AUD/USD Forecast: Initial support emerges near 0.6500

- AUD/USD resumed its downtrend and revisited 0.6530 on Tuesday.

- The Aussie dollar kept looking at China and commodities.

- Further declines remain on the cards while below the 200-day SMA.

AUD/USD resumed its decline after two consecutive daily pullbacks on Tuesday, rapidly setting aside two days in a row of gains and maintaining the trade below the key 200-day SMA.

The ongoing monthly reversal remained well in place in response to poor economic prospects from China, persistently falling commodity prices, the intermittent strength of the US Dollar (USD), and the recent interest rate cut by the People’s Bank of China (PBoC).

The PBoC's unexpected rate cuts last week weakened the Chinese yuan, negatively impacting the Australian dollar due to Australia's economic ties with China and the AUD's role as a liquid proxy for the yuan.

Additionally, persistent weakness in copper and iron ore prices contributed to the AUD's decline, reflecting a broader downturn in the commodity sector.

Regarding monetary policy, the Reserve Bank of Australia (RBA) maintained a hawkish stance at its latest meeting, keeping the official cash rate at 4.35% and showing flexibility for future decisions. The subsequent release of the meeting minutes indicated that officials considered another rate hike to curb inflation but refrained, partly due to concerns about a potential sharp slowdown in the labour market.

Overall, the RBA is expected to be the last G10 central bank to begin cutting interest rates. In fact, the central bank is not in a hurry to ease policy, anticipating that it will take time for inflation to consistently fall within the 2-3% target range.

Potential easing by the Federal Reserve (Fed) in the medium term, contrasted with the RBA's likely prolonged restrictive stance, could support AUD/USD in the coming months.

However, slow momentum in the Chinese economy might hinder a sustained recovery of the Australian dollar as China continues to face post-pandemic challenges, deflation, and insufficient stimulus for a convincing recovery. In fact, concerns about demand from China, the world's second-largest economy, also had an impact following the country's Politburo meeting. Although they pledged to support the economy, no specific new stimulus measures were announced.

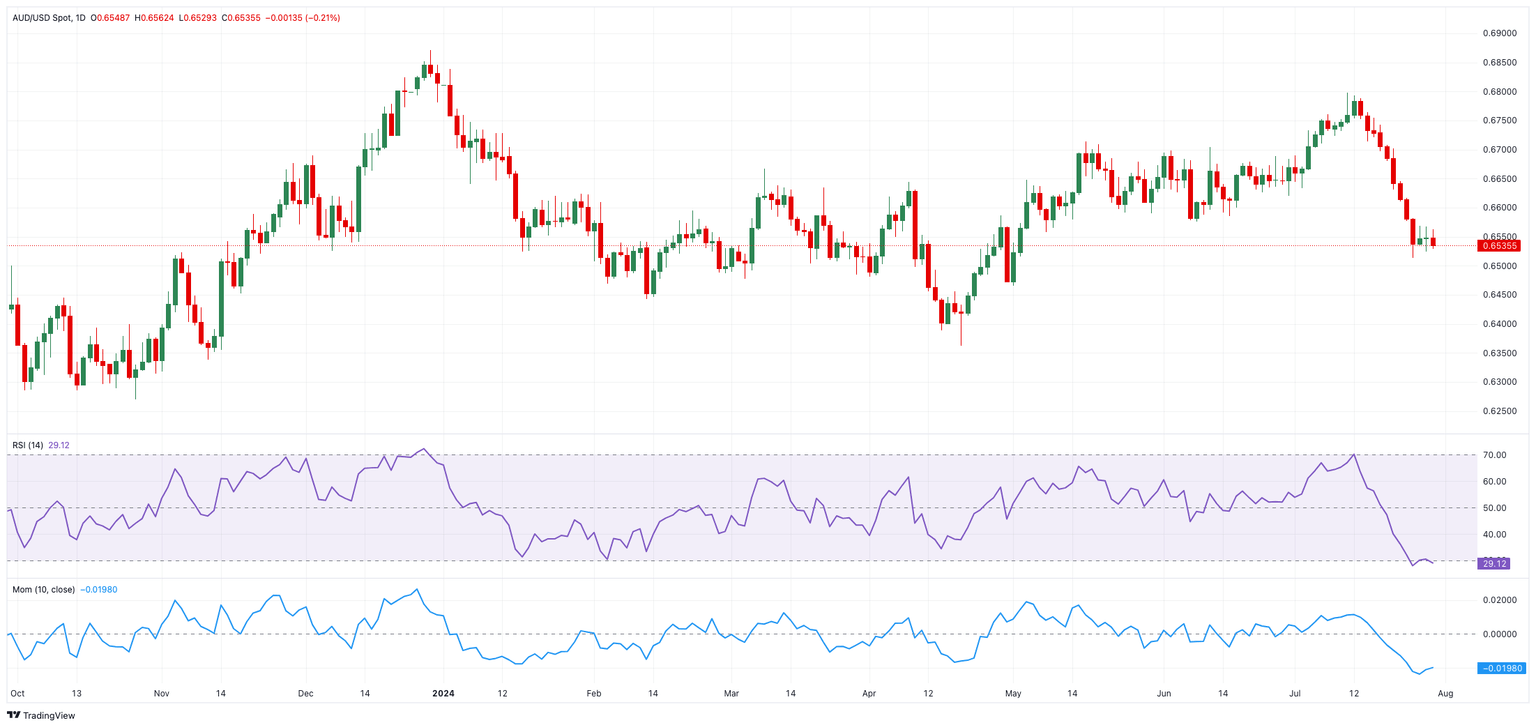

AUD/USD daily chart

AUD/USD short-term technical outlook

Further losses in the AUD/USD may find support at the July low of 0.6513 (July 25). Following that, the May low of 0.6465 occurs before the 2024 bottom of 0.6362 (April 19).

Occasional bullish attempts, on the other hand, may face early resistance at the important 200-day SMA of 0.6588, followed by the temporary 100-day and 55-day SMAs at 0.6604 and 0.6658, respectively, before the July high of 0.6798 (July 8) and the December top of 0.6871.

Overall, additional retracements in AUD/USD are anticipated as the pair remains below the 200-day SMA.

The four-hour chart shows a consolidation move in the works. Against this, immediate support lies at 0.6513, ahead of 0.6465. On the positive side, the initial barrier is 0.6610 ahead of the 200-SMA at 0.6668 and 0.6754. The RSI looked steady around 37.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.