WTI bulls keep in charge in the open among bullish market structure

- West Texas Intermediate (WTI) is bid in the open on Monday with a few headlines from the weekend being digested.

- WTI is trading at $65.29 and has travelled between a low of $64.83 and a high of $65.50 in a bullish start to the week.

WTI was ending Friday around flat at $64.83 and travelled between a low of $63.93 and $65.21, recovering from the worst levels of the day due to the growing optimism over the economic reopening in the US and Europe.

West Texas Intermediate crude for June delivery added on 19 cents, or 0.3%, to settle at $64.90 a barrel on the New York Mercantile Exchange, leaving front-month prices for the US benchmark up 2.1% for the week.

Meanwhile, senior Iranian officials are saying their nation may consider extending cooperation with the International Atomic Energy Agency over inspections of its nuclear sites.

The Iranian President Hassan Rouhani said on Saturday he was optimistic over talks to revive the 2015 nuclear deal with world powers and suggested a deal had been reached to lift the main sanctions on Tehran, state media reported.

Rouhani said only the details remained to be agreed upon. However, there was no immediate confirmation from US officials or from the other parties to the accord.

"We've reached a point where the Americans and the Europeans are saying openly they have no choice but to lift sanctions and return to the (nuclear deal), and that almost all main sanctions have been lifted and talks continue on some details," Rouhani was quoted by state media as saying.

In other news, a US fuel pipeline operator which operates an over 5,500-mile pipeline network from Texas to New Jersey has suffered a cyberattack that has forced the shutdown of its fuel network.

Elsewhere, there are still concerns about the surge in COVID-19 cases in India, the world’s third-largest oil importer.

On Friday, India recorded a record of 414,188 confirmed cases, bringing its tally to more than 21.4 million since the pandemic began. Traders see little prospect of the nation being able to bring down the curve in the short term and the Health Ministry also reported 3,915 additional deaths, bringing the total to 234,083. Both figures are likely undercounted, according to experts.

Meanwhile, the greenback is weaker following the disappointing US jobs report which could offer oil bulls a helping hand in the week ahead. The US created just 266,000 new jobs in April, falling well short of the 1 million forecasts.

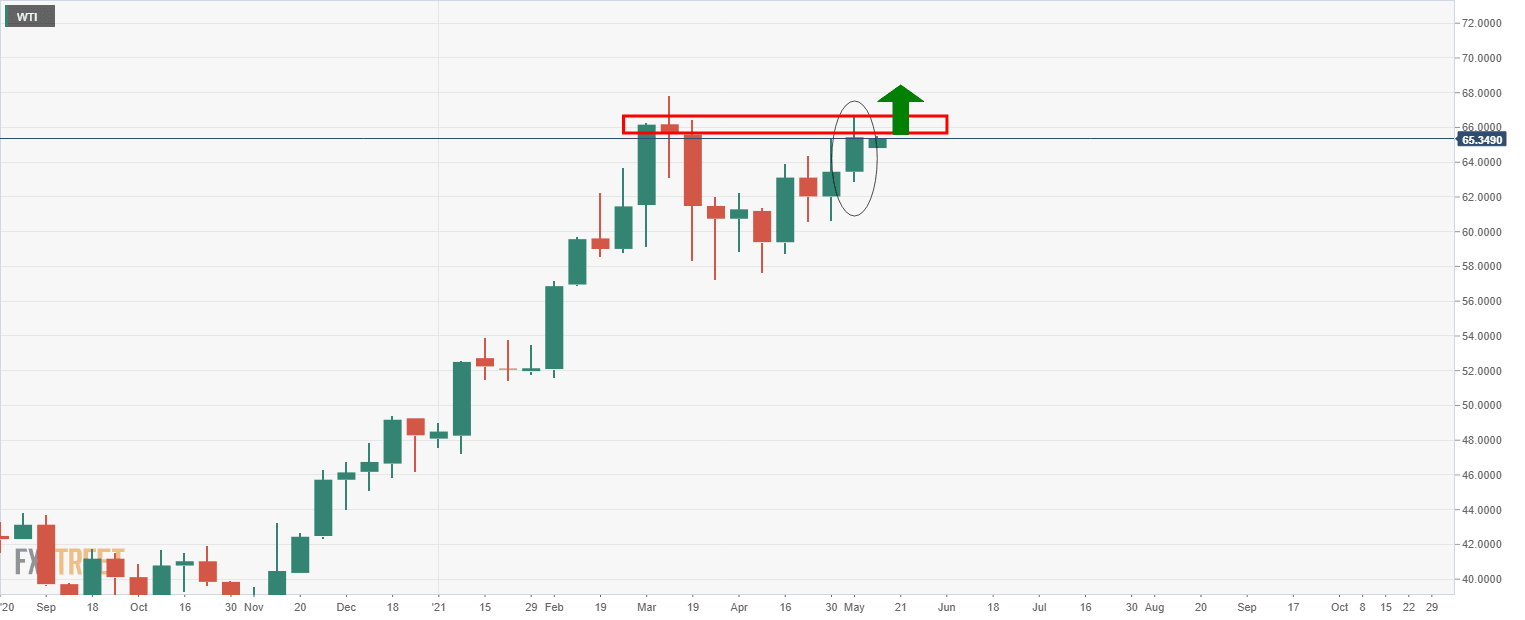

WTI technical analysis

Technically, given the market formation and recovery from the weekly corrective lows, there are prospects of a fresh cycle high for the coming week and the daily chart is in agreement as follows:

Weekly chart

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.

-637561983544964673.png&w=1536&q=95)