Will Tesla shares rally if Elon Musk steps down from Twitter?

Key points

-

The stock is down 57.35% so far this year, with many analysts attributing at least part of the decline to Musk being distracted with his purchase of Twitter.

-

Regulatory filings show that on December 14, after the closing bell, Elon Musk sold almost 22 million Tesla shares between December 12 and 14, for a value of $3.58 billion.

-

Senator Elizabeth Warren sent a letter to Tesla’s board chair asking if Musk was creating conflicts of interest and misappropriating corporate assets.

-

Tesla’s third-largest individual investor said he believes Musk should resign from his role at Tesla.

-

One prominent analyst expects Musk to resign from Twitter and re-focus his attention on the EV maker.

-

5 stocks we like better than Tesla

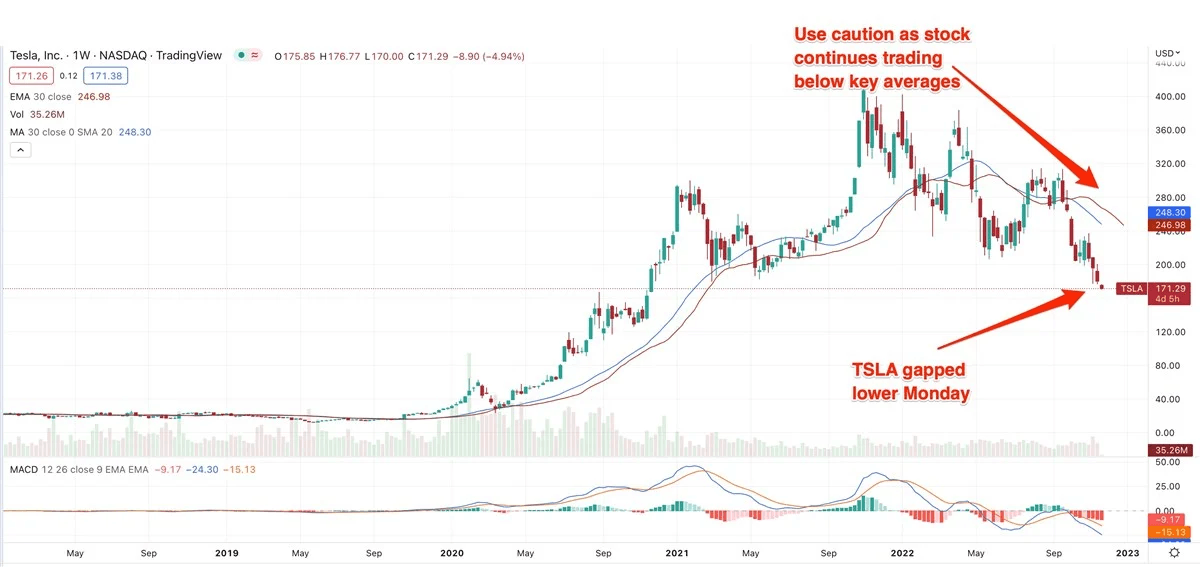

One company that’s been in the headlines lately is Elon Musk’s “other” company Tesla, Inc. (NASDAQ: TSLA). The stock is down 57.35% so far this year, with many analysts attributing at least part of the decline to Musk being distracted with his purchase of Twitter.

Investors and even politicians are taking notice.

To some degree, Tesla’s downward trajectory has paralleled the broader auto industry. Still, it’s inescapably true that Tesla’s performance is worse than established automakers such as General Motors Company (NYSE: GM) or Ford Motor Company (NYSE: F), or even some rival EV makers such as China’s BYD Company Limited (OTCMKTS: BYDDF).

Regulatory filings show that on December 14, after the closing bell, Musk sold almost 22 million Tesla shares between December 12 and 14, for a value of $3.58 billion. Many analysts who follow the company believe the proceeds will go toward funding Twitter, which Musk purchased in October.

There was heavier-than-normal downside trading volume on December 12, 13, and 14. The stock declined 6.27% on December 12, 4.09% on December 13, and 2.58% on December 14.

Big investors are taking notice. Insider selling is just a fact of life for publicly traded companies. Contrary to popular belief, it doesn’t always signal that an insider is acting on secret information that will send lower shares. Executives sell shares for prosaic reasons, such as raising cash to buy a house or fund college tuition.

Violating fiduciary duty?

But there’s also a corporate governance angle whenever an insider, particularly the CEO, sells large numbers of shares. The CEO’s fiduciary obligation is to the company’s shareholders. If Musk, or any CEO of a public company, takes actions that are to the detriment of other shareholders, that may be violating his fiduciary duty.

Over the weekend, Indonesian billionaire KoGuan Leo, the third-largest individual owner of Tesla shares, called for Musk to step down from his role as the car maker.

On Monday, news broke that Massachusetts senator Elizabeth Warren sent a letter to Tesla board chair Robyn Denholm, asserting that Musk’s actions may hurt Tesla shareholders. Warren also raised the question of whether Tesla’s board, which also has a fiduciary duty to shareholders, has been adequately addressing the situation with Musk. In her letter, Warren asked Denholm if Musk had been misappropriating corporate assets and creating conflicts of interest.

In another twist, Musk asked Twitter users in a poll if they believed he should step down as CEO, saying he would abide by their opinion. Tesla shares initially rose on news that the majority believed Musk should resign as Twitter CEO. Shares pulled into the red about an hour into Monday’s session before rallying again.

Not all the news is bad

To be sure, there’s been some good news for S&P 500 component Tesla recently.

Bloomberg reported last week that Tesla is planning to build a new manufacturing facility in Mexico. There’s been no announcement yet from the company, and it’s unclear precisely what Tesla plans to build there.

In addition, PepsiCo Inc. (NASDAQ: PEP) is prepping the rollout of 100 Tesla Semi trucks next year. Thirty-six are already in operation.

MarketBeat analyst data for Tesla show a “hold” rating on the stock. Since November 29, 12 analysts have lowered their price target on Tesla or downgraded their rating. Six boosted their targets or upgraded their rating. One reiterated its “buy” rating.

On Monday, Oppenheimer downgraded the stock to “market perform” from “outperform.”

Meanwhile, Wedbush analyst Dan Ives wrote that he expects Musk to step down from his role at Twitter and renew his focus on Tesla.

Analysts’ consensus price target for Tesla is $264.91, representing a potential upside of 78.23%. That’s certainly a plus for Tesla at the moment, along with Wall Street’s expectation that the company will earn $4.08 per share this year, up 81% from 2022. Next year, that’s seen rising another 40% to $5.72 per share.

Tesla is a part of the Entrepreneur Index, which tracks some of the largest publicly traded companies founded and run by entrepreneurs.

Author

Jacob Wolinsky

ValueWalk

Jacob Wolinsky is the founder of ValueWalk, a popular investment site. Prior to founding ValueWalk, Jacob worked as an equity analyst for value research firm and as a freelance writer. He lives in Passaic New Jersey with his wife and four children.