AUD/USD Forecast: A test of the year low is on the table amid strength on the greenback

AUD/USD Current Price: 0.7189

- Australia keeps lifting covid-related restrictions as Europe moves into lockdowns.

- US inflation hit its highest in three decades, spurring risk-aversion.

- AUD/USD is technically bearish and poised to retest the year low at 0.7105.

The AUD/USD pair lost the 0.7200 figure and trades near a daily low of 0.7183, as inflation and covid-related woes sent investors into safety. On Wednesday, market participants knew that US inflation soared to its highest in 30-years in October, according to the Core Personal Consumption Expenditures Price Index report, Fed’s favorite inflation measure. Policymakers are cautious when it comes to hiking rates to counter the negative effects of inflation on the economy.

Also, the dismal mood was fueled by soaring coronavirus cases in Europe, anticipating restrictive measures in the Old Continent. On the other hand, Australia is moving in the opposite direction, opening back the economy after applying one of the longest lockdowns.

Data wise, Australia published Q3 Construction Work Done, which contracted to -0.3% from 2.2% in Q2. On Thursday, the country will release Q3 Private Capital Expenditure, foreseen at -2% from 4.4% in the previous quarter.

AUD/USD short-term technical outlook

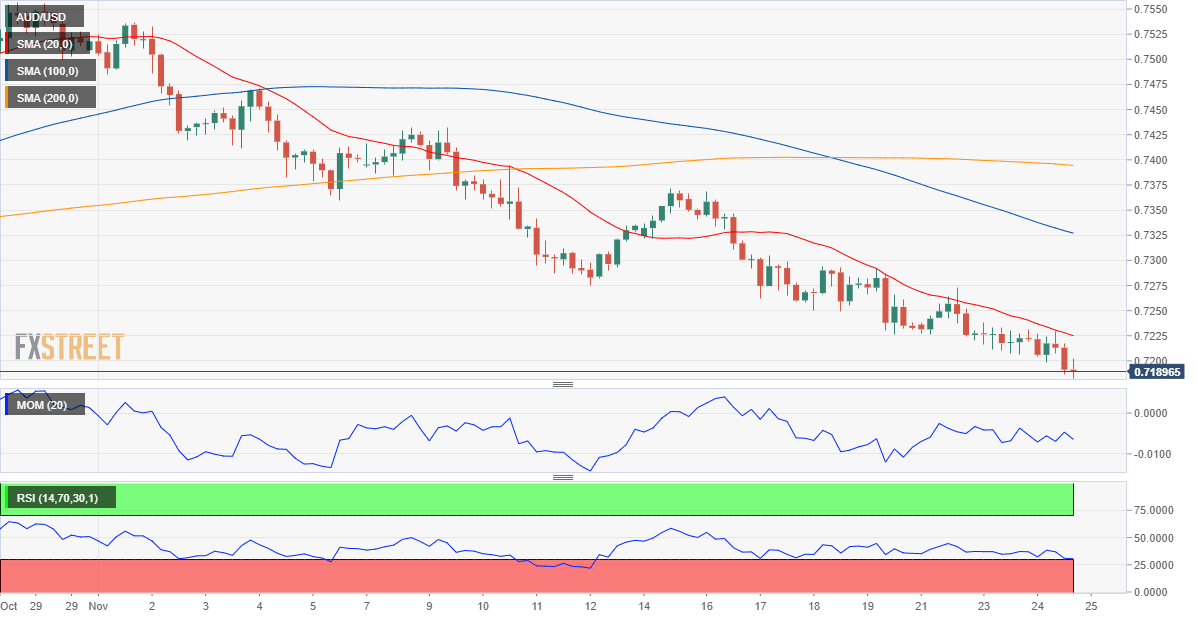

The AUD/USD pair trades near the mentioned daily low, a sign that further declines are likely on Thursday. Technical readings on the daily chart support a bearish continuation, as the 20 SMA accelerated its slide and is about to cross below the 100 SMA, both converging around 0.7350. The Momentum indicator is stable within negative levels, while the RSI extended its decline, currently at around 30.

The bearish case is also clear on the 4-hour chart, as the pair retreated from around a bearish 20 SMA, as technical indicators head firmly lower well below their midlines. September 29 daily low stands at 0.7169, the immediate support level, en route to 0.7105, the year low.

Support levels: 0.7170 0.7135 0.7105

Resistance levels: 0.7225 0.7270 0.7310

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.