AUD/USD Forecast: There is a strong support around 0.6520

- AUD/USD advances further north of 0.6600.

- The resumption of the risk-on trade underpins the Aussie dollar.

- Auspicious PMI prints also bolster the upside in the pair.

Bulls seem to have returned and pushed AUD/USD back above the key 0.6600 barrier on Wednesday, adding to the decent gains observed in the previous session. All in all, spot seems to have put some distance from last week’s yearly lows around 0.6520 for the time being.

This time, the renewed selling pressure around the greenback underpinned the upward bias in the Aussie dollar, while there was no news around China and its lagged economic bounce in post-pandemic life.

The Chinese factor, in combination with the projected decision by the Reserve Bank of Australia (RBA) to maintain its current policy stance at its meeting in February, is still seen as limiting the upside potential of the pair in the next few weeks, allowing for extra retracements in the short-term horizon.

The decline in inflation metrics observed in December, along with the continued moderation of the labour market (albeit still relatively tight), seems to have solidified the consensus among market participants that the RBA would keep its rates on hold, at least in February.

Also weighing on the pair’s price action and even tilting the scales to the bearish side aligns the likelihood that the Federal Reserve could continue to delay expectations of an interest rate reduction in the coming months, a scenario that should be dollar-supportive.

Back to the positive zone, further strength in AUD came on the back of better-than-estimated flash Manufacturing and Services PMIs in Australia in January, at 50.3 and 47.9, respectively.

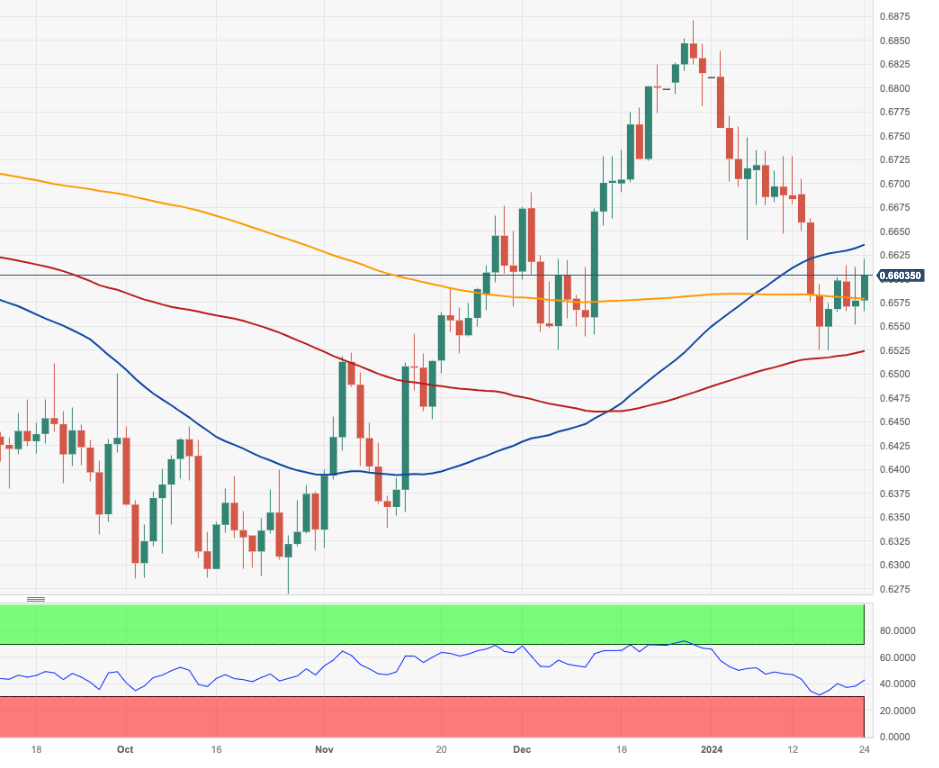

AUD/USD daily chart

AUD/USD short-term technical outlook

If the recovery in AUD/USD gets more serious, the pair could confront the provisional 55-day SMA at 0.6627 prior to the December 2023 peak of 0.6871 (December 28), which is preceded by the July 2023 high of 0.6894 (July 14) and the June 2023 top of 0.6899 (June 16), all of which occur before the critical 0.7000 yardstick.

The 4-hour chart shows the pair putting the upper end of the range to the test for the time being. Next on the upside now comes the 100-SMA at 0.6658 ahead of the 200-SMA at 0.6681. The surpass of this region exposes a probable move to tops near 0.6730. Looking south, remains a reasonable contention zone around 0.6525. If this zone is breached, no significant disagreement persists until 0.6452. The MACD flirts with the positive border, and the RSI hovers around 55.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.