expected at this time.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.