AUD/USD outlook: Aussie remains capped by 10DMA, keeping bearish bias

AUD/USD

The Aussie dollar eases from one-week high on Tuesday after failing to benefit more from positive news that China slashed Covid quarantine for international travelers.

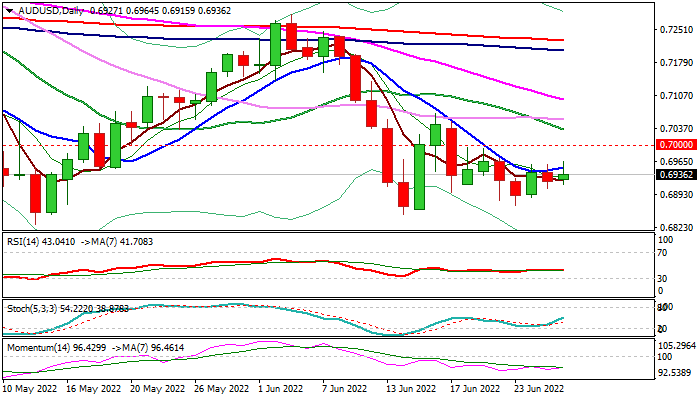

The price action fell back below 10DMA (0.6951) which caps the price since June 9 and maintains negative bias, with repeated daily close below to add to fragile near-term structure.

Daily technical studies remain in full bearish setup and keep negative outlook for retest of key supports at 0.6850/28 (June 14/May 12 lows).

The upside is expected to remain well protected by 10DMA and psychological 0.70 barriers.

Res: 0.6951; 0.7000; 0.7035; 0.7055.

Sup: 0.6907; 0.6869; 0.6850; 0.6828.

Interested in AUD/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.