Will stocks extend their rally after the Fed?

The S&P 500 reached another record high, but post-Fed volatility is likely.

My Volatility Breakout System for the S&P 500 index is showing great results, with a current profit of over 150 points from a long position opened on September 4.

Stocks essentially moved sideways on Tuesday, with the S&P 500 closing 0.13% lower after reaching yet another all-time high of 6,626.99. The market is now eagerly awaiting the FOMC interest rate decision, scheduled for release at 2:00 p.m. today. The S&P 500 will likely continue trading within its current range, though some profit-taking could occur. Attention will also turn to Fed Chair Powell’s Press Conference at 2:30 p.m. This morning, the index is expected to open virtually flat.

Investor sentiment weakened last week, as reflected in Wednesday’s AAII Investor Sentiment Survey, which reported that 28.0% of individual investors are bullish, while 49.5% are bearish.

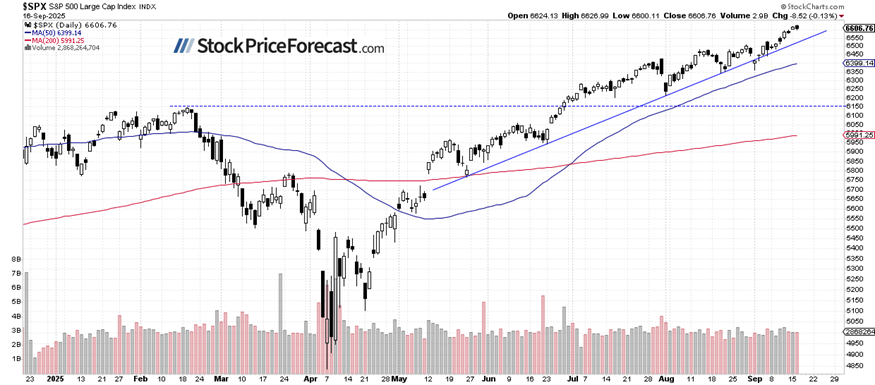

The S&P 500 remains above the 6,600 level, as shown on the daily chart.

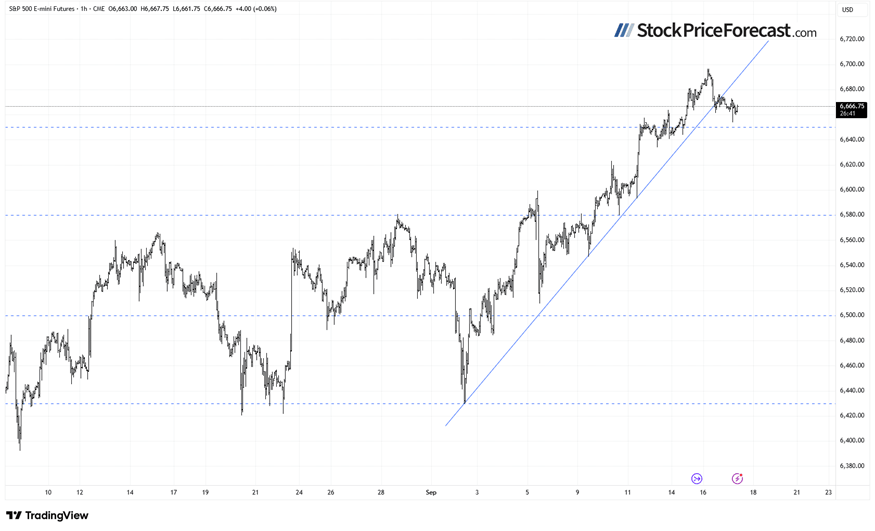

S&P 500 futures contract – Consolidation after a pullback

This morning, the S&P 500 futures contract is trading sideways after pulling back yesterday. The market underwent a quick downward correction after reaching an all-time high of around 6,697 (December series contract which trades around 1% above the cash market.). Potential resistance is at 6,700-6,720, while support is at 6,650, among others.

The market appears to be in a topping pattern ahead of a more meaningful downward correction. However, still no clear negative signals are evident at this time.

Market outlook: Long-awaited Fed decision

The S&P 500 is expected to open virtually flat, with investors awaiting the key interest rate decision, which is likely to raise the rate by 0.25 percentage points. The immediate reaction could be bullish, but much will depend on future expectations and Fed Chair Powell’s Press Conference. Overall, some profit-taking may occur at some point.

Here's what I think is most likely:

-

The S&P 500 will react to the FOMC release later today.

-

My Volatility Breakout System is currently long in the market.

What this means for your portfolio

For individual investors, this environment calls for careful position management. While the market continues to advance, the combination of low volatility, seasonal weakness signals, and stretched valuations suggests that defensive positioning may become increasingly important in the weeks ahead.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.