All eyes on the Fed today

Euro Pulls Back From 1.1900 Once Again

The euro currency is on track to post the first daily decline in five days. The declines come after a steady bout of daily gains.

Prices briefly rose to the 1.1900 handle, but the common currency quickly reversed gains.

With the Fed meeting due later today, we expect the 1.1900 and 1.1800 range to hold.

A breakout from either of these two levels will potentially see further gains or declines.

To the upside, the EURUSD will need to challenge the key 1.2000 level.

While to the downside, the main support area near 1.1715 will be critical.

A break down below this level could lead to further declines with the next support area at 1.1600.

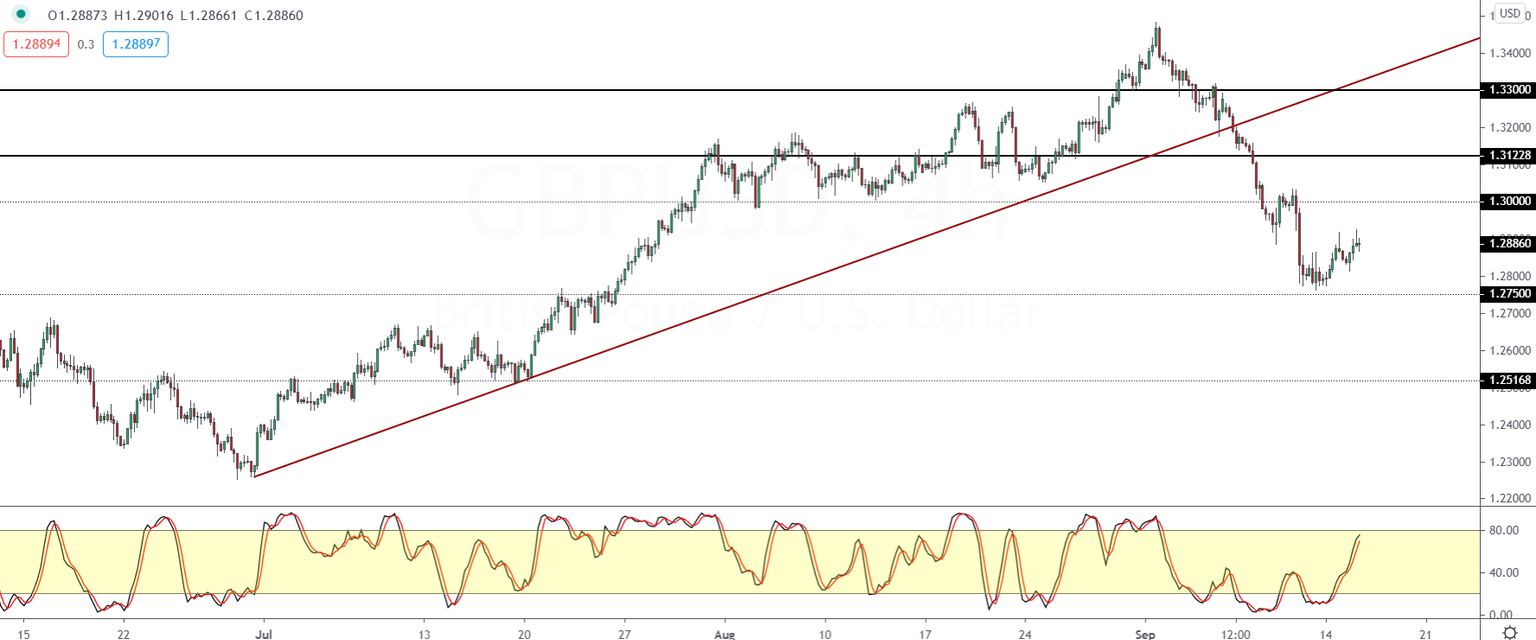

GBP/USD Trades Mixed Ahead Of Fed Meeting

The British pound sterling is trading mixed on Tuesday with price action driven by fundamentals.

Influencing the dollar is of course the expectations from the Fed meeting while Brexit talks are playing a role on the GBP.

For the moment, the hidden divergence on the 4-hour chart could suggest a near term pullback.

The declines, if any, could see the cable testing the 1.2750 handle.

To the upside, price action will need to strongly breakout from the current highs in order to test the 1.3000 handle.

