AUD/USD Forecast: Advancing within range still below 0.7820

AUD/USD Current Price: 0.7741

- Australian data showed signs of further improvement at the beginning of Q2.

- The aussie advanced on sentiment, following the lead of US indexes.

- AUD/USD advanced within range, upside limited by 0.7820.

The AUD/USD pair keeps seesawing between gains and losses, ending Wednesday with modest gains in the 0.7740 price zone. Australian macroeconomic figures released at the beginning of the day were mostly encouraging. The AIG Performance of Construction Index printed at 59.1 in April, below the previous 61.8. The Commonwealth Bank Services PMI for the same month printed at 58.8, while March Building Permits soared 17.4% MoM, largely surpassing the 3% expected.

The positive tone of US indexes provided support to the pair, as US policymakers cooled down expectations for higher US rates. Australia won’t publish macroeconomic data this Thursday, but RBA’s Deputy Governor Debelle is due to deliver a speech titled "Monetary Policy during Covid" in Perth.

AUD/USD short-term technical outlook

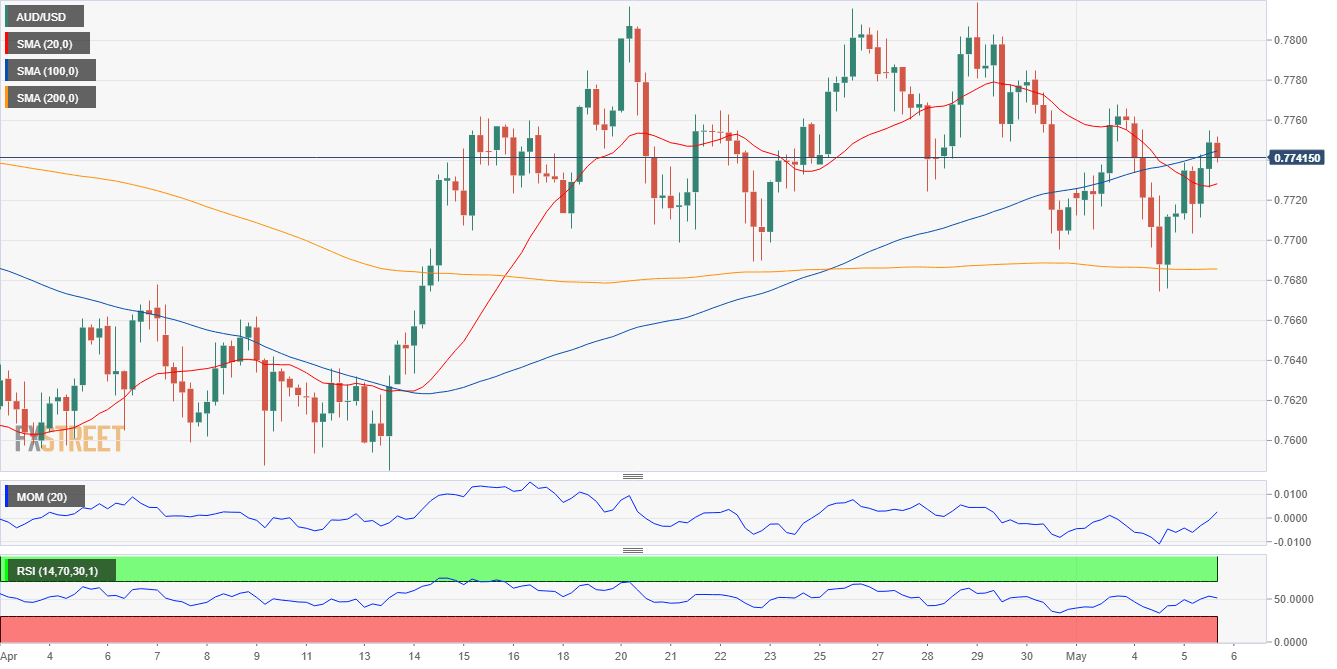

The AUD/USD pair seems poised to extend its advance within range. The 4-hour chart shows that it is hovering around a bullish 100 SMA, while the 20 SMA loses its bearish strength below it. However, technical indicators have turned flat within neutral levels, while the 200 SMA remains flat at around 0.7690. A strong static resistance level comes at 0.7820, with bulls having better chances if the pair gets to advance beyond it.

Support levels: 0.7710 0.7675 0.7630

Resistance levels: 0.7775 0.7820 0.7860

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.