AUD/USD Forecast: Consolidating near 2021 lows

AUD/USD Current Price: 0.7359

- Australia will report Q2 Consumer Price Index figures on Wednesday.

- Gold prices remain under selling pressure, with the bright metal struggling around 1,800.

- AUD/USD is neutral-to-bearish in the near-term, could reach fresh yearly lows.

The AUD/USD pair held on to familiar levels on Tuesday, ending the day with modest losses around 0.7360. The poor performance of equities overshadowed the broad greenback’s weakness, mainly against commodity-linked currencies. Another negative factor for the Australian currency was the price of gold, as the bright metal was unable to recover beyond the 1,800 level, hovering around it ahead of the Asian opening.

Australia will publish Q2 inflation data on Wednesday. The annual Consumer Price Index is foreseen at 3.8%, up from 1.1%. The RBA Trimmed Mean CPI for the same period is expected at 1.6%, also better than the previous 1.1%.

AUD/USD short-term technical outlook

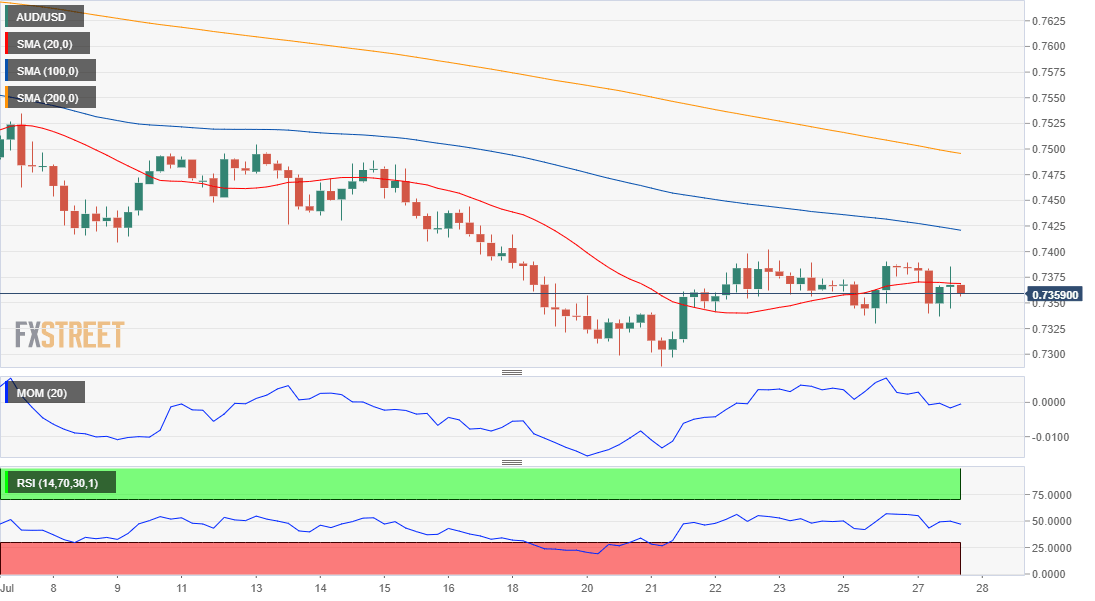

The AUD/USD pair is neutral-to-bearish in the near-term. The 4-hour chart shows that it is seesawing around a flat 20 SMA, while below the longer ones, which maintain their bearish slopes. Technical indicators have turned lower after failing to recover above their midlines, lacking directional momentum at the time being. The pair needs to fall below the 0.7290 support level to gain bearish momentum.

Support levels: 0.7330 0.7290 0.7260

Resistance levels: 0.7400 0.7440 0.7475

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.