AUD/USD outlook: Aussie rises after RBA, strong Chinese data

AUD/USD

The Australian dollar advanced to the highest in nearly two weeks on Tuesday, lifted by rising risk sentiment and RBA minutes.

In minutes of its September meeting Australia's central bank stated it will maintain highly accommodative settings and indicated no changes in the policy for now.

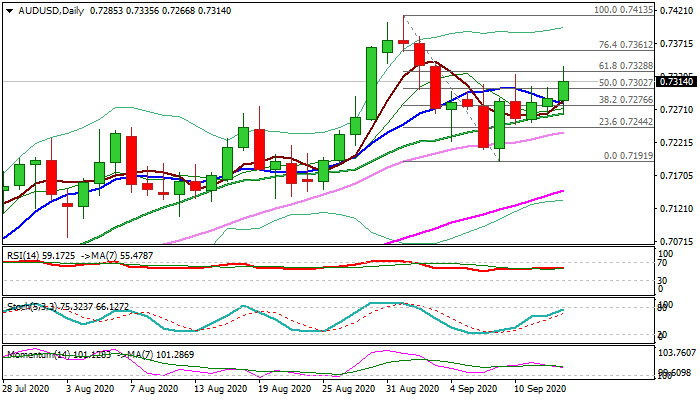

Fresh advance probed again above 0.7300, following recent multiple failures to close above this barrier and cracked pivotal Fibo level at 0.7328 (61.8% of 0.7413/0.7191). Bulls need close above 0.7300 (also 50% retracement) for initial bullish signal, which would be confirmed on close above 0.7328 and expose key barrier at 0.7413 (two-year high, posted on 1 Sep).

Caution on repeated failure to clearly break 0.7300 hurdle that would keep the downside vulnerable.

Res: 0.7335; 0.7361; 0.7395; 0.7413

Sup: 0.7300; 0.7275; 0.7264; 0.7244

Interested in AUD/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.