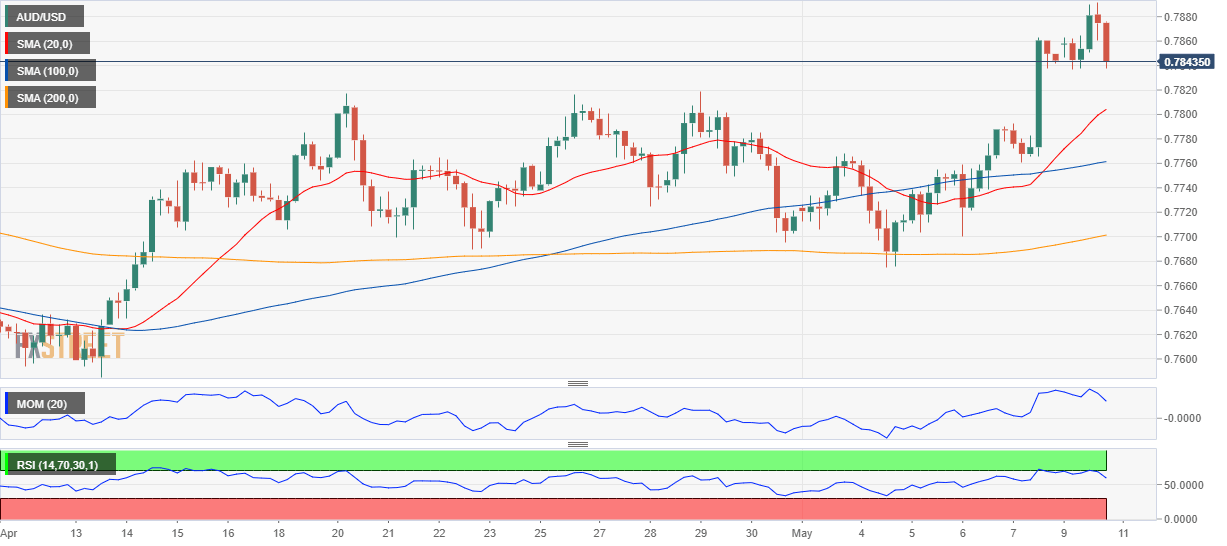

AUD/USD Forecast: Corrective decline could extend once below 0.7820

AUD/USD Current Price: 0.7843

- Rallying base metals and the broad dollar’s weakness underpinned the pair.

- Australian NAB’s Business Confidence improved to 25 in April from 15 previously.

- AUD/USD could extend its slide in the near-term toward the 0.7770 price zone.

The AUD/USD pair hit 0.7890 this Monday, ending the day unchanged in the 0.7840 price zone. The aussie was backed by strengthening base metals and equities, and as investors kept selling the greenback. Copper prices soared to fresh record highs, while spot gold peaked at 1,845.39. Australia published April NAB’s Business Confidence, which improved to 25 from 15, while NAB’s Business Conditions resulted in 32 from 25 in March. Retail Sales were downwardly revised from 1.4% to 1.3% in March.

This Tuesday, the focus will shift to China, as the country will release April inflation figures. The Consumer Price Index is seen accelerating to an annual pace of 6.6%, while the monthly reading is expected at -0.2%, improving from -0.5% in March.

AUD/USD short-term technical outlook

The AUD/USD pair is flat for the day, correcting overbought conditions in the near-term. The 4-hour chart shows that technical indicators ease from extreme levels, although the pair needs to break below the 0.7820 support level to confirm a corrective slide. The bearish potential is limited according to moving averages, as the 20 SMA heads firmly higher above the longer ones, currently at around 0.7800.

Support levels: 0.7820 0.7770 0.7720

Resistance levels: 0.7860 0.7900 0.7950

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.