Yellen: Will work with Pres. Biden to fight currency manipulation

Treasury Secretary Janet Yellen has said that she will work with president Joe Biden to fight currency manipulation.

Additional comments

- Will not alter China tariffs until allies consulted.

- Need 'new approach' for meaningful China pressure.

- US to take on China's abusive, illegal practices.

- Will use a full array of tools to counter china practices, comprehensively review debt management practices to analyse weighted-average maturity of the debt.

Market implications

Some strong language coming from the Biden administration directed at China on Day Two of office.

On Day One, China imposed sanctions on outgoing Donald Trump officials just as the inauguration was taking place.

This act enraged the new administration.

"Imposing these sanctions on Inauguration Day is seemingly an attempt to play to partisan divides," Emily Horne, a spokeswoman for President Biden's National Security Council, told Reuters on Wednesday.

"President Biden looks forward to working with leaders in both parties to position America to out-compete China."

The world's two largest economies became locked in a damaging trade war during Trump's term, and that looks set to continue.

While Biden is expected to strike a more predictable and diplomatic tone than former President Trump, the new administration isn't likely to ease up on Beijing too much when it comes to tech and trade.

''China is undercutting American companies by dumping products, erecting trade barriers, and giving away subsidies to corporations," Yellen told the Senate Finance Committee this week, echoing some of the Trump administration's biggest criticisms of China.

There are plenty of loose ends to the trade agreement between the US and China, a theme that markets will be on monitoring very closely.

The USD will likely experience spikes in periodic short-term volatilities as key events of the trade war unfold under the Biden administration.

In the long-term, the performance of the USD will depend on the US and global economic performance, the Federal Reserve, adopted monetary policies of central banks around the globe and fiscal monetary policy pertaining to covid.

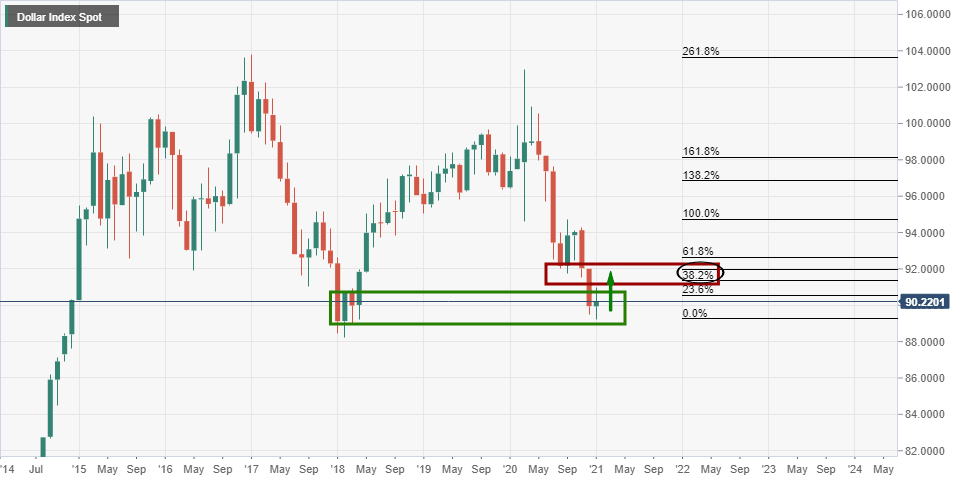

DXY monthly chart

The monthly chart indicates the possibility of a continuation of the current correction.

Following such a move into a prior structure, in this case, a demand zone, a correction would be expected to at least the 38.2% Fibonacci, especially where it meets prior stricture, in this case, prior lows.

Trade war sentiment and demand for US Treasuries coupled with inflationary expectations and a less dovish Fed leading to rising US yields could be the catalyst for a period of US dollar strength.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.