AUD/USD Forecast: Heading towards September high at 0.7477

AUD/USD Current Price: 0.7414

- Firmer gold prices and rallying equities boosted the AUD/USD pair.

- Australia lost 138,000 job positions in September, worse than anticipated.

- AUD/USD is technically bullish and could approach the 0.7500 level.

The AUD/USD pair trades in the 0.7410 price zone after topping at 0.7426, its highest in over a month. The positive tone of equities and firmer gold prices underpinned the aussie, despite local data missed the market’s expectations. Equities rallied on the back of earnings reports, while gold remained strong on the back of soft US government bond yields.

Australian data released at the beginning of the day was generally discouraging. October Consumer Inflation Expectations came in at 3.6%, down from the previous 4.4% and below the expected 3.8%. Also, the country reported that it lost 138,000 job positions in September, worse than anticipated. The Unemployment Rate worsened to 4.6%, better than anticipated, although the Participation Rate contracted to 64.5%. China published September Inflation figures. The Consumer Price Index was up 0.7%, while the Producer Price Index rose 10.7%.

The Asian macroeconomic calendar has nothing relevant to offer on Friday, with the market’s attention centred around US September Retail Sales and the preliminary estimate of the October Michigan Consumer Sentiment Index, foreseen improving from 72.8 to 73.1.

AUD/USD short-term technical outlook

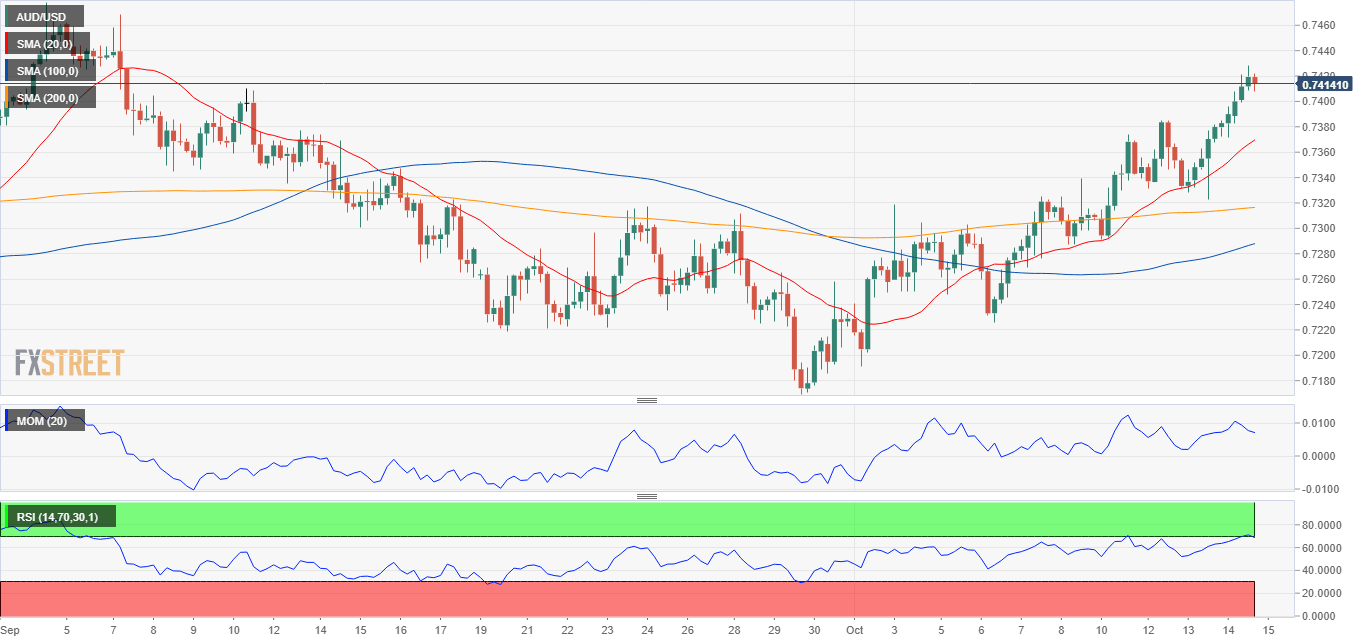

The AUD/USD pair is bullish according to the daily chart, as it continued advancing beyond its 20 SMA, while technical indicators head firmly north within positive levels. The same chart shows that the pair is currently converging with a firmly bearish 100 SMA. Once above the latter, the pair has room to complete a full 100% retracement to the September high at 0.7477.

Support levels: 0.7365 0.7330 0.7290

Resistance levels: 0.7440 0.7475 0.7510

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.