AUD/USD outlook: Bears may pause for consolidation, daily cloud top to cap upticks

AUD/USD

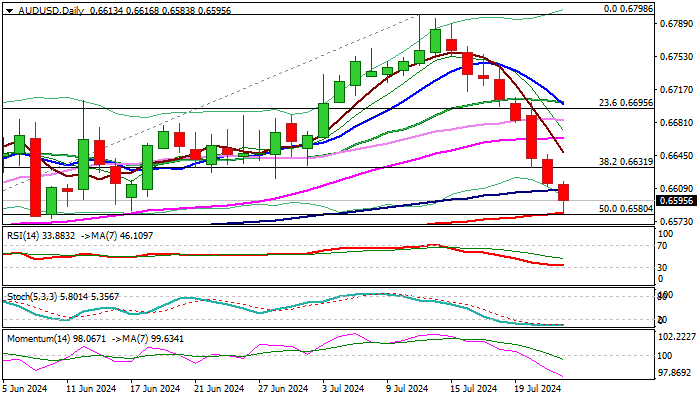

AUDUSD remains in red for the eighth consecutive day and fell to the lowest in six weeks in early Wednesday.

Aussie dollar remains under increased pressure from stronger US dollar, falling prices of commodities and concerns about China’s economic growth.

Bears cracked pivotal support at 0.6580 (200DMA / 50% retracement of 0.6362/0.6798) after Tuesday’s close below Fibo 38.2% and break below 100DMA in early Wednesday’s trading.

The price is holding in the middle of thick daily Ichimoku cloud, with formation of daily Tenkan / Kijun-sen bear cross adding to bearish near term outlook.

However, strongly oversold conditions warn that bears may pause for consolidation, with 200DMA producing headwinds and keeping the price action for now.

Corrective upticks should be capped under cloud top (0.6642) to keep bears in play and offer better selling opportunities for fresh push lower and attack at 0.6538/28 targets (daily cloud base / Fibo 61.8%).

Res: 0.6607; 0.6631; 0.6642; 0.6663.

Sup: 0.6580; 0.6538; 0.6528; 0.6465.

Interested in AUD/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.