AUD/USD Price Forecast 2021: Winning the covid crisis insufficient for the aussie to withstand Chinese boomerang

- Australia weathered the covid crisis better than most, sending the AUD higher by year-end.

- Momentum from the crisis and central bank action could extend the trend early in 2021.

- Relations with China are set to weigh on the aussie, especially in the latter half of the year.

- AUD/USD price forecast poll for 2021 is moderately bullish as commodity currencies are bid.

A trough-to-peak rise of 38% is impressive for most stocks – and a rarity in currency markets, yet that is what happened to AUD/USD in 2021. Australia’s success against COVID-19, Chinese demand and central bank action are behind the rise from the ashes.

These trends will likely extend into early 2021 when Australia’s relative advantage should keep it bid. However, the world’s emergence from the crisis and worsening relations with China – that it heavily depends on – could bring the AUD down under later on.

AUD/USD Price Analysis 2020: Winning coronavirus on three fronts

The Aussie’s risk-currency status has been in play in 2020, similar to the 2008-2009 financial crisis. The currency was sold off with stocks, often in panic as speculators rushed the US dollar – the King of Cash. It then recovered swiftly, surpassing the opening levels of the year:

Better treatment

Australia may officially be a continent, but being an isolated island nation is one reason it successfully coped with coronavirus. Early on, the land down under restricted travel and forced entrants into strict quarantines, successfully stemming the virus’s first wave while temperatures fell.

An outbreak of the disease in Melbourne caused authorities to impose a harsh lockdown that included cutting off ties between Victoria, the encompassing state, and the rest of the nation. These measures and others proved successful, as the chart below shows. Australia outperformed by far other rich-nation peers, except for neighbouring New Zealand.

Source: FT

Opening up to QE

The Aussie tumbled down in March amid a liquidity crunch that sent investors to the safety of the US dollar. However, the cavalry quickly came in – the US Federal Reserve went on a shopping spree that underpinned a stock market rally and sent funds also back toward the AUD.

The Fed did most of the heavy lifting for the global financial system – roughly $3 trillion goes a long way – and it was aided by generous fiscal stimulus from Washington. Authorities down in Canberra were also active.

Phillip Lowe, the Governor of the Reserve Bank of Australia, introduced a bond-buying scheme. Australia’s interest rates used to be among the highest in the developed world – even after the financial crisis. Therefore, going for Quantitative Easing (QE) seemed like a remote option. Nevertheless, the RBA’s scheme helped shore up the government finances.

RBA Balance Sheet:

Source: Trading Economics

Australian Prime Minister Scott Morrison used the money to provide relief to the economy while laying a heavy hand with restrictions. While the former Treasurer oversaw Australia’s first recession since the early 1990s – inevitable as the pandemic wrought havoc across the world – his handling of the crisis brought him praise at home and abroad.

Australia’s unemployment rate stands at 6.8% as of November, still above the post-crisis trough or pre-pandemic levels of 5%, but dropping at a pace that has surprised economists for five consecutive months.

Source: FXStreet

Trade with China

Australia’s near 30 recession-less years were, in a very significant part, a result of China’s spectacular growth and insatiable demand for Australian iron ore, copper and other metals. While newspapers in Sydney and Melbourne already declared the “end of the mining boom” several years ago, China’s landing has been soft, allowing for further growth for Australia.

Demand from the world’s second-largest economy served as another stabilizing factor amid the pandemic. While COVID-19 originated in the Chinese city of Wuhan, Beijing used brute force to curb the spread of the virus and rapidly returned to growth – benefitting Australia.

Australia’s dependency on China:

Source: Australian Bureau of Statistics

However, Canberra’s questioning of China’s handling of the virus triggered retaliation from Beijing. Apart from a public rebuke of statements from Australian officials, authorities in China imposed bans on several imports on safety grounds, which sometimes seemed arbitrary.

The Quadrilateral Security military exercise, including the US, India and Japan, also angered China. Nevertheless, the Aussie advanced around year-end due to events in the US.

US stimulus and vaccine impact

After long months of back and forth, it seems that Congress is on the verge of agreeing on additional stimulus. While it is set to be under $1 trillion, any funds funnelled during the “lame-duck” session are welcome to risk assets, such as the Aussie.

