AUD/USD Forecast: RBA set to surprise investors

AUD/USD Current Price: 0.7533

- RBA’s Governor Lowe is set to offer an unusual press conference after the decision.

- Australian data came in mixed but was overall encouraging.

- AUD/USD is technically neutral-to-bullish ahead of the event.

The AUD/USD pair is hovering around 0.7530, unchanged from its previous daily close. Mixed Australian data released at the beginning of the day was mostly encouraging, as the AIG Performance of Construction Index printed at 55.5 in June, below the previous 58.3, while the Commonwealth Bank Services PMI improved to 56.8 in the same month, beating expectations. May Retail Sales were upwardly revised from 0.1% to 0.4%, while Building Permits fell by 7.1%, worse than anticipated.

On Tuesday, the country will publish June TD Securities inflation, previously at 3.3% YoY. Also, the Reserve Bank of Australia will announce its latest decision on monetary policy. Rates are expected to remain on hold at 0.1%, while policymakers may introduce a change to the bond-buying program. Governor Philip Lowe will offer a press conference afterwards, an unusual event that anticipates the need to explain a change in the current policy.

AUD/USD short-term technical outlook

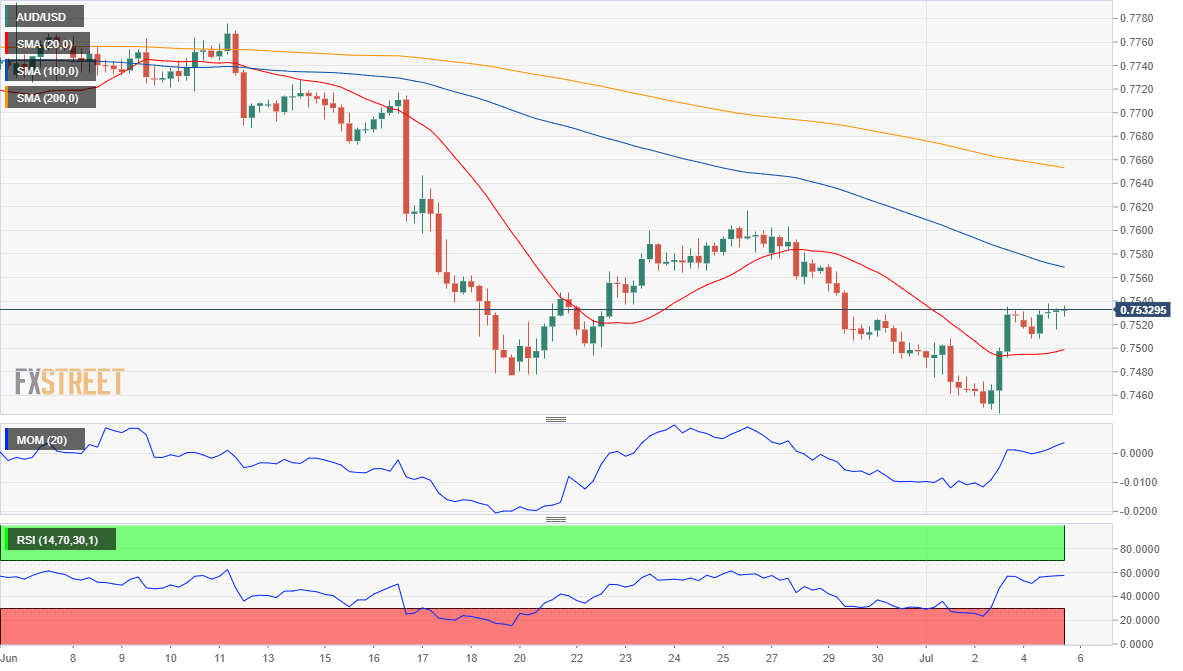

The AUD/USD pair is holding on to modest daily gains, offering a neutral-to-bullish stance in the near-term. The 4-hour chart shows that the price stands above its 20 SMA, which slowly turns higher, although the longer ones maintain their bearish slopes above the current level. The 100 SMA acts as dynamic resistance at around 0.7570. The Momentum indicator eases within positive levels while the RSI indicator consolidates around 56, reflecting the absence of volume instead of suggesting bullish exhaustion.

Support levels: 0.7485 0.7440 0.7400

Resistance levels: 0.7570 0.7610 0.7650

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.