AUD/USD Forecast: Bullish potential seems limited at current levels

AUD/USD Current Price: 0.7160

- The RBA kept the cash rate on hold, reaffirmed the outlook remains “highly uncertain.”

- Australian Retail Sales beat expectations in June, posted their worst quarterly performance since 2000.

- AUD/USD holds above 0.7000 but lacks enough bullish momentum in the short-term.

The AUD/USD pair is ending Tuesday with modest gains near a daily high of 0.7158, underpinned by rising equities and the sour tone of the greenback. Australian data released at the beginning of the day was mixed, as Retail Sales rose 2.7% MoM in June, beating expectations. However, and in the second quarter of the year, retail volumes were down 3.4% when compared to the previous quarter, the largest seasonally adjusted decline in two decades. The country’s Trade Balance posted a surplus of 8202 million in June, below the 8800M expected. Also, the RBA had a monetary policy meeting, leaving the cash rate at 0.25% as expected. Policymakers said the worst of the global economic contraction has passed, although adding that the outlook remains “highly uncertain”.

The country will publish this Wednesday the AIG Performance of Construction Index for July, previously at 35.5, and the Commonwealth Bank Services PMI for the same month, foreseen unchanged from the previous estimate at 58.5. Later in the day, the country will unveil June Home Loans and Investment Lending for Homes.

AUD/USD short-term technical outlook

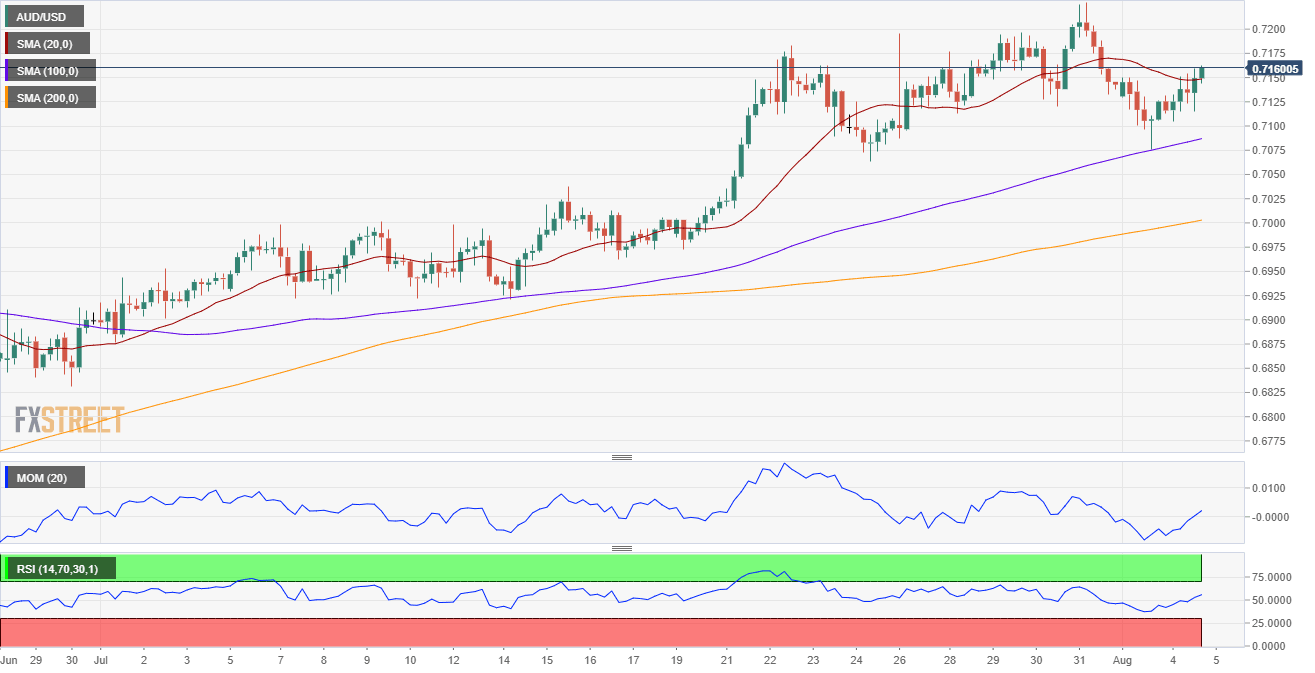

From a technical point of view, the bullish potential for the AUD/USD pair remains limited in the short-term. The 4-hour chart shows that the pair is hovering around a flat 20 SMA, while technical indicators recovered from intraday lows, but turned flat, the Momentum within negative levels and the RSI in neutral territory. A bullish extension will have more chances if the pair extends the ongoing recovery beyond 0.7180, the immediate resistance.

Support levels: 0.7110 0.7070 0.7030

Resistance levels: 0.7180 0.7225 0.7260

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.