XAU/USD Forecast: Gold reaches records amid escalating US-China trade war

- Escalating tensions between the United States and China put markets in risk-off mode.

- Wall Street resumed its bearish route, with the three major indexes down over 4% each.

- XAU/USD holds on to solid gains around $3,160 after reaching fresh record highs.

The bright metal soared on Thursday, hitting a fresh all-time high of $3,175.00 a troy ounce during American trading hours. The US Dollar (USD) plummeted on headlines indicating the trade war unleashed by US President Donald Trump is far from over.

Trump announced massive retaliatory tariffs last week, only to pause most of them on Wednesday. Stock markets collapsed with the original news, recovering with the more optimistic pause. However, the good mood was short-lived. The White House confirmed on Thursday that levies on China account for 145%, the original 20% plus an additional 125%, which followed Beijing’s announcement of retaliatory 84% levies.

Tensions between the two countries revived concerns about a potential United States (US) recession around the corner. Even further, the US March Consumer Price Index (CPI) released earlier in the day showed inflationary pressures eased by more than anticipated, which will help the Federal Reserve (Fed) extend its wait-and-see stance on monetary policy. With easing inflation and fears of an economic setback, it’s not crazy to think the Fed could even hike interest rates in the future.

Wall Street plummeted with the news, falling alongside the USD. At the time of writing, the Dow Jones Industrial Average is down roughly 4%, while the Nasdaq Composite and the S&P 500 shed over 5% each.

Technical Outlook

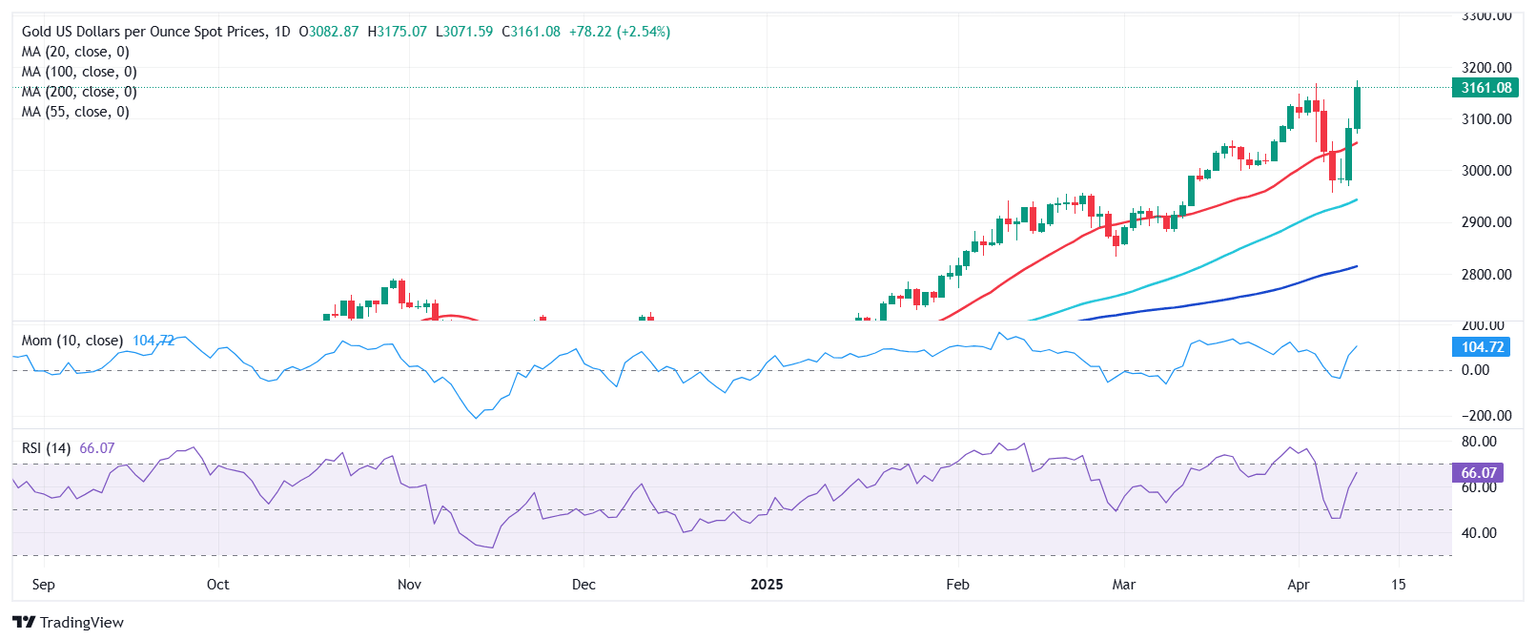

From a technical perspective, Valeria Bednarik, FXStreet Chief Analyst, notes: “The XAU/USD pair daily chart shows that additional gains are likely, given the strong upward momentum. Technical indicators head north almost vertically while still far from overbought levels. At the same time, the bright metal extended its advance beyond a now bullish 20 Simple Moving Average (SMA), currently at $3,052. Finally, the 100 and 200 SMAs also aim north, but far below the shorter one.”

Bednarik foresees XAU/USD reaching the $3,200 region in the upcoming sessions.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Author

FXStreet Team

FXStreet