AUD/USD outlook: Aussie falls to two-week low

AUD/USD

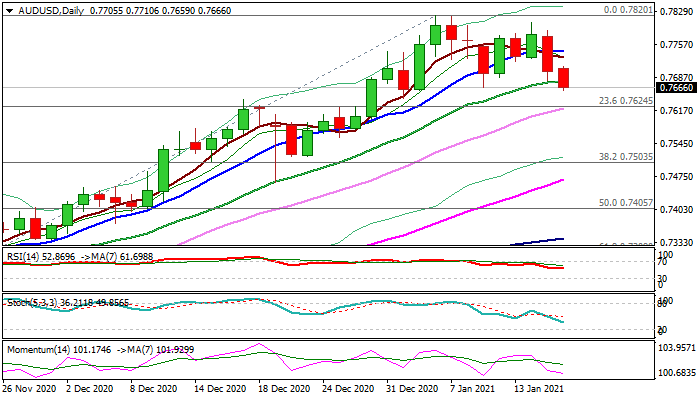

The Australian dollar stays in red for the second consecutive day and falls to two-week low on Monday, weighed by fading risk sentiment and higher greenback on comments that the US does not seek weaker dollar.

Fresh extension lower is about to complete failure swing pattern on daily chart that would add on existing signs of reversal.

Probe below 20DMA (0.7678) eyes pivotal Fibo support at 0.7624 (23.6% of 0.6991/0.7820) reinforced by rising 30DMA, close below which would open way towards next key support at 0.7503 (Fibo 38.2% of 0.6991/0.7820).

Formation of 5/10DMA bear-cross weighs on near-term action, along with fading bullish momentum and south-heading daily stochastic and RSI.

Res: 0.7678; 0.7710; 0.7730; 0.7743

Sup: 0.7659; 0.7624; 0.7557; 0.7503

Interested in AUD/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.