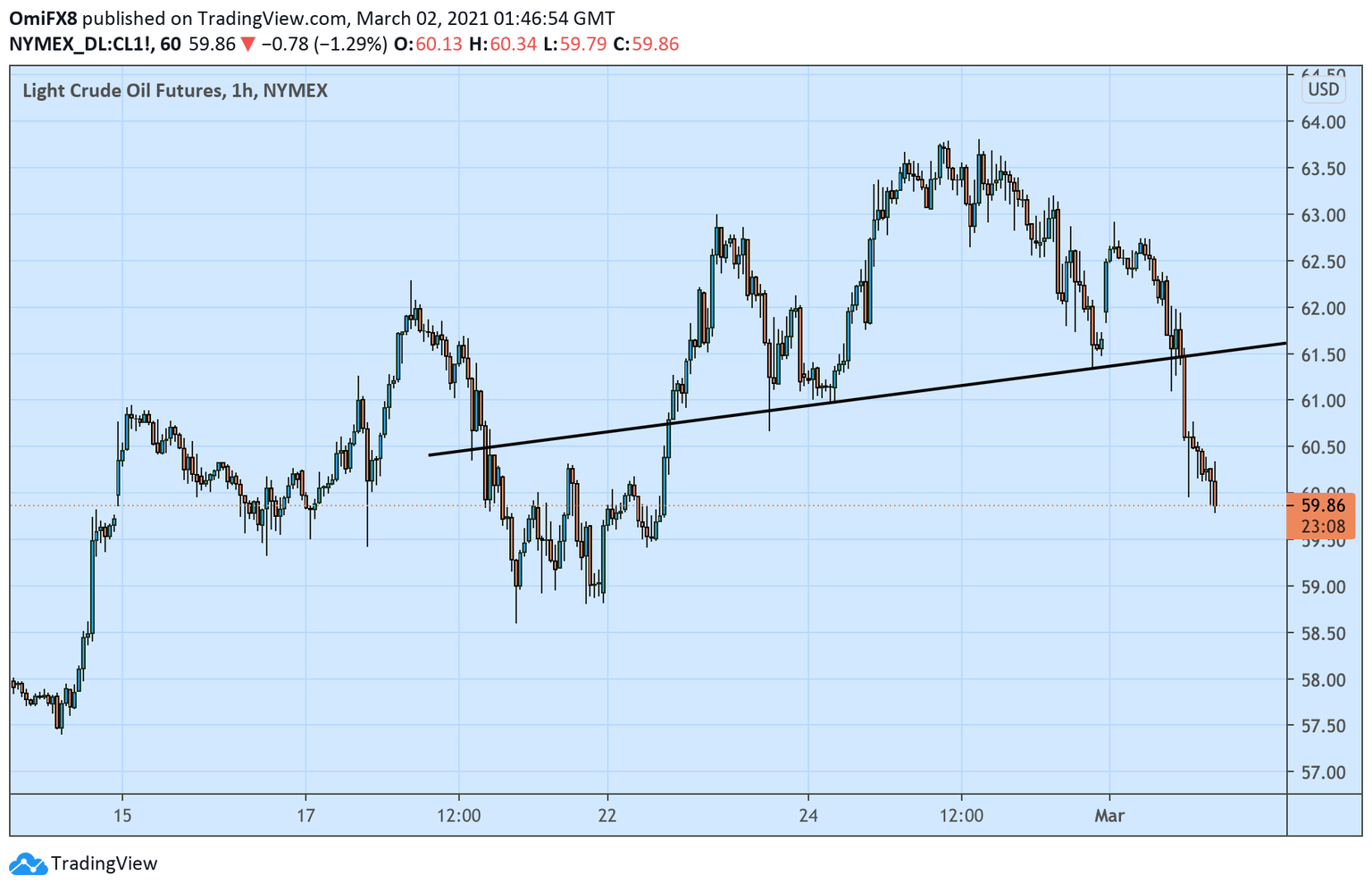

WTI Price Analysis: Crude drops below $60 after head-and-shoulders breakdown

- WTI drops below $60 to hit the lowest since Feb. 22.

- The hourly chart shows scope for a deeper decline.

West Texas Intermediate (WTI) crude, a North American oil benchmark, printed a low of $59.86 soon before press time, having confirmed a head-and-shoulders (H&S) breakdown, a bearish reversal pattern, on the hourly chart on Monday.

Oil could drop further, as the H&S breakdown has opened the doors for $59.13 (target as per the measured move method).

The case for a deeper pullback looks strong, with the daily chart flashing a bearish Doji reversal pattern. Further, the 14-day Relative Strength Index (RSI) is diving out of a sideways channel in favor of the bears.

Acceptance above the 200-hour Simple Moving Average at $61.55 would invalidate the bearish view.

Hourly chart

Trend: Bearish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.