AUD/USD Price Forecast: Immediate contention emerges at the 200-day SMA

- AUD/USD navigated an inconclusive range around 0.6650 on Monday.

- The Dollar extended Friday’s post-NFP strong recovery amidst lower yields.

- Next on tap Down Under is the Westpac Consumer Confidence gauge.

The US Dollar (USD) maintained its bullish trend, extending Friday’s post-Payrolls advance and keeping the risk complex under pressure at the beginning of the week. Against that, AUD/USD flirted with the 100-day SMA near 0.6650, where some initial support appears to have resurfaced.

Although the Australian Dollar closed the past two weeks in negative territory, it retains a positive outlook, supported by the crucial 200-day Simple Moving Average (SMA) at 0.6615. However, the recent strengthening of the USD and ongoing concerns over China's economic outlook challenge this optimism.

The vacillating tone in AUD/USD came on the back of a solid bounce in copper prices vs. marginal losses in iron ore prices. On the latter, continued weakness in iron ore prices could limit further gains for the AUD, given its strong correlation with China’s economic activity.

Recent changes in monetary policy have also supported the Aussie Dollar’s upward momentum, particularly in August. That sad, the Reserve Bank of Australia (RBA) kept the Official Cash Rate (OCR) at 4.35%, adopting a cautious approach amid ongoing inflationary pressures with no immediate signs of relief.

Further confidence in the AUD came from a hawkish tone in the latest RBA Minutes, which highlighted discussions among members about whether to raise the cash rate target. The minutes emphasized ongoing inflationary pressures and market expectations of potential rate cuts in late 2024.

Additionally, RBA Governor Michelle Bullock reaffirmed the bank’s hawkish stance on Wednesday, warning about the risks of high inflation. She noted that if the economy progresses as expected, the Board does not anticipate being in a position to cut rates in the near future.

Despite this, RBA cash rate futures still suggest a high probability, around 85%, of a 25 bps cut by year-end.

Overall, the RBA is expected to be the last among the G10 central banks to start cutting rates.

However, with almost fully priced-in rate cuts from the Federal Reserve (Fed) on the horizon and the RBA likely to maintain a restrictive policy for an extended period, AUD/USD could experience further gains later this year.

Nonetheless, the Australian Dollar's upside may be capped by the slow recovery of the Chinese economy. Issues like deflation and insufficient stimulus are hampering China’s post-pandemic recovery. The latest Politburo meeting, while expressing support, did not introduce any significant new stimulus measures, raising concerns about demand from the world's second-largest economy.

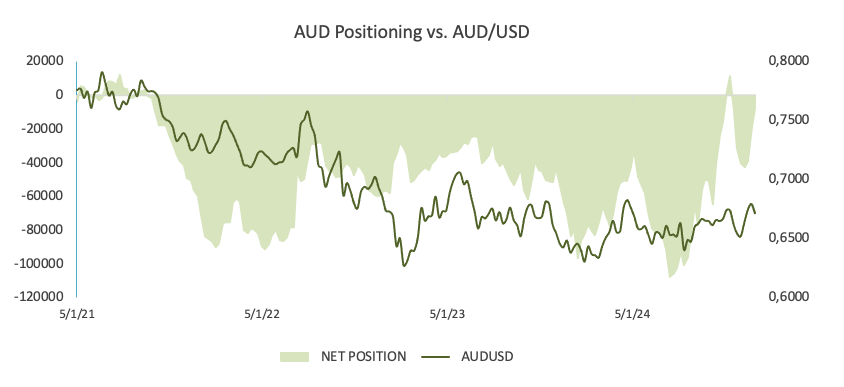

Meanwhile, the latest CFTC report for the week ending September 3 showed that speculative net shorts shrank to the lowest level in several weeks amidst an increase in open interest, which should be supportive of some recovery in spot. The AUD has been in net-short territory since Q2 2021, with only a brief two-week exception earlier this year.

On the economic front, Australia's Consumer Confidence print tracked by Westpac is due on September 10.

AUD/USD daily chart

AUD/USD short-term technical outlook

Further gains are expected to take AUD/USD to its August high of 0.6823 (August 29), then to the December 2023 top of 0.6871 (December 28), and ultimately to the critical 0.7000 level.

Sellers, on the other side, may first push the pair below its September low of 0.6647 (September 9), ahead of the key 200-day SMA of 0.6615.

The four-hour chart shows a small return to the downward tilt. Nonetheless, 0.6689 aligns as immediate resistance, followed by 0.6767, and then 0.6791. On the other hand, the initial support level is 0.6647, prior to 0.6560 and then 0.6507. The RSI rebounded to around 35.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.