AUD/USD Price Forecast: Next on the upside comes 0.6800 and above

- AUD/USD added to Wednesday’s uptick and flirted with 0.6700.

- The Dollar retreated markedly following labour data and inflation prints.

- Australia’s Inflation Expectations eased a tad in September.

The resurgence of the selling bias in US Dollar (USD) lent much-needed oxygen to the risk-associated universe, favouring another positive day in the Australian currency and thus sending AUD/USD higher to the vicinity of the 0.6700 neighbourhood on Thursday.

In the meantime, the Aussie Dollar managed to reverse part of the recent weakness against the US Dollar, maintaining its outlook positive and supported by the 200-day SMA today at 0.6617. However, occasional bouts of strength in the Greenback and persistent concerns about China’s economic outlook present challenges to this optimism.

AUD/USD's second day of gains was accompanied by another daily uptick in copper prices, while iron ore prices saw a slight decline. Continued weakness in iron ore prices could limit further gains for the AUD, given its strong link to China's economic performance.

Monetary policy developments have recently supported the Australian Dollar's upward trend, particularly in August. On this, the Reserve Bank of Australia (RBA) held the Official Cash Rate (OCR) at 4.35%, taking a cautious stance amid ongoing inflationary pressures without signs of immediate easing.

The AUD also found support from a hawkish tone in the latest RBA Minutes, which highlighted discussions among members about potentially raising the cash rate target. The minutes emphasized persistent inflationary pressures and market expectations of possible rate cuts in late 2024.

Navigating the same path, RBA Governor Michelle Bullock reiterated the bank's hawkish stance in her latest remarks, warning of the risks of high inflation. She indicated that, if the economy progresses as expected, the Board does not anticipate needing to cut rates in the near term.

Nevertheless, RBA cash rate futures still show a high probability (around 85%) of a 25 basis point cut by the end of the year.

Overall, the RBA is expected to be the last among G10 central banks to begin cutting rates.

With the Federal Reserve (Fed) expected to implement nearly fully priced-in rate cuts and the RBA likely to maintain a restrictive policy stance for an extended period, AUD/USD could experience further gains later this year.

However, the upside for the Australian Dollar may be constrained by the slow recovery of the Chinese economy. Issues such as deflation and insufficient stimulus measures are hampering China’s post-pandemic recovery. The latest Politburo meeting, while expressing support, did not announce any significant new stimulus, raising concerns about demand from the world's second-largest economy.

Meanwhile, the latest CFTC report for the week ending September 3 showed that speculative net shorts fell to their lowest level in several weeks amid rising open interest, which could support some recovery in spot. The AUD has remained in net-short territory since Q2 2021, except for a brief two-week period earlier this year.

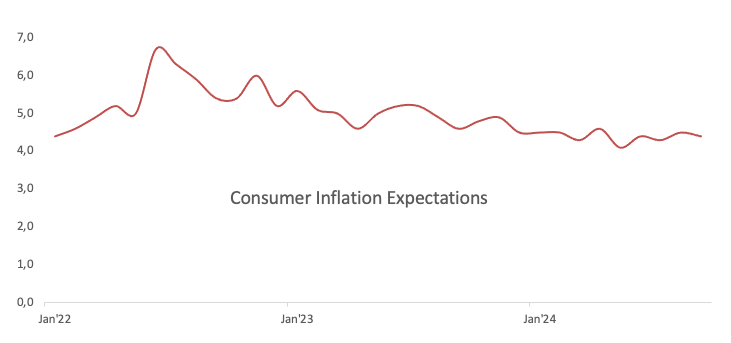

In terms of data, Consumer Inflation Expectations eased to 4.4% in September (from 4.5%), according to the Melbourne Institute.

AUD/USD daily chart

AUD/USD short-term technical outlook

Further gains are expected to propel the AUD/USD to its August top of 0.6823 (August 29), then to the December 2023 peak of 0.6871 (December 28), and ultimately to the critical 0.7000 level.

Sellers, on the other hand, may push the pair below its September low of 0.6622 (September 11) before touching the crucial 200-day SMA of 0.6617.

The four-hour chart shows a gradual pick-up of the bullish stance. That said, the 55-SMA at 0.6706 serves as immediate resistance, followed by the 100-SMA at 0.6734 and then 0.6767. On the other hand, the 200-SMA lies at 0.6657 followed by 0.6622 and then 0.6560. The Relative Strength Index (RSI) rose to around 57.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.