AUD/USD Price Forecast: Bears seem losing grip as dovish Fed caps USD recovery

- AUD/USD prolongs its recent sharp retracement slide amid some follow-through USD strength.

- Dovish Fed expectations and a positive risk tone the USD and help limit losses for spot prices.

- Traders now look forward to speeches by influential FOMC members for short-term impetus.

The AUD/USD pair is seen extending last week's retracement slide from its highest level since October 2024 – levels just above the 0.6700 mark – and drifting lower for the fourth consecutive day on Monday. The downward trajectory drags spot prices to an over two-week low during the early part of the European session and is sponsored by the recent US Dollar (USD) recovery.

In fact, the USD Index (DXY), which tracks the Greenback against a basket of currencies, extends last week's recovery from a three-and-a-half-year low amid a hawkish assessment of Federal Reserve (Fed) Jerome Powell's comments. Speaking at the post-meeting press conference last Wednesday, Powell said that the Fed move to lower interest rates for the first time since December was a risk management cut. Powell added that risks to inflation are tilted to the upside and that he doesn't feel the need to move quickly on rates. This, in turn, lifts the USD to an over one-week high and exerts downward pressure on the AUD/USD pair.

The US central bank, however, signaled that more interest rate cuts would follow by the year-end amid signs of a softening labor market. Moreover, traders still believe that interest rates will drop much faster than the Fed is planning and are now betting on the possibility that the short-term rate, currently in the 4.00%-4.25% range, will fall under 3% by the end of 2026. This, along with a generally positive tone around the equity markets, keeps a lid on any further appreciating move for the safe-haven buck. Apart from this, diminishing odds for further rate cuts by the Reserve Bank of Australia (RBA) limit deeper losses for the Aussie.

Meanwhile, the AUD/USD pair reacts little to the People’s Bank of China's (PBOC) decision to keep its benchmark lending rates unchanged for the fourth straight month in September, in line with expectations. The one-year and five-year Loan Prime Rates (LPRs) stood at 3.00% and 3.50%, respectively. This reflect a cautious approach to monetary easing amid easing US-China trade tensions, despite signs of a slowdown. Nevertheless, trade optimism assists spot prices in recovering a few pips from the daily low. There aren't any relevant market-moving economic releases due from the US on Monday. However, speeches from influential FOMC members might drive the USD and provide some impetus to spot prices later during the North American session.

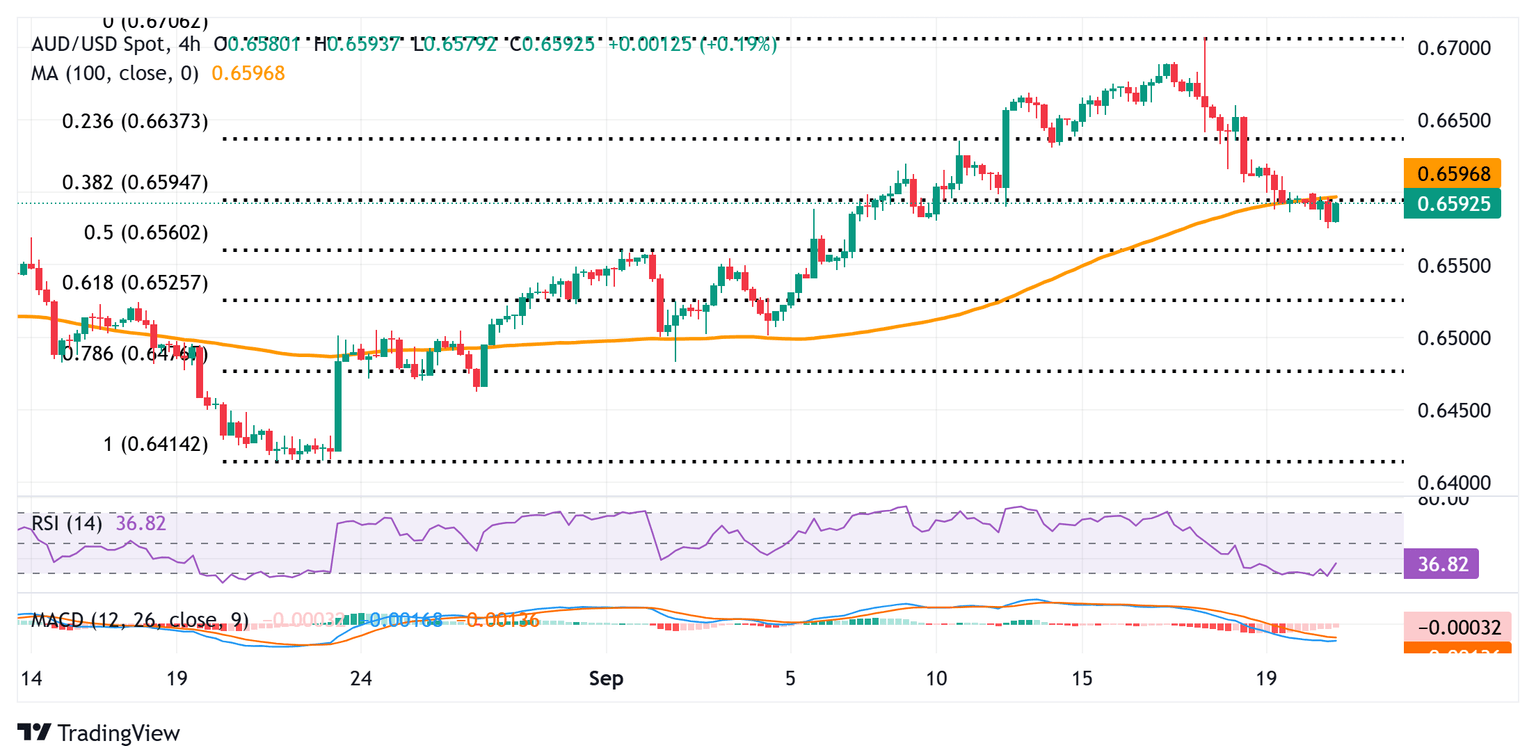

AUD/USD 4-hour chart

Technical Outlook

The AUD/USD pair now seems to have found acceptance below the 0.6600 mark, or the 38.2% Fibonacci retracement level of the recent move up from the August monthly swing low. The said handle coincides with the 100-period Simple Moving Average (SMA) on the 4-hour chart. However, oscillators on the daily chart – though have been losing traction – are holding in positive territory and warrant some caution for aggressive bearish traders. Nevertheless, spot prices still seem vulnerable to slide further towards testing the 50% Fibo. retracement level, around the 0.6560 region. Some follow-through selling would expose the 61.8% Fibo. retracement level, around the 0.6525 area, before the pair eventually drops to the 0.6500 psychological mark.

On the flip side, the 0.6620 region could act as an immediate barrier and cap any attempted recovery. A sustained strength beyond the said barrier, however, could lift the AUD/USD pair to the next relevant hurdle near the 0.6660 region. The subsequent move up could allow spot prices to make a fresh attempt to conquer the 0.6700 mark and climb further towards the 0.6730-0.6735 zone en route to the 0.6800 mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.