AUD/USD Outlook: Bulls need to wait for sustained move and acceptance beyond 38.2% Fibo.

- AUD/USD meets with a fresh supply in reaction to rather unimpressive domestic employment data.

- The uncertainty over the Fed’s rate-hike path benefits the USD and also exerts pressure on the pair.

- A softer risk tone further underpins the buck and drives flows away from the risk-sensitive Aussie.

The AUD/USD pair comes under heavy selling pressure following the release of Australian employment details on Thursday and retreats further from over a three-month peak, around the 0.6540 region touched the previous day. The Australian Bureau of Statistics reported that the number of employed people rose by 55K in October, smashing estimates pointing to a reading of 20K and 6.7K seen in September. The bulk of the addition, however, was led by a surge in part-time jobs. Moreover, the jobless rate edged up to 3.7% in the wake of a jump in the participation rate back to an all-time peak of 67%. This, in turn, suggests that the labour market is not the main driver of inflation, giving the Reserve Bank of Australia (RBA) little reason to hike interest rates again in December. Apart from this, some follow-through US Dollar (USD) buying turns out to be another factor contributing to the offered tone surrounding the major.

The USD Index (DXY), which tracks the Greenback against a basket of currencies, is seen gaining positive traction for the second straight day and building on the overnight bounce from its lowest level since September 1. The softer US CPI report released on Tuesday showed that consumer inflation was cooling faster than anticipated. Adding to this, the decline in October US Retail Sales, for the first time in seven months, was less than expected, suggesting that the economy remains on track for a soft landing. This could allow the Federal Reserve (Fed) to stick to its hawkish stance and wait for longer before cutting rates, fueling worries about economic headwinds stemming from higher borrowing costs. Adding to this, mixed signals from high-level US-China talks weigh on investors' sentiment, which, in turn, drives some haven flows towards the safe-haven buck and exerts additional pressure on the risk-sensitive Aussie.

Market participants, meanwhile, seem convinced that the Fed will not hike interest rates again and have been pricing in the possibility of rate cuts during the first half of 2024. This is reinforced by a fresh leg down in the US Treasury bond yields, which might hold back the USD bulls from placing aggressive bets and help limit losses for the AUD/USD pair. Hence, it will still be prudent to wait for strong follow-through selling before confirming that spot prices have formed a near-term top and positioning for any meaningful depreciating move. Traders now look to the US economic docket, featuring the release of the usual Weekly Initial Jobless Claims, the Philly Fed Manufacturing Index and Industrial Production data later during the early North American session. Apart from this, speeches by influential FOMC members, along with the broader risk sentiment, will drive the USD demand and provide some impetus to the major.

Technical Outlook

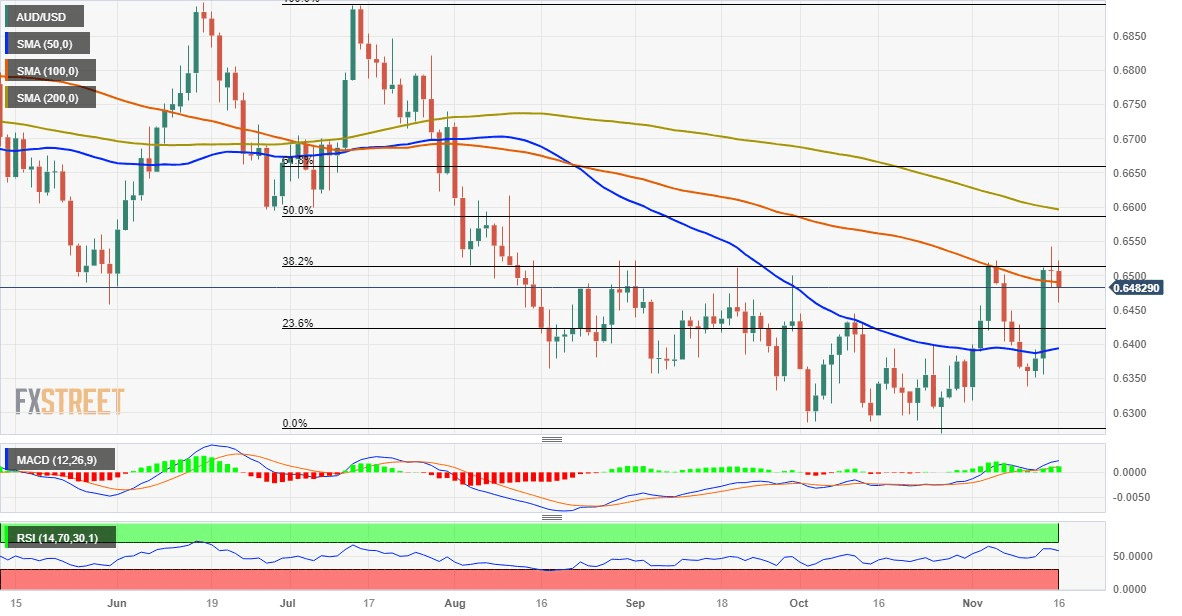

From a technical perspective, the AUD/USD pair, so far, has been struggling to find acceptance above the 38.2% Fibonacci retracement level of the July-October downfall. The subsequent downfall warrants caution for bullish traders. That said, oscillators on the daily chart are holding comfortably in the positive territory and support prospects for the emergence of some dip-buying. This should help limit losses near the 23.6% Fibo. level, around the 0.6420-0.6415 region, which is closely followed by the 0.6400 mark. A convincing break below the latter might shift the bias in favour of bearish traders and drag spot prices further towards last week's swing low, around the 0.6340-0.63352 region.

On the flip side, the 38.2% Fibo. level, around the 0.6510 area, might continue to act as an immediate hurdle ahead of the overnight swing high, around the 0.6540 zone. Some follow-through buying will confirm a near-term breakout through the 100-day Simple Moving Average (SMA) and allow the AUD/USD pair to climb further towards the 0.6580-0.6590 confluence barrier. The latter comprises the 50% Fibo. level and the 200-day SMA, which if cleared decisively could push spot prices further beyond the 0.6600 round-figure mark, towards the 61.8% Fibo. level, around the 0.6650-0.6655 area.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.