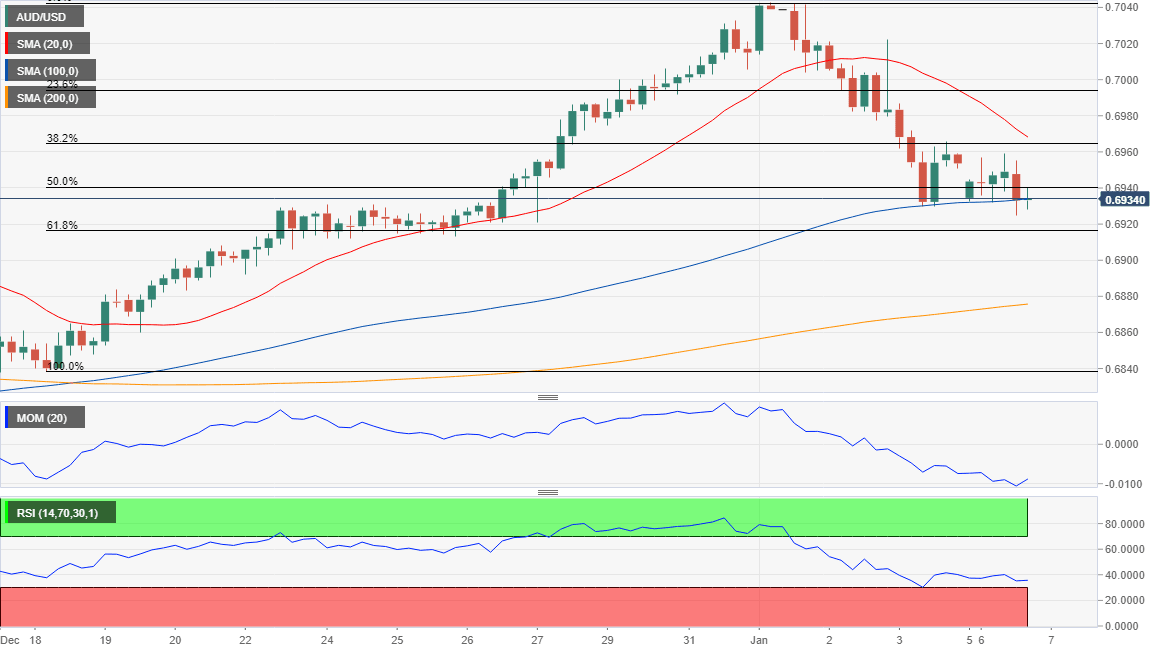

AUD/USD Forecast: Slide continues toward critical 0.6915 level

AUD/USD Current Price: 0.6934

- Australian data better than anticipated, but Chinese services output contracted.

- High-yielding assets recovered some ground, although tensions remain in the background.

- AUD/USD battling with the 50% retracement of its latest bullish run.

The Australian dollar was the greenback’s weakest rival, with the AUD/USD pair edging lower for a third consecutive day. The AUD/USD pair fell to 0.6924, following the lead of Asian and European stocks, and despite soaring gold prices. Upbeat US data kept the upside limited for the pair during US trading hours, in spite of Wall Street’s recovery. The Aussie was weighed Chinese data, as the Caixin Services PMI declined to 52.5 in December, after printing at 53.5 in November.

The Australian Commonwealth Bank Services PMI for December came in at 49.8, better than the expected 49.5, while the Commonwealth Bank Composite PMI resulted at 49.6. This Tuesday, Australia will release the December ANZ Job Advertisements report.

AUD/USD short-term technical outlook

The AUD/USD pair is down to the 50% retracement of its latest daily advance, and bearish according to intraday technical readings. In the 4-hour chart, the 20 SMA further accelerated south above the current level, while technical indicators barely corrected oversold conditions before turning flat within negative levels. The 61.8% retracement of the mentioned rally comes at 0.6915, the immediate support and the level to break to anticipate another bearish day.

Support levels: 0.6915 0.6880 0.6840

Resistance levels: 0.6960 0.7000 0.7035

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.