AUD/USD Forecast: Waiting for the RBA

AUD/USD Current Price: 0.6430

- Aussie under pressure amid risk-averse market’s mood.

- The Reserve Bank of Australia is expected to maintain its policy unchanged.

- AUD/USD bounced from a one-week low but retains its negative tone.

The AUD/USD pair trades with modest intraday gains at the end of the American session in the 0.6420 price zone, helped by Wall Street’s recovery from intraday lows. The Aussie fell at the beginning of the day, undermined by the prevalent risk-averse sentiment and softer than expected Australian inflation. The TD Securities Inflation estimate for April resulted in -0.1% MoM and at 1.2% YoY, below its previous estimates. On a positive note, Building Permits in the country beat market’s expectations down by 4.0% in March vs the -15% forecast.

The Reserve Bank of Australia is having a monetary policy meeting this Tuesday. Policymakers are expected to live the rates at a record low of 0.25%, although investors will be looking for a possible adjustment to the central bank’s assets purchase program. More relevant, investors will scrutinize Lowe’s words about the economic situation of the country and estimates of growth and unemployment.

AUD/USD short-term technical outlook

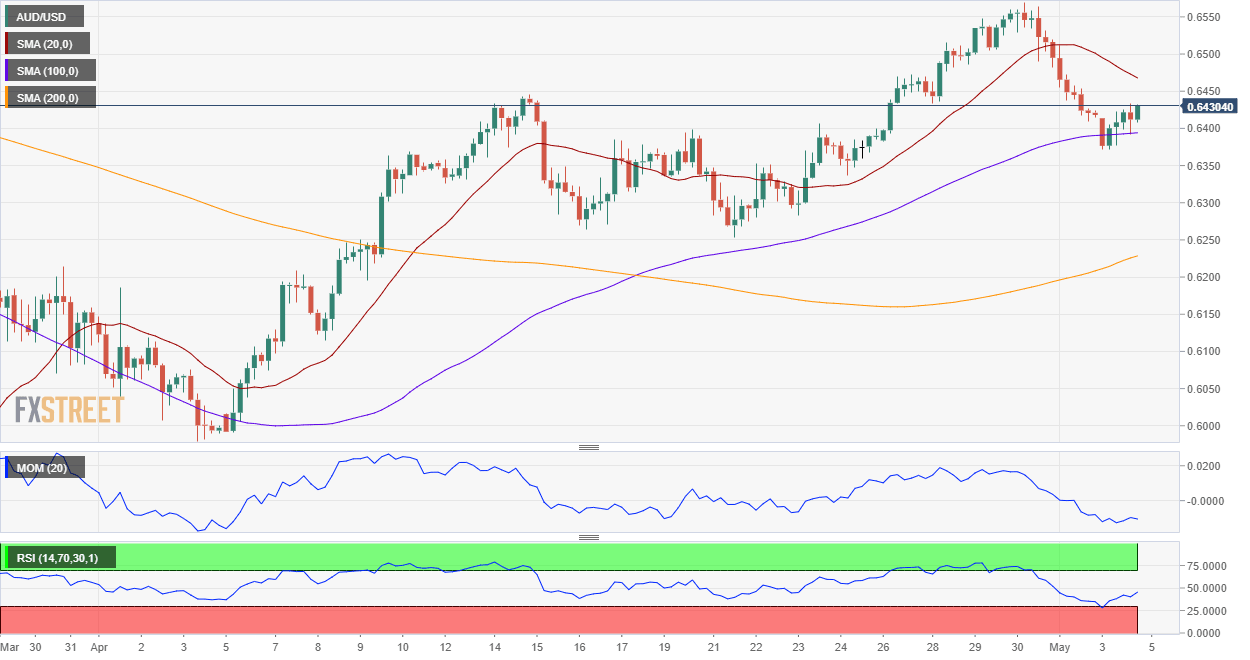

The AUD/USD pair has recovered from 0.6372, its lowest in a week, but remains at risk of extending its decline according to intraday readings. In the 4-hour chart, the 20 SMA gains bearish strength above the current level, although it met buyers around its 100 SMA. Technical indicators have recovered from oversold levels, but remain within negative levels. Overall, the upcoming directional strength will depend on Lowe’s words.

Support levels: 0.6375 0.6350 0.6310

Resistance levels: 0.6440 0.6480 0.6515

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.