AUD/USD Forecast: Pressuring lows and at risk of falling further

AUD/USD Current Price: 0.6872

- Australian macroeconomic calendar to remain empty throughout the first half of the week.

- AUD/USD under pressure after printing a lower low daily basis.

The AUD/USD pair fell to 0.6854, recovering ahead of the close to finish the day unchanged at around 0.6870. The pair traded inside a well-limited range throughout the day amid the absence of first-tier data that could trigger some action, and a holiday in the US, with volumes plummeting during US trading hours. The Australian macroeconomic calendar will remain empty this Tuesday, while China won’t release any data either.

AUD/USD short-term technical outlook

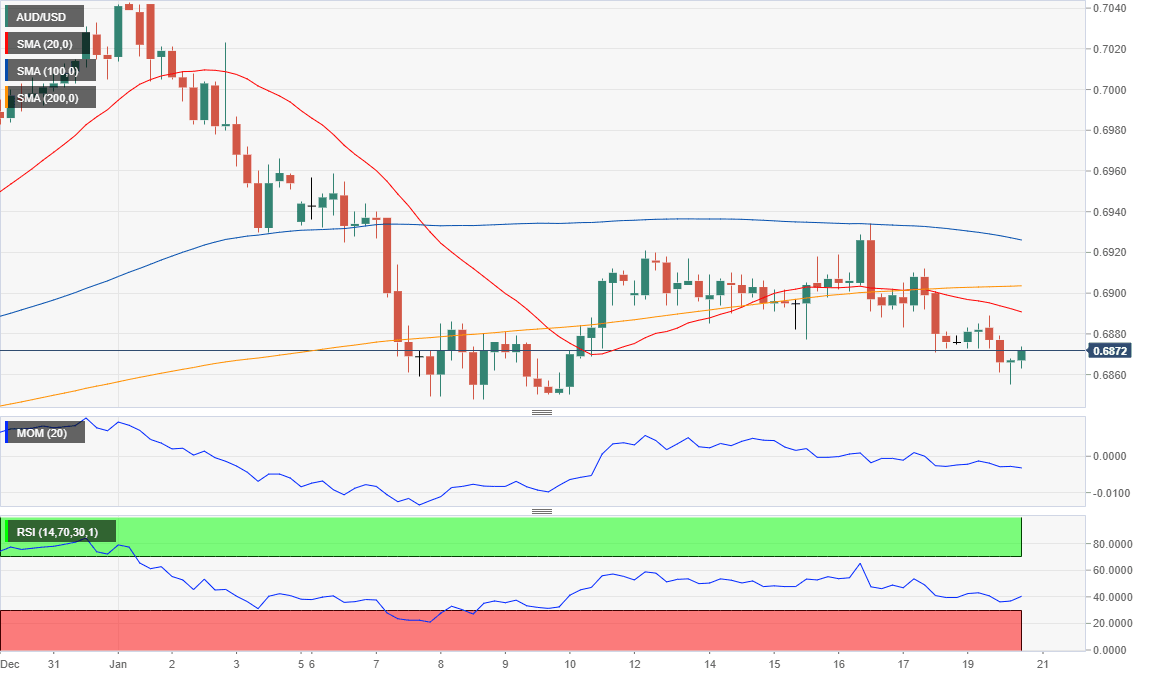

The AUD/USD pair retains its bearish stance according to technical readings in the 4-hour chart, as it’s developing below all of its moving averages, with the 20 SMA crossing below the 200 SMA, both at around 0.6890 providing intraday resistance. The Momentum indicator maintains its strong bearish slope in negative territory, while the RSI consolidates around 41, after recovering just modestly from near oversold readings. Further slides are to be expected on a break below 0.6840, the immediate support.

Support levels: 0.6840 0.6800 0.6770

Resistance levels: 0.6890 0.6920 0.6950

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.