AUD/USD Forecast: Australian lockdowns add to the bearish case

AUD/USD Current Price: 0.7338

- RBA Meeting Minutes reaffirmed the dovish stance and pledge for continued support.

- Australian Retail Sales are expected to have fallen in July due to the latest lockdowns.

- AUD/USD retains the bearish stance in the near stance, holding near 2021 lows.

The AUD/USD pair bottomed for the day at 0.7299, a fresh 2021 low, recovering just modestly ahead of the daily close. The aussie has been among the worst performers against the greenback in a risk-averse environment, as the Australian currency has also suffered from local woes. The spread of the Delta variant in the country and the subsequent lockdowns are weighing heavily on the economy, according to June macroeconomic figures. Restrictions have been extended these days, which means July will be another month of soft data.

The Reserve Bank of Australia published the Minutes of its latest meeting. The document showed that policymakers are compromised to maintain supportive monetary conditions, and repeated rates will remain at record lows until employment and inflation reach the desired levels. On Wednesday, Australia will publish the June Westpac Leading Index previously at -0.06%, and the preliminary estimate of June Retail Sales, foreseen at -0.5%.

AUD/USD short-term technical outlook

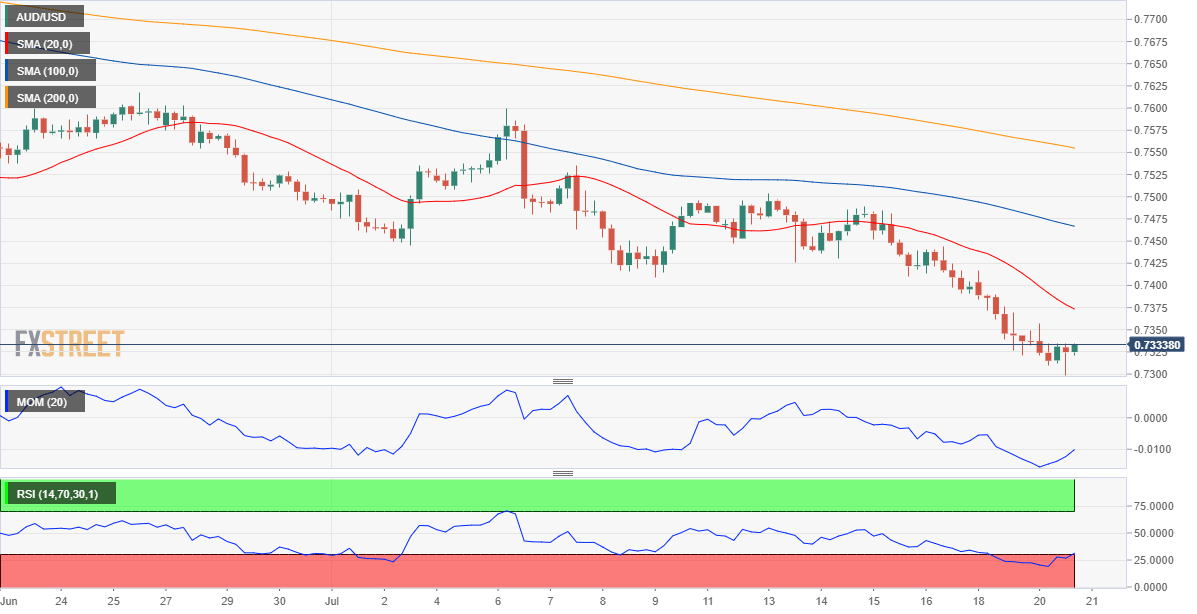

The AUD/USD pair is currently trading around the 0.7330 level, and the risk is skewed to the downside. The 4-hour chart shows that technical indicators have stabilized well into negative levels, while the RSI is indicating oversold conditions. In the mentioned time frame, moving averages maintain their bearish slopes above the current level, suggesting sellers are still in control of the pair.

Support levels: 0.7290 0.7260 0.7215

Resistance levels: 0.7365 0.7400 0.7440

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.