Will NVO (Novo Nordisk) provide any buying opportunity?

Novo Nordisk A/S (NVO), a healthcare company engages in the research, development, manufacture & marketing of the pharmaceutical products worldwide. It operates in two segments, Diabetes & Obesity care & Rare Disease. It is based in Denmark, comes under Healthcare – Biotechnology sector & trades as “NVO” ticker at NYSE.

NVO is trading at all time high in bullish weekly impulse sequence in ((3)) of III & expect to remain supported in 3, 7 or 11 swings pullback to resume higher. It favors upside in (3) & soon will starts correction, that offers trading opportunity.

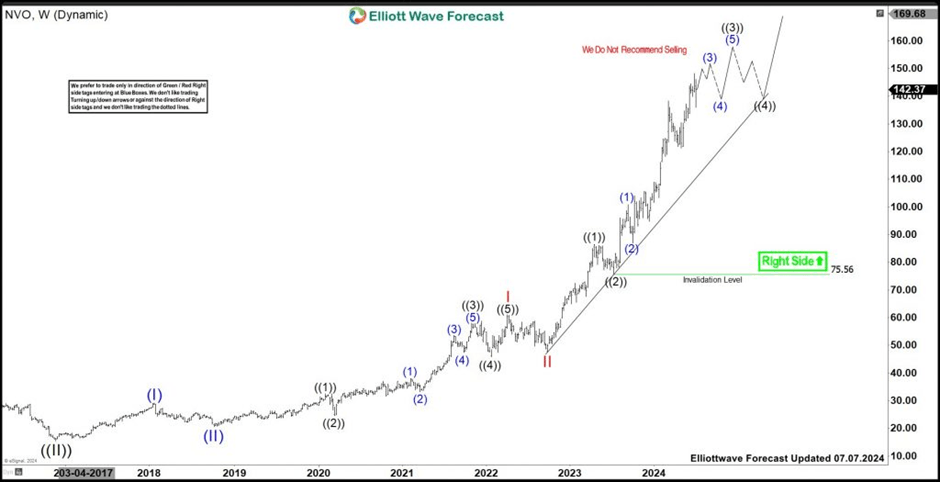

NVO – Elliott Wave latest weekly view

In weekly, it placed ((II)) at $15.45 low in November-2016 & (II) at $20.61 low in October-2018. Within (III) sequence, it placed I at $61.08 high & II at $47.51 low in September-2022 low. In I sequence, it placed ((1)) at $32.41 high, ((2)) at $24.62 low, ((3)) at $57.98 high, ((4)) at $45.76 low & ((5)) at $61.08 high. It broke above I high, ended ((1)) of III at $86.48 high & ended correction of ((2)) at $75.56 low in July-2023 low.

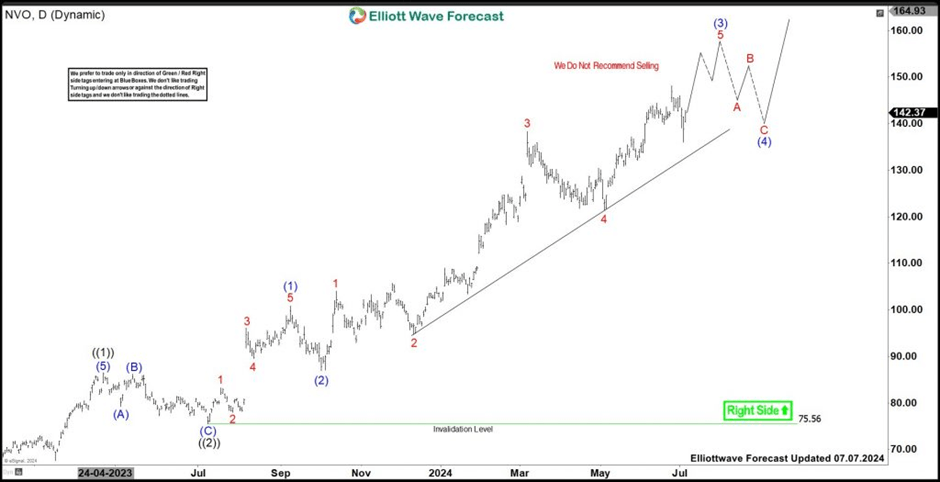

NVO – Elliott Wave latest daily view

Above ((2)) low, it placed (2) at $86.96 low & favors upside in (3) of ((3)) of III. Within (3), it placed 1 at $104 high, 2 as flat correction at $94.73 low, 3 at $138.28 high & 4 at $121.29 low. Above there, it favors upside in 5 & expect two more highs to finish (3) of ((3)), while dips remain above $136.01 low. It has minimum number of swings to call the (3) completed, which confirms below price trendline. We like to buy the pullbacks in (4) or ((4)) at extreme areas while above weekly price trendline.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com