WTI Price Analysis: Oil buyers need $72.20 breakout to retake controls

- WTI eases from intraday top, remains mildly bid.

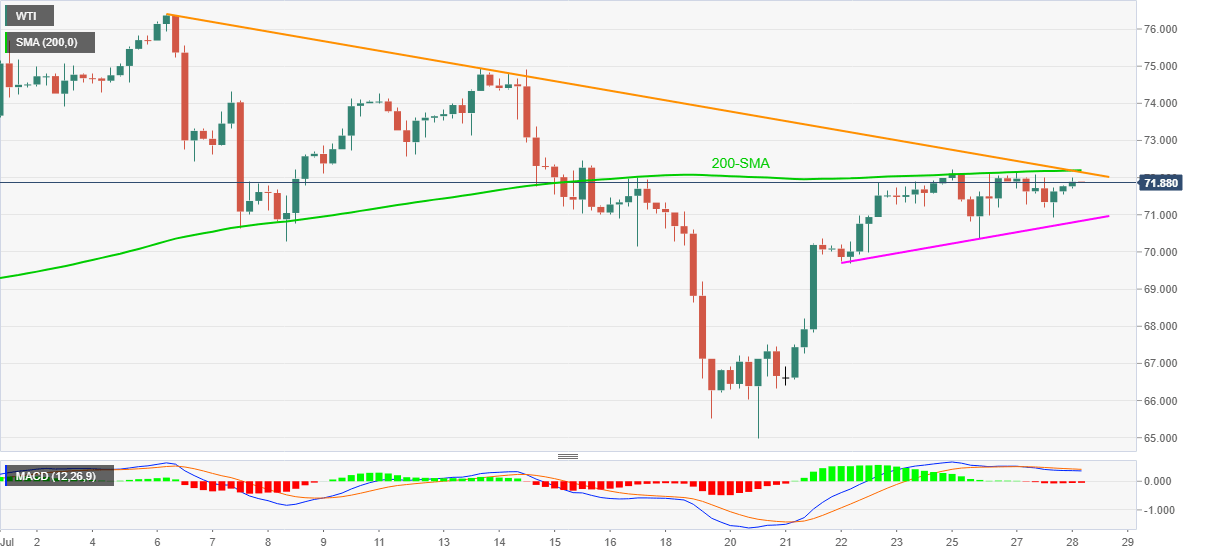

- Convergence of 200-SMA, three-week-old descending trend line probes bulls.

- Pullback moves can retest weekly support line, MACD portrays traders’ indecision.

WTI crude oil fades early Asian strength, eases to $71.90 by the press time of pre-European session trading on Wednesday. Even so, the black gold prints 0.27% gains on a day while keeping the previous day’s rebound from $70.90.

With the sluggish MACD conditions, bearish of late, the recent tops surrounding $72.20, also including 200-SMA and a downward sloping trend line from July 06, will keep testing the oil bulls.

However, a clear upside break of the same won’t hesitate to recall the $75.00 to the chart, comprising the mid-month top, before directing the energy buyers toward the monthly top near $76.40.

Alternatively, a pullback move, which is widely expected, will revisit a week-old support line near $70.80, a break of which will direct the WTI sellers to the $70.00 threshold.

It should be noted though that the oil bears’ dominance past $70.00 will be questioned by the last Thursday’s low near $69.70 before highlighting the monthly low surrounding $65.00.

WTI: Four-hour chart

Trend: Sideways

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.