AUD/JPY Elliott Wave technical analysis [Video]

![AUD/JPY Elliott Wave technical analysis [Video]](https://editorial.fxsstatic.com/images/i/AUDUSD-bullish-chart_XtraLarge.png)

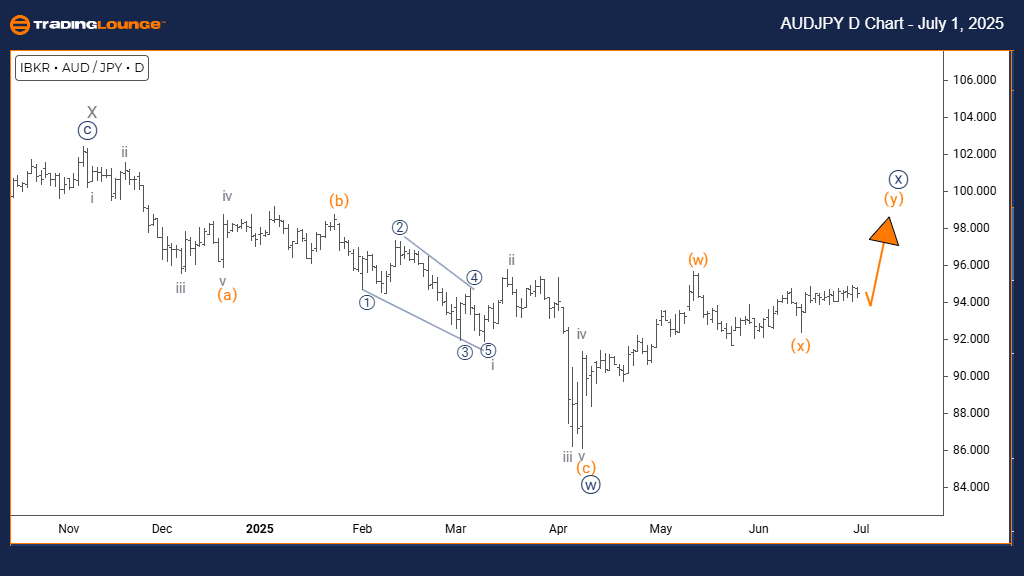

AUD/JPY Elliott Wave technical overview

Function: Counter-Trend.

Mode: Impulsive.

Structure: Navy Blue Wave X.

Position: Gray Wave Y.

Direction (Lower degrees): Navy Blue Wave Y.

Details: Navy Blue Wave W appears completed; Navy Blue Wave X is in progress.

Daily chart summary

The Elliott Wave analysis for the AUDJPY daily chart shows a counter-trend setup. The current price action is impulsive, moving strongly against the main trend. The wave structure is identified as Navy Blue Wave X, which belongs to a broader correction under Gray Wave Y. This setup suggests a potential shift or extension of the corrective phase.

Wave W to X transition

With Navy Blue Wave W completed, the pair has entered Navy Blue Wave X. This wave typically represents part of a complex correction and may develop into a combination pattern. The next anticipated move is Navy Blue Wave Y, which would follow the completion of the ongoing Wave X.

Technical outlook

AUDJPY is positioned for a corrective move, with Wave X now developing after Wave W's conclusion. The impulsive structure of this wave implies strong price momentum. However, this activity remains part of a correction—not the beginning of a new trend direction.

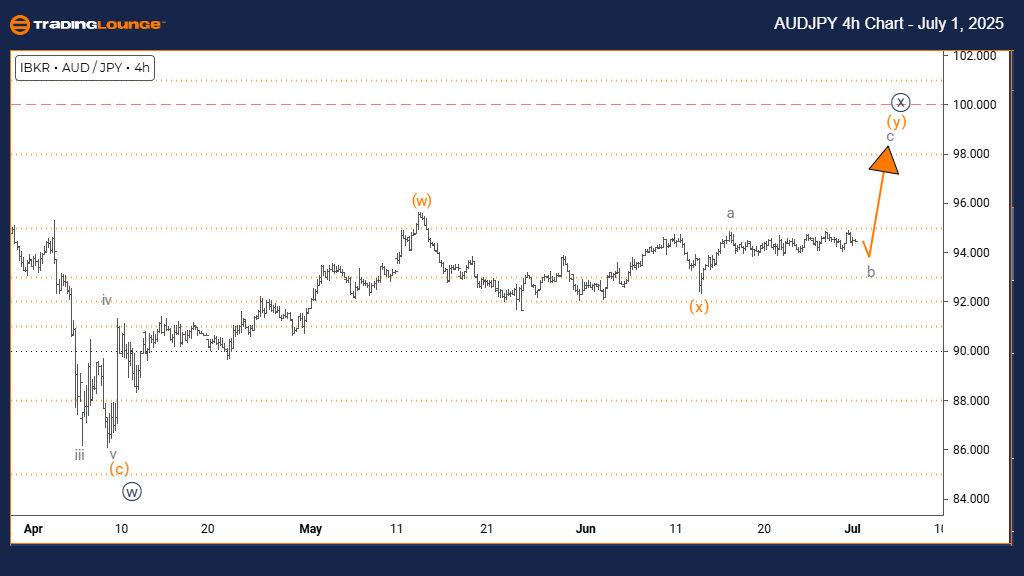

AUD/JPY Elliott Wave technical overview

Function: Counter-Trend.

Mode: Impulsive.

Structure: Orange Wave Y.

Position: Navy Blue Wave X.

Direction (Higher degrees): Orange Wave Y (Continues).

Details: Orange Wave X appears complete; Orange Wave Y is now developing.

Four-hour chart summary

The 4-hour Elliott Wave analysis of AUDJPY reflects a counter-trend setting. Price action is impulsive, showing strong movement contrary to the main trend. The active structure is Orange Wave Y within a broader correction under Navy Blue Wave X. This formation hints at a potentially extended corrective phase.

Wave x to Y Shift

With Orange Wave x completed, the chart now reflects the progression of Orange Wave Y within Navy Blue Wave X. This stage usually develops into a more structured pattern such as a zigzag or another complex correction.

Technical outlook

The technical structure places AUDJPY in a counter-trend corrective move with active Wave Y. Following the conclusion of Wave x, strong momentum is evident, though it remains part of a broader corrective phase—not a trend reversal. Traders should be cautious and monitor the next development within the pattern.

AUD/JPY Elliott Wave technical overview [Video]

Author

Peter Mathers

TradingLounge

Peter Mathers started actively trading in 1982. He began his career at Hoei and Shoin, a Japanese futures trading company.