Crude Oil Holds Steady Despite Bleak Demand

Oil prices are trading somewhat stronger despite the bleak assessment from the Paris based International Energy Association (IEA).

The IEA trimmed its demand for the outlook for 2020, but the report did not see much reaction from the oil markets.

Price action remains caught in the newly established range, within 38.26 and 36.46.

So far, there is no evidence that oil prices could move higher.

However, if there is any upside, then oil will need to struggle to breakout above the 38.83 level which could act as resistance.

To the downside, the declines are limited to the previous lows near 36.46 for the moment.

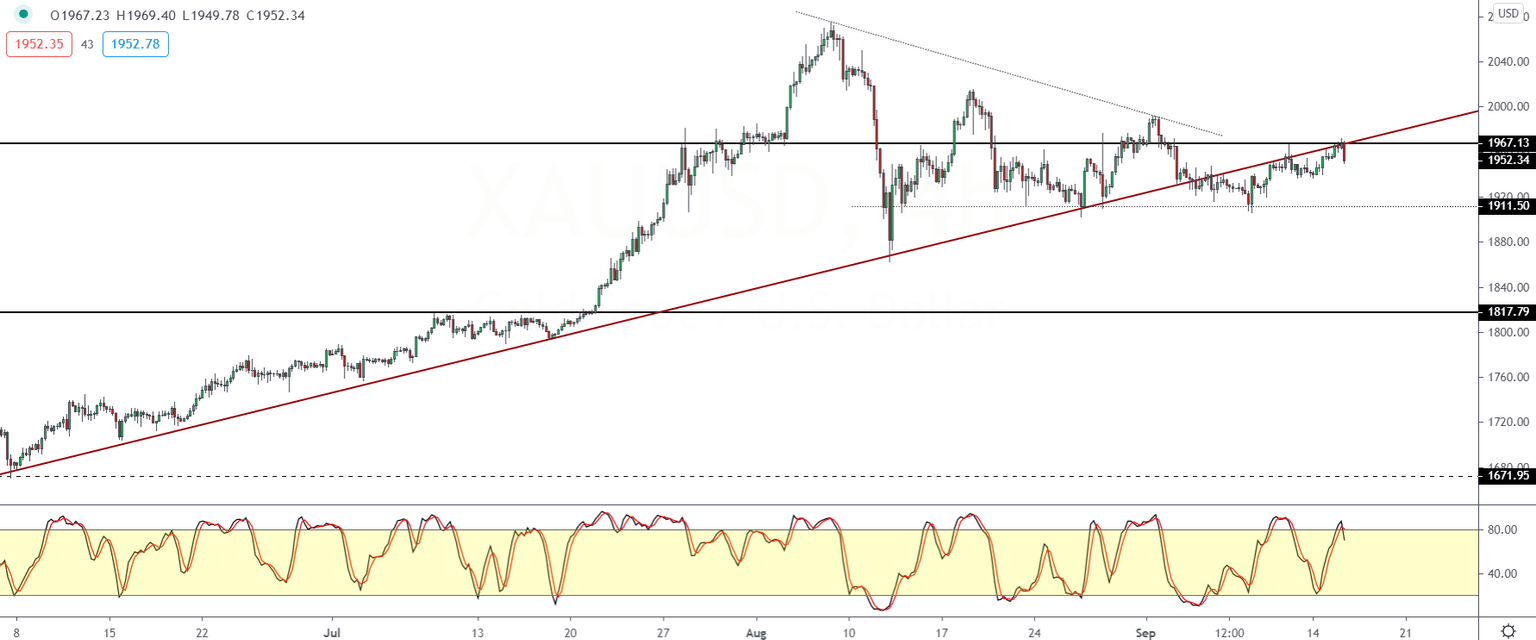

Gold Fails Near 1967 Technical Resistance

The recent gains in the precious metal hit a snag after price failed to breakout above the 1967 resistance.

The strong confluence of both the trend line and the horizontal support level has reversed direction.

Price action is likely to remain in a sideways range within 1967 and 1911.50. The Fed meeting later today will most likely see this range being breached.

The bias is limited to the upside unless gold can clear the 1967 and the 2000 levels.

To the downside, a close below the 1900 region could trigger a sharper correction.

Author

John Benjamin

Orbex

John is a market analyst for Orbex Ltd. and is a forex and equities trader having been involved in trading since late 2009. John makes use of a mix of technical and fundamental analysis and inter-market relationships.