AUD/USD Forecast: Extra weakness should not be ruled out near term

- AUD/USD met decent contention around 0.6500.

- The pair regained pace despite the strong Dollar.

- Consumer Inflation Expectations in Australia rose by 4.6% in April.

The continuation of the upward bias in the US Dollar (USD) did not prevent its Australian counterpart from regaining some balance and encouraged the AUD/USD to print decent gains beyond 0.6500 on Thursday.

Contributing to the upside momentum in the Aussie dollar, Chinese inflation figures came in below expectations in March, which could reignite talks about further stimulus from the PBoC in the not-so-distant future.

Despite the daily advance, spot remains well on track to close the week in negative territory. Indeed, Wednesday’s sharp decline in spot came after higher-than-expected US inflation readings motivated investors to reprice the likeliness that the Fed might now reduce rates only once this year (probably in December), which eventually boosted the demand for the Greenback.

Back to the Reserve Bank of Australia (RBA), it reiterated its commitment to maintaining current monetary policy in the Minutes of its March meeting. Futures for the RBA cash rate suggest an expectation of approximately 50 basis points of policy rate cuts in 2024, with the first cut now potentially occurring in December.

It's notable that the RBA is one of the last G10 central banks expected to consider adjusting interest rates this year.

Given the Federal Reserve's (Fed) firm stance on maintaining tighter monetary policies for an extended period and the prospect of the RBA embarking on an easing cycle later in the year, AUD/USD faces an increased likelihood of sustained and intensified downward pressure in both the short and medium terms.

Somewhat bolstering the move higher in the pair, Australian Consumer Inflation Expectations tracked by the Melbourne Institute rose to 4.6% in April (from 4.3%).

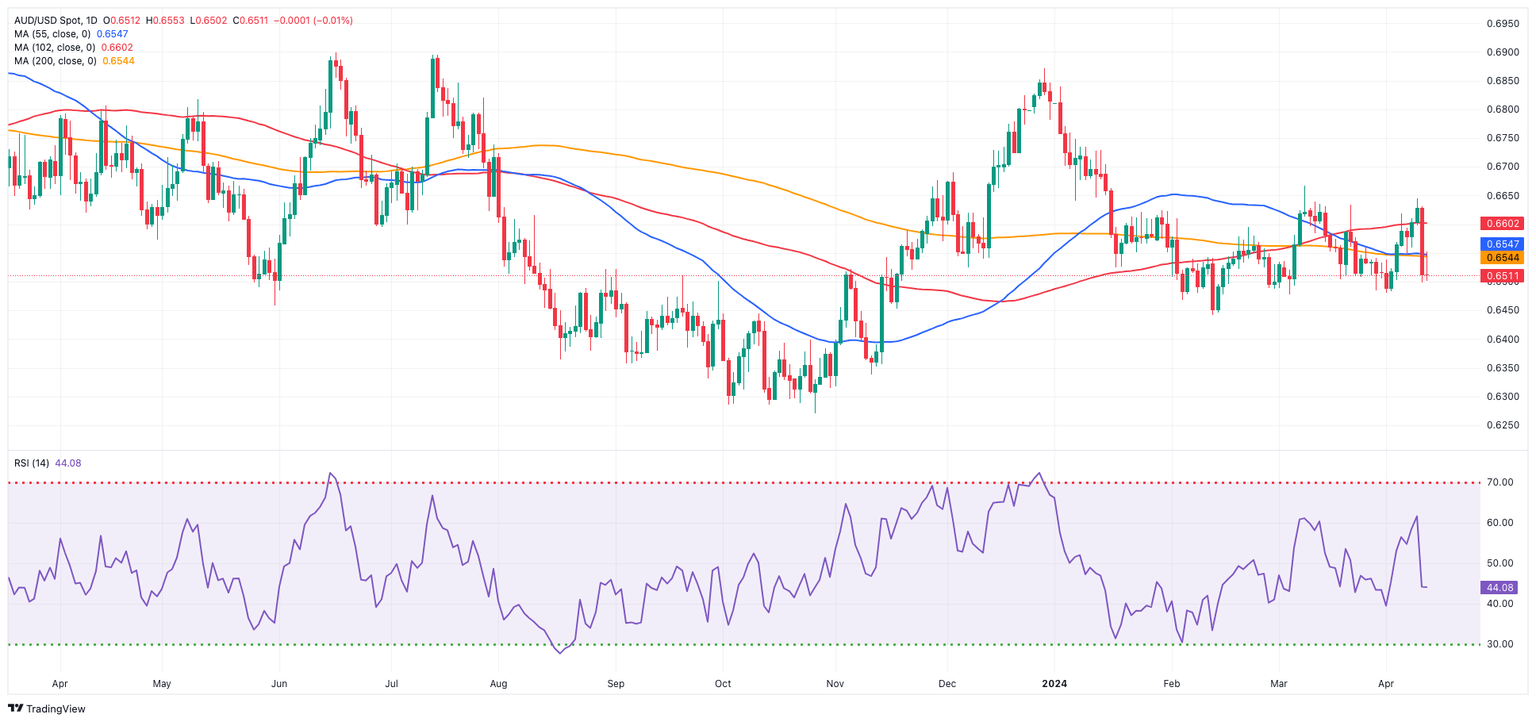

AUD/USD daily chart

AUD/USD short-term technical outlook

If sellers regain the initiative, AUD/USD could fall to the April low of 0.6480 (April 1), ahead of the March low of 0.6477 (March 5) and the 2024 low of 0.6442 (February 13). Breaking below this level may result in a test of the 2023 bottom of 0.6270 (October 26), which precedes the round level of 0.6200.

Further upward is expected to initially challenge the April high of 0.6644 prior to the March top of 0.6667 (March 8) and the December 2023 peak of 0.6871. Further north, the July high of 0.6894 (July 14) comes before the June top of 0.6899 (June 16) and the key 0.7000 level.

Looking at the big picture, the pair is expected to continue its negative trend while remaining below the crucial 200-day SMA at 0.6541.

On the 4-hour chart, the pair's constructive bias appears to have resurged somewhat. The support level is at 0.6498, and then 0.6480. On the other hand, immediate resistance is at 0.6644, which comes before 0.6667. Furthermore, the MACD slipped back to the bearish zone, although the RSI ticked higher past 41.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.