Moreover, President-elect Joe Biden – whose decisive victory served as another boon for markets – promised additional support. While the Fed seems reluctant to act, Chairman Jerome Powell stands ready to intervene and verify that “financial conditions” – aka liquidity and stocks – remain robust.

Another upside driver of risk came from the medical field. At the time of writing, three vaccines have reported favorable efficacy rates, and that from Pfizer and BioNTech is already administered in the US and the UK. The “light of the end of the tunnel” is also weighing on the safe-haven dollar.

AUD/USD 2021 Forecast: Relations with Beijing are a double-edged sword

The world is set to emerge from the coronavirus crisis. Will Australia’s victory help it lead into the future, or will others catch up? How will relations with China evolve? These are the main questions for AUD/USD traders in 2021.

Picking on Australia rather than the US and Europe

It will take time for developed countries and the entire world to reach herd immunity and get rid themselves of COVID-19. In the meantime, another global change happens early in the year – Joe Biden becomes President of the United States.

Outgoing President Donald Trump has been a staunch proponent of bilateral and transactional deals with other countries. His Phase One agreement with China sought, among other things, to appease his rural base with Chinese buying of soya beans. On his way to that January 2020 accord, he slapped tariffs on other countries, including on Canada – and the grounds of national security.

Biden’s administration marks a return to multilateralism – agreed norms and values that separate those that adopt them from the rest. As Democrats and Republicans are united in their desire to halt China’s growing influence, he will likely pursue Beijing’s trade and military practices – but by first aligning allies.

Biden may attempt to return to the Trans-Pacific Partnership (TPP) trade agreement, which worked on as vice president to then-President Barack Obama. Trump pulled out of the deal that binds 40% of the world’s economy and excludes China.

TPP Map:

Source: Trade Vistas

European countries which Trump bashed, Australia and others are set to be part of his alliance – that could “gang up” against Beijing. Xi Jinping, China’s President, will likely push back against limits to his Belt and Road initiative and technological curbs. However, while he could make compromises with the US or Germany, he may pick on Australia.

It would be easier to bully a smaller country that is far more dependent on Beijing. Moreover, China is moving away from the classic industry and massive building into technology. The world’s second-largest economy is, therefore, less dependent on Australian commodities.

Is the land down under ready to also move away from its dependence on China? That will probably take some time, and in the meantime, Sino-Australian relations may further deteriorate in 2021, weighing on the Aussie.

Less dependent on a vaccine

While London is under severe Tier 3 restrictions, New York is facing a shutdown and Christmas looks gloomy in Berlin, Sydney’s Bondi Beach will likely be packed around New Year’s Eve and beyond.

However, this Australian summer – relative strength against its peers – is set to end once vaccine production and distribution ramp up elsewhere. On one hand, growing demand for Australian exports is good news for the nation and the recovery could gather some pace. However, it would eventually erode its advantage.

Investors chasing higher returns may move away from the South Pacific, weighing on the Aussie in the latter part of the year.

US stimulus remains a critical factor

Will exports to America compensate for some of the lost trade with China? That heavily depends on Uncle Sam’s expenditure. If Democrats win the two runoffs in Georgia, they would have effective control of the Senate, allowing them to enact a more generous stimulus package. Biden could then fulfil his promise to boost US infrastructure, such spending would also make its way to Australia and strengthen the global economy.

Even without largesse from Congress, Federal Reserve’s action remains critical for the aussie. If the current rate of QE – some $120 billion/month holds up or even rises, the AUD would benefit. As long as America’s inflation remains subdued – and there is no guarantee due to potential post-covid supply issues – the greenback would stay depressed and AUD/USD would shine.

Source: Federal Reserve

RBA to taper slowly

Will Governor Lowe lift Australia’s interest rate from its lows? Eventually, the RBA is set to pick borrowing costs up from their lows, but that is unlikely in 2021. The Canberra-based institution tends to leave rates unchanged for months and, sometimes, years. Without any major shocks, the bank will likely reduce its balance sheet at a snail’s pace.

Instead of making Aussie-moving policy announcements, there is a higher chance that the RBA announces macro-prudential measures to curb rising house prices in Australia’s largest cities. It will be hard to stem the global tide in house prices, but demanding higher down payments, limiting foreign investment and being creative with other measures would substitute rate hikes and allow the Aussie to drop.

