AUD/USD Forecast: Bearish case to become stronger below 0.7640

AUD/USD Current Price: 0.7715

- Australian Retail Sales plunged to -4.2% MoM in December, according to preliminary estimates.

- Coronavirus and stimulus concerns weighed on global equities.

- AUD/USD is bearish in the near-term, but it seems corrective in the long-run.

The AUD/USD pair lost ground by the end of the week, to finish it unchanged a few pips above the 0.7700 figure. The aussie took a hit from local data, as the preliminary estimate of December Retail Sales came in at -4.2% MoM, down from 7.1% in the previous month. The Commonwealth Bank Services PMI contracted from 57 to 55.8 in January, while the manufacturing index improved to 57.2 from 55.7.

The soft tone of global equities maintained the pair under pressure throughout the day. Stocks fell on the back of coronavirus and stimulus concerns. Australia will start the week with a bank holiday, which means it won’t publish macroeconomic data this Monday.

AUD/USD short-term technical outlook

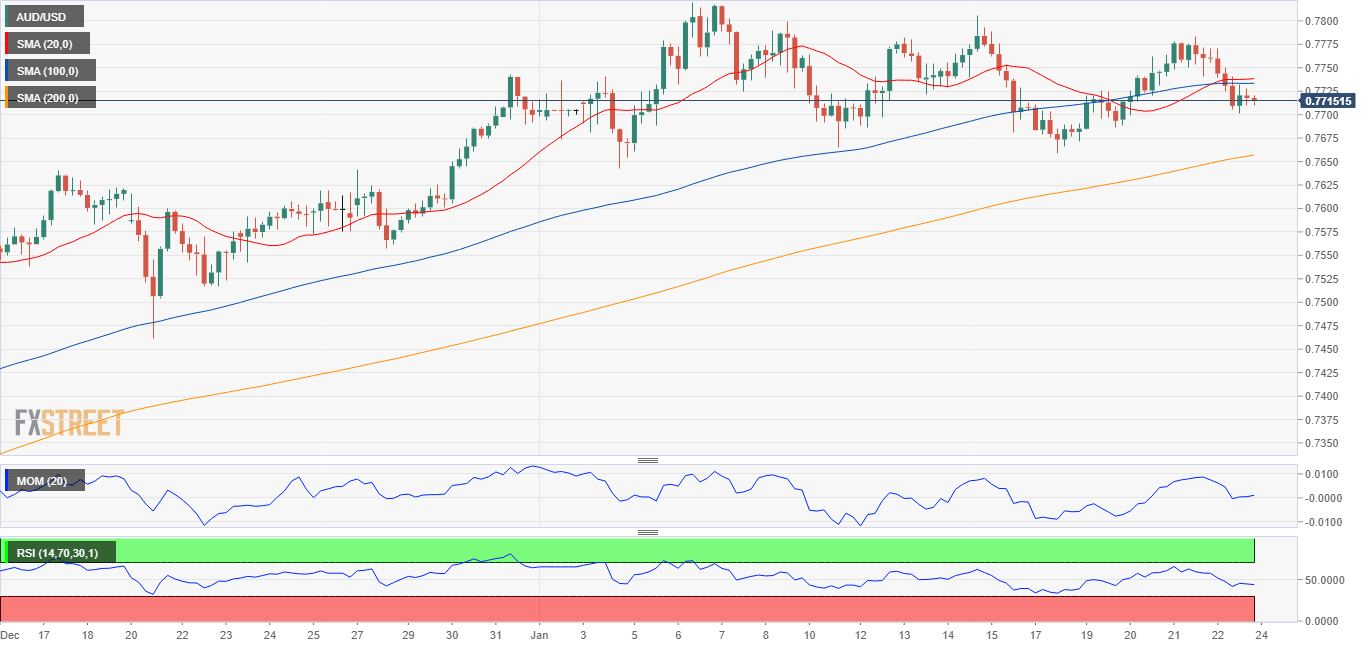

The AUD/USD pair is losing bullish potential but not yet bearish according to the daily chart. The pair is finding support around a bullish 20 SMA, which advances above the larger ones. In the meantime, technical indicators eased within positive levels, holding above their midlines. In the near-term and according to the 4-hour chart, the risk is skewed to the downside, as the pair settled below its 20 and 100 SMAs, which converge around 0.7735, as technical indicators develop within negative levels, with modest bearish slopes. Bears will likely take control of the pair if it loses 0.7640, a strong static support level.

Support levels: 0.7690 0.7640 0.7600

Resistance levels: 0.7735 0.7770 0.7815

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.