XAU/USD Price Forecast: Gold price holds its ground after Fed decision

- Fed Held rates steady at 5.25%-5.5% as expected.

- Markets await Powell's presser for further insights.

- The 2,5 and 10-year yields remain down, favoring the non-yielding yellow metal.

On Wednesday, the XAU/USD rose to $2,440 and held its ground after the widely anticipated Federal Reserve (Fed) decision.

The US Federal Reserve has again decided to keep the policy rate unchanged at 5.25%-5.5%, marking the eighth consecutive meeting without a rate adjustment. Following the decision the 2, 5, and 10-year Treasury yields remain stable at 4.36%, 4.02%, and 4.11% respectively with investors keenly anticipating Federal Reserve Chair Jerome Powell's press conference for further insights.

Regarding the statement, there weren’t major language changes and the bank still considers that the inflation is somewhat elevated. There was no clear guidance regarding the September meeting which could be considered hawkish. As such the bank hints that it remains data-dependant.

XAU/USD Technical analysis

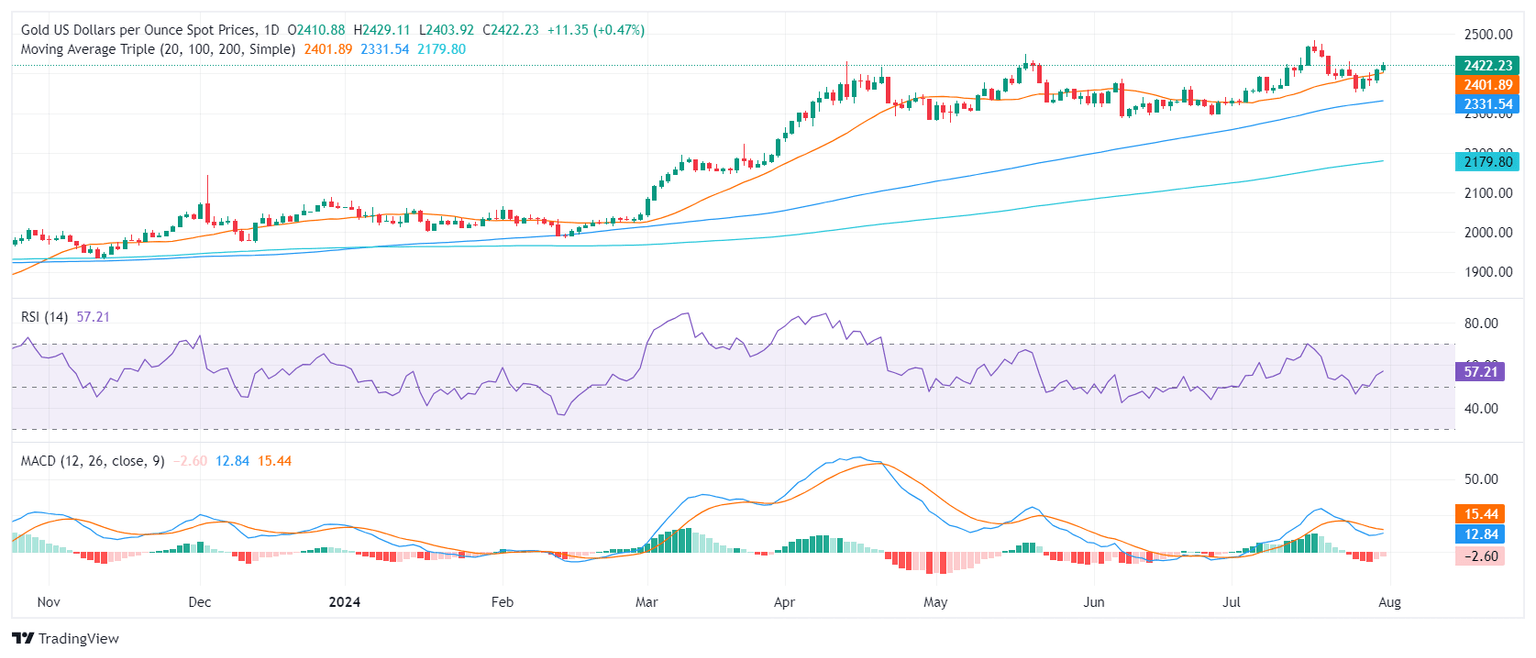

The overall outlook is positive with the price above the 20,100 and 200-day Simple Moving Averages (SMA). Indicators also remain in positive terrain which indicates steady buying pressure. For the next sessions, markets should eye the $2,400 - $2,490 (cycle high) range for movements.

XAU/USD Daily chart

Author

Patricio Martín

FXStreet

Patricio is an economist from Argentina passionate about global finance and understanding the daily movements of the markets.