AUD/USD Technical Levels 2021

The weekly chart provides a big-picture view of AUD/USD movements and the critical levels to watch out for. The Aussie has surpassed both the 50-week and 200-week Simple Moving Averages for the first time since early 2018, a bullish sign. On the other hand, it is entering overbought territory – a Relative Strength Index of 70 or higher – on the weekly chart, thus indicating a substantial correction.

The immediate upside resistance line is 0.7680, which held AUD/USD back in early 2018. It is followed by 0.7810 that capped it earlier that year and also provided support in mid-2017.

Another line that played such a dual role is 0.79, which last capped a recovery attempt as the page turned onto 2018. Perhaps the fiercest resistance awaits at 0.8180, which is a robust long-term double top.

Support awaits at 0.74, a former double-top after capping AUD/USD in late 2018 and on its way up in 2020, before a recent break to the upside. The next level to watch is 0.70 and a round number provided worked as a double-bottom before the late surge.

Further down, 0.6650 both cushioned the pair in late 2019 and was a swing low beforehand. Even lower, 0.6230, was a stepping stone on the way up. The 2020 abyss at around 0.55 is unlikely to be tackled in 2021.

Conclusion

Emerging from the worst of the crisis is the aussie's speciality but maintaining the bullish trend is entirely different. The post-covid year could start with a surge but end with a downtrend for AUD/USD as the world catches up, geopolitical dynamics shift and central bank actions fail to provide the same oomph as beforehand.

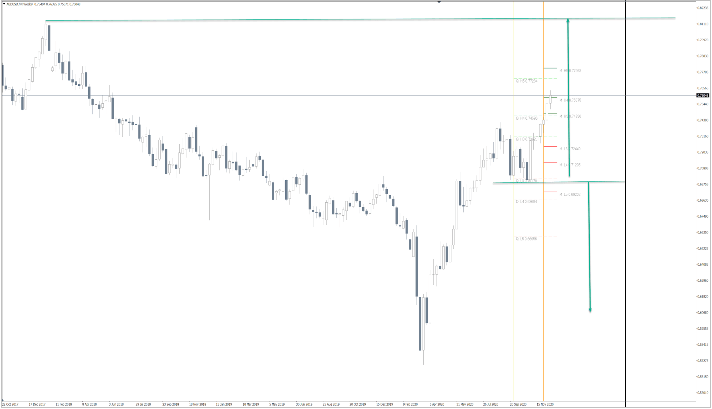

Nenad Kerkez projects a long-term bullish outlook for the aussie on his Camarilla Pivot Point analysis:

AUD/USD Camarilla Pivot Point Analysis

The AUD/USD is very similar to GBP/USD except that this commodity currency (AUD) is not dependent on Brexit but rather Gold, Iron Ore and Copper exports. We can see on the chart that the pair is bullish and I expect 0.7723, 0.7798 and 0.8150 levels to be it in 2021.

Forecast Poll 2021

| Forecast | Q1 - Mar 31st | Q2 - Jun 30th | Q4 - Dec 31st |

|---|---|---|---|

| Bullish | 40.0% | 31.7% | 43.9% |

| Bearish | 12.5% | 4.9% | 9.8% |

| Sideways | 45.0% | 63.4% | 46.3% |

| Average Forecast Price | 0.7684 | 0.7752 | 0.7988 |

| EXPERTS | Q1 - Mar 31st | Q2 - Jun 30th | Q4 - Dec 31st |

|---|---|---|---|

| Alberto Muñoz | 0.7800 Bullish | 0.8000 Bullish | 0.8230 Bullish |

| Alistair Schulz | 0.7500 Sideways | 0.7800 Sideways | 0.8000 Bullish |

| Andrew Lockwood | 0.7700 Sideways | 0.7700 Sideways | 0.8000 Bullish |

| Andrew Pancholi | 0.7980 Bullish | 0.7680 Sideways | 0.8040 Bullish |

| Andria Pichidi | 0.7500 Sideways | 0.7700 Sideways | 0.7800 Sideways |

| ANZ FX Strategy Team | 0.7400 Sideways | 0.7600 Sideways | 0.7900 Sideways |

| BBVA FX Team | 0.7300 Sideways | 0.7500 Sideways | 0.7600 Sideways |

| Blake Morrow | 0.7600 Sideways | 0.7200 Sideways | 0.7700 Sideways |

| Brad Alexander | 0.8000 Bullish | 0.8000 Bullish | 0.7500 Sideways |

| Commerzbank Analyst Team | 0.7100 Bearish | 0.7200 Sideways | 0.7300 Sideways |

