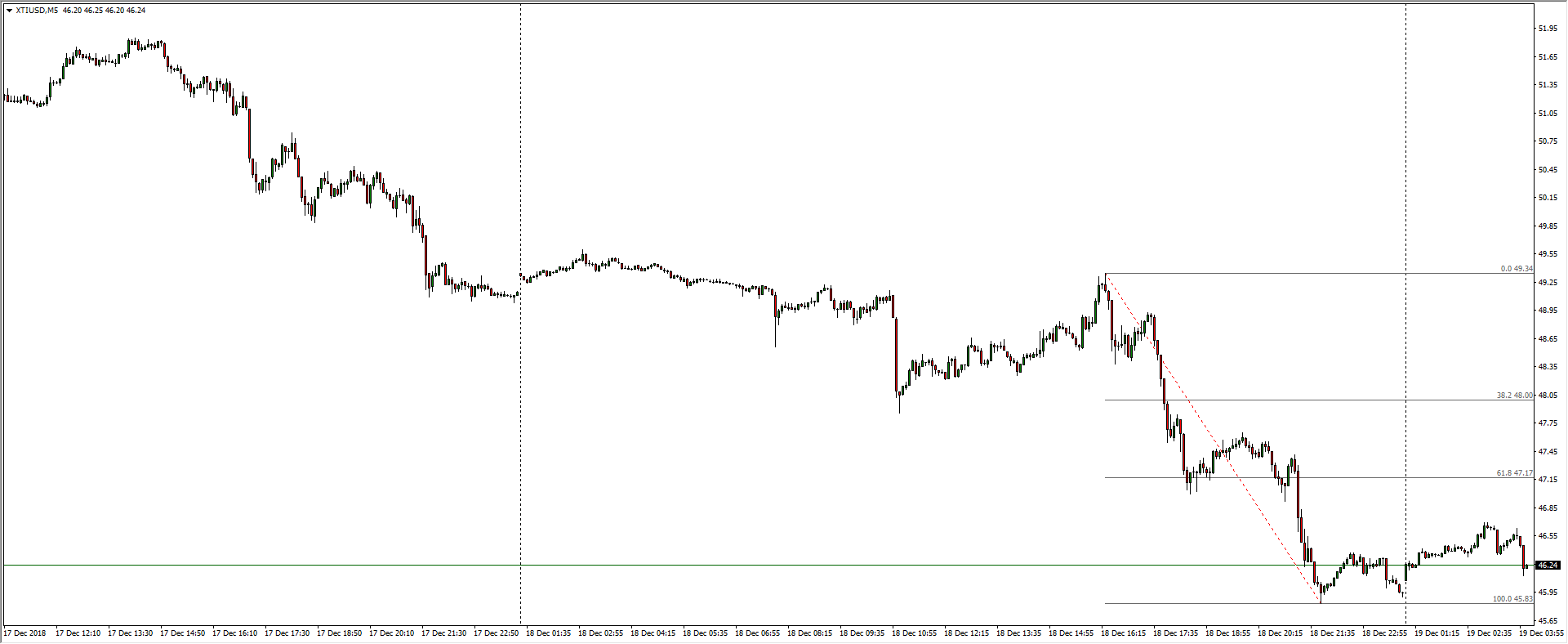

WTI Technical Analysis: New 17-month lows and accelerating bearish lean into $46.00

- US crude barrels continue to collapse, pinning into a low of 45.83 on Tuesday, and the early overnight session for Wednesday sees oil prices gearing up for another run into intraday lows.

WTI, 5-Minute

- Energies markets have given up on oil barrels, allowing crude to tumble into alarming lows, and even a recovery of the 61.8% Fibo retracement at the $50 major price level for WTI would still see US crude in bearish territory.

WTI, 30-Minute

- Tuesday's bottom represents a 17-month low for WTI, and crude's acceleration out of consolidation from 49.50 into the downside sees US barrels set for further declines.

WTI, 4-Hour

WTI

Overview:

Today Last Price: 46.83

Today Daily change: 56 pips

Today Daily change %: 1.21%

Today Daily Open: 46.27

Trends:

Previous Daily SMA20: 51.41

Previous Daily SMA50: 57.35

Previous Daily SMA100: 64.1

Previous Daily SMA200: 66.46

Levels:

Previous Daily High: 49.92

Previous Daily Low: 46.14

Previous Weekly High: 53.48

Previous Weekly Low: 50.57

Previous Monthly High: 63.92

Previous Monthly Low: 49.64

Previous Daily Fibonacci 38.2%: 47.58

Previous Daily Fibonacci 61.8%: 48.48

Previous Daily Pivot Point S1: 44.97

Previous Daily Pivot Point S2: 43.66

Previous Daily Pivot Point S3: 41.19

Previous Daily Pivot Point R1: 48.75

Previous Daily Pivot Point R2: 51.22

Previous Daily Pivot Point R3: 52.53

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.