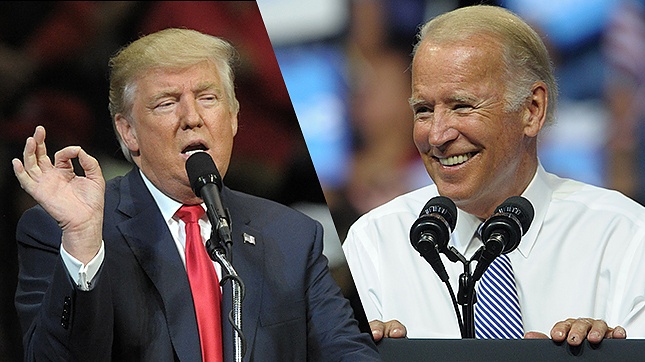

2020 Elections: Markets cheer prospects of a delayed Biden victory, not a contested election

- Biden taking a lead in three states that could send him to the White House.

- President Trump's false claims are falling on deaf ears.

- Split Congress risks derailing the rally, but a final call on the Senate could wait for January.

A repeat of 2016 or 2000? It is probably more like 2004, and markets are beginning to like it. Pundits are obsessed with President Donald Trump's narrow victory four years ago or with the contested election 20 years ago, but the 2020 elections are more reminiscent of George W. Bush's re-election in 2004 – a result that took another day to clarify, but resulted in a clear winner.

Democratic candidate Joe Biden has improved his position according to the recent count. The former Vice-President is leading in narrow margins in Wisconsin, Michigan, and Nevada. The margins in these three states are below 1%, but the remaining votes are from cities or from mail-in votes – which tend to lean toward the Democrats.

The race in Nevada's neighbor Arizona is all but wrapped up. While Fox and AP have called AZ it for Biden, other outlets are hesitating. Biden leads there by 3.4% with 86% of the votes counted.

Tallying up the electoral college votes from these four states brings Biden to the magic number of 270, a majority to secure a White House victory. That may happen as early as Wednesday, and betting markets are already heavily leaning toward such an outcome.

Source: NYT

The count in Pennsylvania is only at 76% and Trump is leading thereby over 10%. However, authorities still need to tally Democratic-leaning Philadelphia and mail-in ballots. The president is also leading in North Carolina by 1.4%, yet the Tar-Heel State allows ballots to arrive by November 12.

Georgia holds a similar story – Trump is up by 2.2% but votes from Atlanta are yet to be fully tallied. The Peach State also features two Senate battles.

While Trump has falsely claimed, "Frankly, I already won," his recent tweet says this "blue shift" – a move from his lead to Biden pulling ahead – is only "very strange" and not outright fraud. Republicans may still contest some of the races in the courts, potentially demanding a recount if the races are very tight.

However, markets seem to be getting comfortable with adding "president-elect" as Biden's title. It seems like a matter of time – perhaps hours and not days. The president's complaints seem to be ignored, at least for now.

Investors are eyeing a large stimulus package, and Biden would likely push for a larger one. However, without Democratic control of the Senate, he may have a hard time approving anything. Currently, the GOP seems well-placed to retain control of the Senate, yet that hinges on North Carolina and Georgia, with the latter potentially holding two run-offs in January.

A Republican win of the Senate is confirmed, markets may come off their highs.

See 2020 Elections: Why markets may now ditch Biden and cheer Trump

Nevertheless, that may wait for a cold day in 2021. In 2020 – and more likely in a matter of hours, Biden could be confirmed as the 46th President, and investors are cheering a relatively early resolution.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.