| Dmitry Lukashov | 0.7900 Bullish | 0.8300 Bullish | 0.8100 Bullish |

| Dukascopy Bank Team | 0.8000 Bullish | 0.8150 Bullish | 0.8850 Bullish |

| Eliman Dambell | 0.8300 Bullish | 0.7400 Sideways | 0.6700 Bearish |

| FP Markets Team | 0.8100 Bullish | 0.7700 Sideways | 0.8000 Bullish |

| Frank Walbaum | 0.7820 Bullish | 0.7500 Sideways | 0.7200 Sideways |

| George Hallmey | 0.8000 Bullish | 0.7600 Sideways | 0.8500 Bullish |

| Giles Coghlan | 0.8000 Bullish | 0.8300 Bullish | 0.9000 Bullish |

| Grega Horvat | 0.7700 Sideways | 0.7600 Sideways | 0.7400 Sideways |

| Jamie Saettele | 0.7000 Bearish | 0.7600 Sideways | 0.8300 Bullish |

| Jeff Langin | 0.7700 Sideways | 0.7850 Bullish | 0.7500 Sideways |

| Jeffrey Halley | 0.8000 Bullish | 0.8500 Bullish | 0.9500 Bullish |

| JFD Team | 0.8130 Bullish | 0.8660 Bullish | 0.9500 Bullish |

| Joseph Trevisani | 0.7800 Bullish | 0.8300 Bullish | 0.9200 Bullish |

| JP Morgan Global FX Strategy | - | 0.6800 Bearish | 0.6800 Bearish |

| Kaia Parv, CFA | 0.7800 Bullish | 0.7250 Sideways | 0.7000 Bearish |

| M.Ali Zah | 0.7025 Bearish | 0.7600 Sideways | 0.6690 Bearish |

| Matthew Levy, CFA | 0.9700 Bullish | 0.9800 Bullish | 0.9900 Bullish |

| Murali Sarma | 0.7559 Sideways | 0.7325 Sideways | 0.7562 Sideways |

| Navin Prithyani | 0.7400 Sideways | 0.7600 Sideways | 0.8000 Bullish |

| Nomura FX Research & Strategy | 0.7100 Bearish | 0.7300 Bullish | 0.7400 Sideways |

| Paul Dixon | 0.7500 Sideways | 0.7500 Sideways | 0.7500 Sideways |

| Rick Ackerman | 0.7628 Sideways | - | - |

| RoboForex Team | 0.7900 Bullish | 0.8000 Bullish | 0.8500 Bullish |

| Sachin Kotecha | 0.8000 Bullish | 0.9000 Bullish | 1.0500 Bullish |

| Société Génerale Analyst Team | - | 0.7400 Sideways | 0.7900 Sideways |

| Standard Bank Research Team | 0.7300 Bullish | 0.7400 Sideways | 0.7600 Bullish |

| Stephen Innes | 0.7700 Sideways | 0.8000 Bullish | 0.8000 Bullish |

| Theotrade Analysis Team | 0.6200 Bearish | 0.6500 Bearish | 0.7500 Sideways |

| UniCredit Research | 0.7400 Sideways | 0.7500 Sideways | 0.7700 Sideways |

| Walid Salah El Din | 0.7600 Bearish | 0.7700 Bearish | 0.7800 Sideways |

| Wayne Ko Heng Whye | 0.7700 Sideways | 0.7600 Sideways | 0.7550 Sideways |

| Yohay Elam | 0.7500 Sideways | 0.7700 Sideways | 0.7800 Sideways |

Risk on with vaccine will push global ecomomies higher supporting commodity currencies.

The appeteite for commodities such as Iron Ore and Copper will be a tailwind for the AUDUSD in 2021. We believe the lows from 2021 were generational and should stay well above .7000 through 2021..

by Blake Morrow

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637443139660579572.png&w=1536&q=95)

-637443140510977206.png&w=1536&q=95)

-637443141504013389.png&w=1536&q=95)

-637443142472857920.png&w=1536&q=95)

-637443143312801542.png&w=1536&q=95)

-637443144861551373.png&w=1536&q=95)

-637443146712995617.png&w=1536&q=95)

-637443148365794940.png&w=1536&q=95)