AUD/USD Forecast: Bearish potential intact, remains at the mercy of USD price dynamics

- AUD/USD staged a goodish recovery on Friday amid some USD profit-taking.

- The upbeat US economic outlook helped limit the USD losses and capped gains.

- A softer risk tone prompted some fresh selling around the pair on Monday.

The AUD/USD pair managed to gain some positive traction on Friday and stage a goodish rebound from the vicinity of YTD lows. A generally positive risk tone failed to assist the safe-haven US dollar to build on the overnight gains to four-month tops, instead prompted some profit-taking. This, in turn, was seen as a key factor that benefitted the perceived riskier Australian dollar. The greenback remained depressed following the release of rather unimpressive US economic data. In fact, the US Personal Income and Personal Spending declined by 7.1% and 1%, respectively in February. Adding to this, the Core Personal Consumption Expenditures (PCE) Price Index slowed to 1.4% YoY during the reported month as against 1.5% in January. The softer readings, to a larger extent, were offset by an upward revision of the Michigan Consumer Sentiment Index, which rose to the highest level in a year and was finalized at 8.9 for March.

The pair rallied around 70 pips intraday, albeit lacked any strong follow-through. The upbeat outlook for the US economy helped limit any deeper losses for the greenback. Investors remain optimistic about the prospects for a relatively faster US economic recovery amid the impressive pace of coronavirus vaccinations. The US President Joe Biden – in his first formal news conference on Thursday – made an ambitious pledge of administering 200 million vaccine shots in 100 days. This comes on the back of a massive US stimulus package and speculations for another $3.0 trillion infrastructure plan from the US. Apart from this, tensions between China and Australia further collaborated to cap any strong gains for the Australian dollar. Nevertheless, the pair ended the week in the red and edged lower during the Asian session on Monday.

A modest pullback in the US equity futures drove some haven flows towards the greenback and exerted fresh downward pressure on the major. In the absence of any major market-moving economic releases, the underlying bullish sentiment surrounding the USD suggests that the path of least resistance for the pair remains to the downside. Hence, any attempted positive move might still be seen as a selling opportunity and runs the risk of fizzling out rather quickly.

Short-term technical outlook

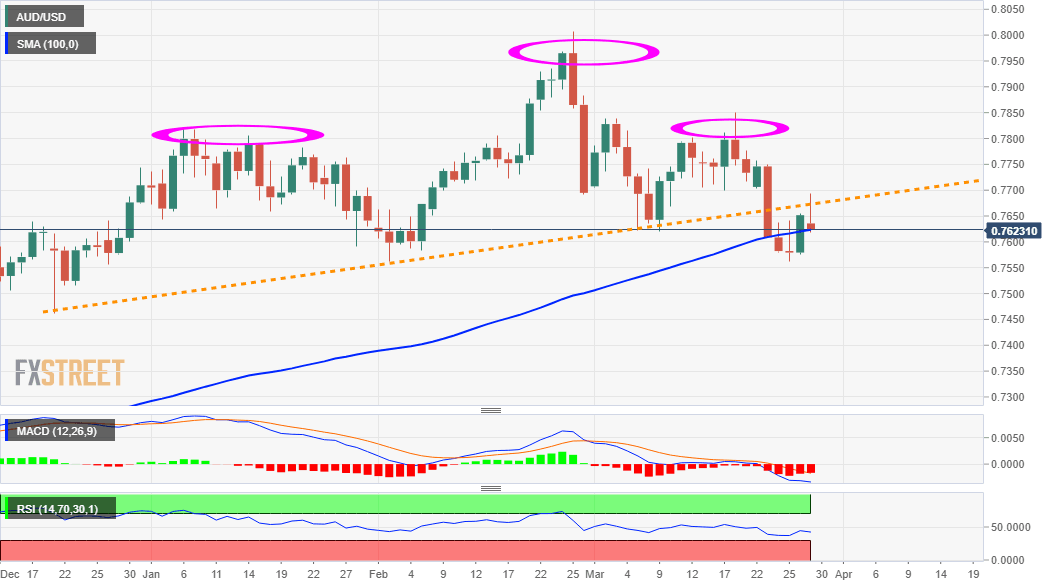

From a technical perspective, the pair last week confirmed a near-term bearish breakdown through a head and shoulders neckline support. This adds credence to the negative outlook and supports prospects for an extension of the recent sharp pullback from the key 0.8000 psychological mark, or over three-year tops touched on February 25.

In the meantime, any meaningful slide below the 0.7600 mark might find some support near the 0.7580-75 horizontal zone. Some follow-through selling will reaffirm the bearish bias and turn the pair vulnerable to accelerate the fall towards challenging the key 0.7500 psychological mark. The pair could eventually drop to the next major support near the 0.7460 area.

On the flip side, the mentioned neckline support breakpoint, around the 0.7665-70 region now seems to act as a strong resistance. This is followed by the 0.7700 mark, which if cleared decisively might trigger some short-covering move. This, in turn, could push the pair further beyond an intermediate resistance near the 0.7740-50 region and allow bulls to make a fresh attempt to reclaim the 0.7800 mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.