AUD/USD Forecast: No hopes for the Aussie despite greenback’s weakness

AUD/USD Current Price: 0.7371

- Australian Q2 annualized Consumer Price Index hit 3.8%, as expected.

- AUD/USD is higher in range, retains the neutral stance.

The AUD/USD pair ended Wednesday at around 0.7370 up for the day but holding within familiar levels. The greenback shed ground after US Federal Reserve Chairman Jerome Powell refused to provide details on future tapering. Once again, he repeated that any decision would be communicated well in advance, also reiterating that heating inflation would likely be temporary.

At the beginning of the day, Australia reported Q2 inflation figures, which met the market’s expectations. The annualized Consumer Price Index hit 3.8% QoQ, while the RBA Trimmed Mean CPI for the same period improved to 1.6% as expected. The country will publish the Q2 Import Price Index and the Export Price Index, hardly a market mover.

AUD/USD short-term technical outlook

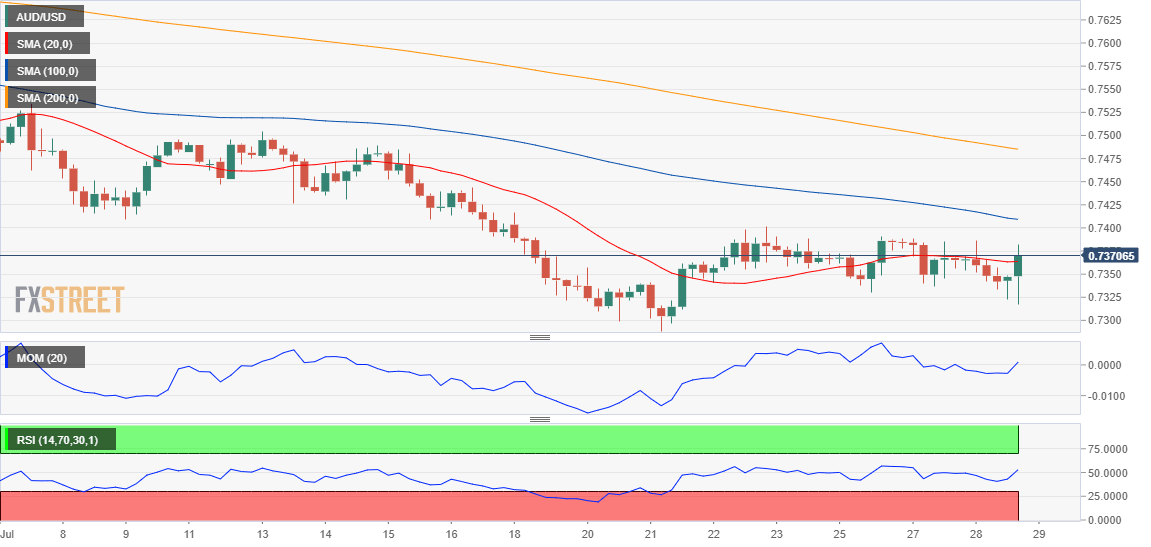

The AUD/USD pair is neutral in the near-term. The 4-hour chart shows that it keeps hovering around a directionless 20 SMA while developing below bearish 100 and 200 SMAs. Technical indicators turned higher but remain around their midlines, unable to confirm a bullish extension. Sellers will likely surge on approaches to the 0.7400 level, while a steeper decline could be expected on a break below 0.7290.

Support levels: 0.7330 0.7290 0.7260

Resistance levels: 0.7400 0.7440 0.7475

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.