AUD/USD Price Forecast: Near-term support sits around 0.6350

- AUD/USD traded in an inconclusive fashion in the low-0.6400s.

- The US Dollar gathered extra steam as investors assessed the Fed meeting.

- President Trump announced a US-UK trade agreement.

The Australian Dollar (AUD) slipped on Thursday, adding to the previous day’s pullback despite briefly climbing above the 0.6500 mark against the US Dollar (USD).

Indeed, AUD/USD extended its rejection from Wednesday’s five-month high past 0.6510—the strongest since December 2024—before retreating under renewed selling pressure, driven by a marked rebound in the Greenback.

The move came amid improving sentiment over US-China trade ties ahead of the upcoming talks over the weekend, while a fresh US-UK trade deal also contributed to the US Dollar’s strong bounce.

While signs of thawing relations offered a boost to risk appetite, analysts caution that Australia’s economic fortunes remain tightly linked to Chinese demand. Any deterioration in Beijing’s growth trajectory or resurgence in political friction could weigh heavily on the Aussie.

It is worth recalling that the People’s Bank of China (PBoC) recently responded to the country’s softness in economic data with targeted easing this week, trimming the 7-day reverse repo rate by 10 basis points to 1.40% and lowering the reserve requirement ratio (RRR) by 50 basis points. Further measures included increased loan quotas and rate cuts for select sectors. Markets are now focused on April inflation figures due May 10, which may offer further clues on deflationary trends and future stimulus.

Rate path divergence comes into focus

Central bank messaging has also played into recent AUD/USD dynamics. The Federal Reserve (Fed) and Reserve Bank of Australia (RBA) both kept rates unchanged but struck different tones.

Fed Chair Jerome Powell remained on the hawkish side after the Fed kept rates unchanged on Wednesday, reiterating the bank’s “wait-and-see” stance, while RBA Governor Michele Bullock highlighted persistent inflation and a tight labour market as reasons to keep the cash rate at 4.10%.

While a 25 basis point cut at the RBA’s May 20 meeting is still priced in, expectations for deeper reductions have faded. Markets now anticipate up to 125 basis points of cuts over the next year.

Positioning suggests tentative optimism

CFTC data showed net short positions on the Aussie fell to a seven-week low—around 50K contracts as of April 29—while rising open interest points to stabilising sentiment.

What are techs saying?

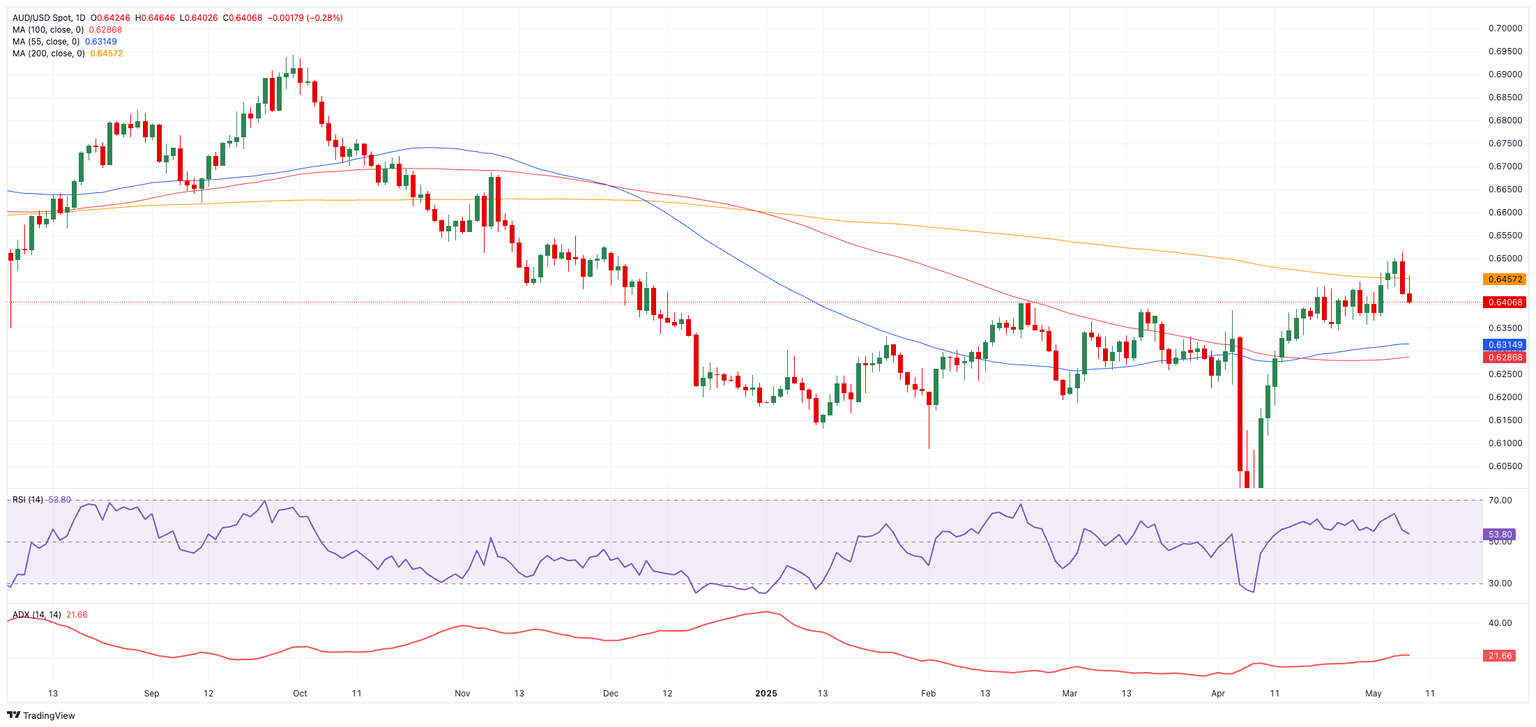

The outlook appears mixed. A convincing move above the 200-day SMA should shift the AUD/USD’s outlook to a more constructive one.

Extra gains are expected to face initial hurdle at the 2025 peak at 0.6514 (May 7), followed by the November 2024 high at 0.6687.

Provisional support levels lie at the 55-day and 100-day SMAs at 0.6313 and 0.6285, respectively. A break below those levels could bring the 2025 bottom at 0.5913 and even the pandemic-era trough near 0.5506 into view.

Momentum indicators suggest the bullish tilt could be put to the test, with the Relative Strength Index (RSI) coming down to 54, and the Average Directional Index (ADX) climbing to nearly 23.

AUD/USD daily chart

Outlook: Cautiously constructive

While technical signals and positioning point to further upside potential, the broader outlook for the Australian dollar remains constrained. Persistent domestic inflation, fragile Chinese demand, and ongoing geopolitical risks suggest any rally may be short-lived without a clearer catalyst from macro data or monetary policy.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.