AUD/USD outlook: Falls further as RBA decision disappoints traders

AUD/USD

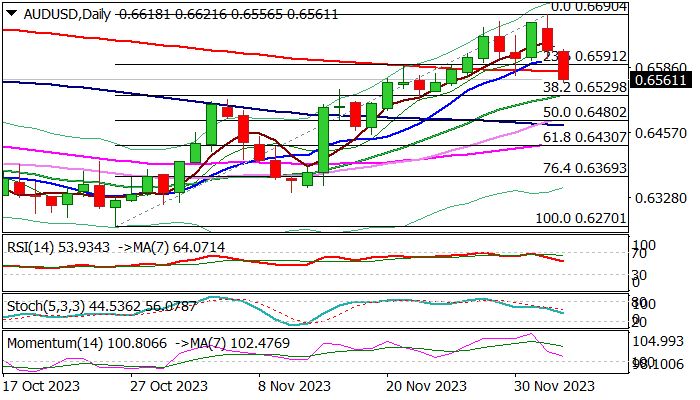

AUDUSD extends pullback from four month high (0.6690) into second straight day, additionally pressured from decision of Australian Central Bank to keep interest rates unchanged.

Although the RBA’s statement kept hawkish bias, traders were disappointed and continued to sell Aussie dollar.

Fresh weakness broke below 200DMA (0.6578), to further soften near-term structure for attack at pivotal support at 0.6529 (Fibo 38.2% of 0.6270/0.6690, reinforced by rising 20DMA) violation of which would generate reversal signal and open way for deeper drop.

Sharp loss of bullish momentum and south-heading RSI contribute to negative outlook, in addition to daily cloud twist early next week, which could be magnetic.

Upticks should stay capped under 0.6600 zone to keep bears in play.

Res: 0.6578; 0.6591; 0.6614; 0.6663.

Sup: 0.6529; 0.6502; 0.6480; 0.6430.

Interested in AUD/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.