AUD/USD Forecast: Bearish ahead of Australian quarterly inflation data

AUD/USD Current Price: 0.6752

- Australian Q4 inflation seen unchanged yearly basis at 1.7%.

- Recovering equities prevented the Aussie from falling further.

- AUD/USD poised to retest the multi-year low of 0.6770.

Commodity-linked currencies continued to ease, with AUD/USD falling to 0.6736, to finish the day around 0.6750. The Aussie was undermined at the beginning of the day by persistent weakness among local equities, and the NAB’s Business Confidence Index for December, which resulted in -2 against the 1 expected. Business Conditions met the market’s expectations by printing 3. The pair stabilized during the American session, trapped between the dollar’s strength and the solid performance of Wall Street.

Australia will release Q4 inflation estimates early Wednesday. Quarterly inflation is expected to have risen by 0.6%, slightly better than Q3 0.5%, while yearly basis, the CPI is seen unchanged at 1.7%. The RBA Trimmed Mean estimates are seen at 0.4% QoQ and 1.5% YoY, this last down from 1.6%. A worse-than-expected report could exacerbate speculation of a rate cut next week, and send the pair nose-diving toward 0.6670, the multi-year low achieved in 2019.

AUD/USD short-term technical outlook

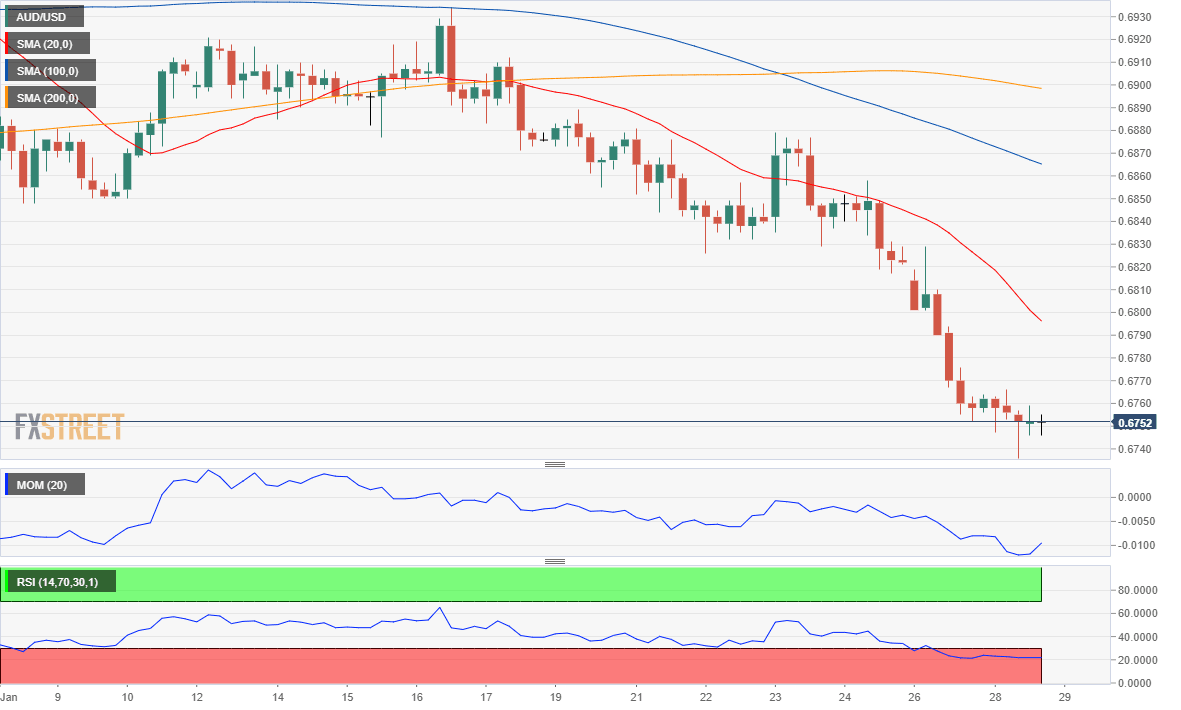

The AUD/USD pair is stuck in a range but poised to extend its slide, according to technical readings in the 4-hour chart, giving no signs of downward exhaustion. The pair remains below a bearish 20 SMA which accelerated its decline in the mentioned time frame, while technical indicators stand pat near daily lows, lacking directional strength. The fact that it broke and met sellers on approaches to the 0.6770 level, add to the bearish case.

Support levels: 0.6730 0.6700 0.6670

Resistance levels: 0.6770 0.6805 0.6840

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.