Why I was steadfast about SPX, NDX rising

Did S&P 500 decline to my support level of low 5,970s given to clients? It took time following a bit underwhelming retail sales and unemployment claims, yet hot manufacturing data, but it did. Similarly some more tech weakness in key big names (AAPL, NVDA, less so AMD and SMCI – check TSLA too) exercised their weight, but otherwise it had been a risk-on day, one of recovering from a shallow pullback (several attempts that got quickly bought) – in line with the premarket prospects shared.

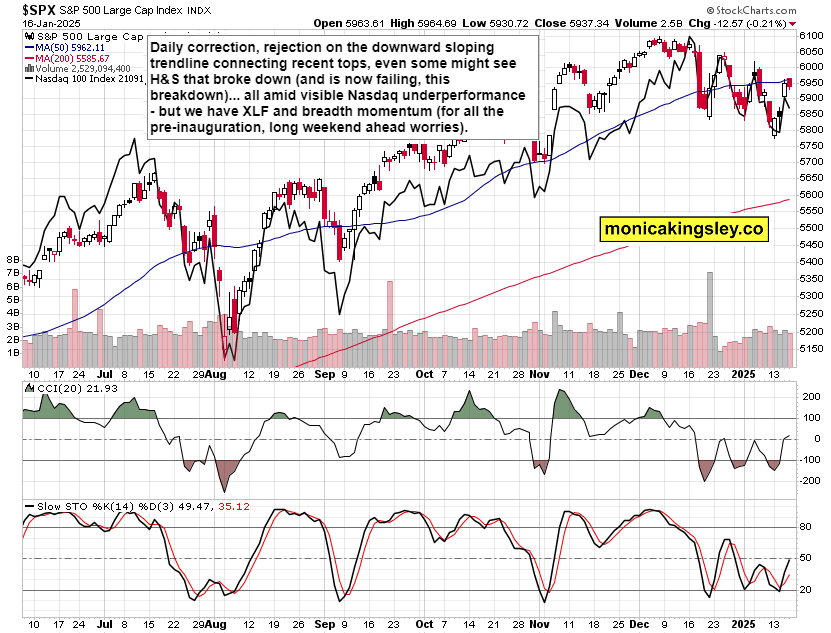

Check out today‘s premarket video where I talk why failed chart patterns have such a great power, and I would say we‘re in for a surprise move – basing first, and then pushing higher. Didn‘t we have enough of a false breakdown already? Have a look at Bitcoin over $102K today, and beware of typical opex volatility off the open. Run though my latest articles or videos, and compare the breadth developments for yourself.

The clues are clear, and clients were told days ago already, their open profits are growing – here is a little commented preview of what Trading Signals and Stock Signals clients are getting.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.