AUD/USD Analysis: mixed signals

AUD/USD

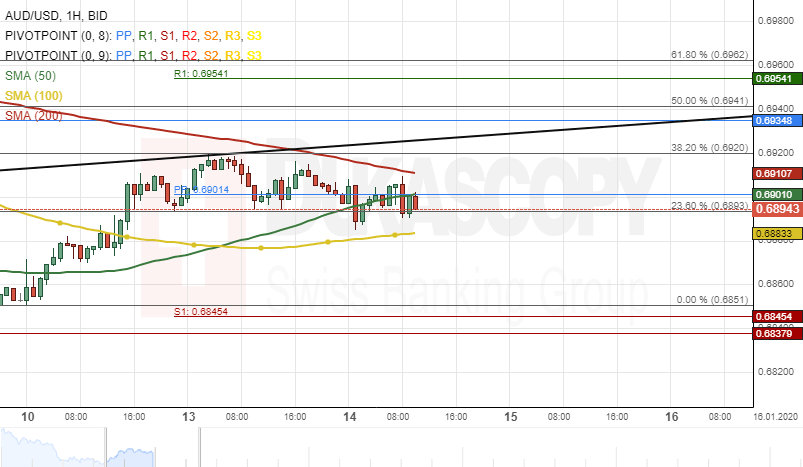

The Australian Dollar declined by 25 basis points against the US Dollar on Monday. The decline began after the currency pair tested the 38.20% Fibonacci retracement level at 0.6920 during yesterday's trading session.

Everything being equal, the AUD/USD exchange rate will most likely continue to decline in the descending channel pattern within this session. The possible target will be at the 0.6880 area.

However, the 100– hour simple moving average at 0.6882 could provide support for the currency exchange rate and drive the pair to break the descending channel pattern within this session.

Author

Dukascopy Bank Team

Dukascopy Bank SA

Dukascopy Bank stands as an innovative Swiss online banking institution, with its headquarters situated in Geneva, Switzerland.