Why AMD could be on the verge of a breakdown

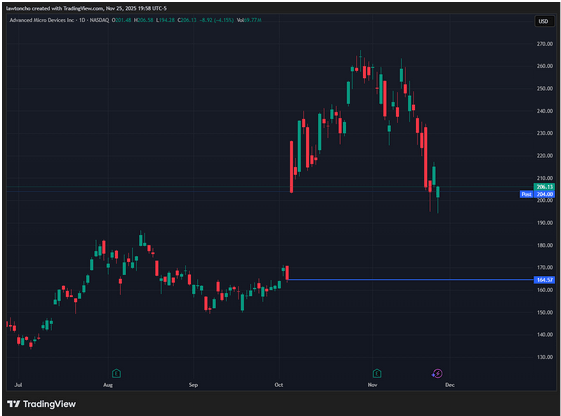

Advanced Micro Devices (AMD) had a rough session yesterday, finishing the day down more than 2% during regular market hours. From a technicals perspective, this was not just a red day—it was a day that brought price action into a very important area on the chart. When I step back and look at the daily timeframe, AMD is now pressing directly into a major upsloping trendline that has been guiding price for months.

This trendline is not arbitrary. It can be clearly identified by connecting the pivot low from September through the successive lows formed in December and extending that line forward to meet yesterday’s intraday lows. Each of these touches reinforces the validity of the level, and price now finds itself right at that decision point. When stocks approach a well-defined trendline like this, especially after weakness, I pay close attention because it often marks the difference between continuation and breakdown.

Despite the trendline sloping higher, the technical structure here is bearish. An upsloping trendline breaking to the downside typically signals that buyers are losing control, and if this level gives way, it opens the door for further downside. From my perspective, the concern is not just the single red day, but the location of that move within the broader technicals. AMD is no longer comfortably above support—it is testing it.

From a trading standpoint, there are two straightforward ways I would think about approaching this setup. The first is entering on a clean break of the upsloping trendline, which would confirm that support has failed. The second is waiting for a breakdown followed by a retrace back into the trendline, using that former support as new resistance. Both approaches rely on patience and confirmation rather than anticipation.

It’s also worth briefly stepping back and acknowledging the stock itself. Advanced Micro Devices is a widely followed name in the market, and because of that, its charts tend to attract a lot of attention from traders focused on technicals. That level of participation often makes key trendlines and pivot points more meaningful, as many eyes are watching the same areas and reacting accordingly.

As always, none of this matters without proper risk management. Regardless of whether one chooses to trade the break or the retrace, controlling risk is essential. Trendline setups can fail, and even the cleanest technicals do not guarantee outcomes. For me, the focus is on structure, confirmation, and discipline—letting the chart dictate the trade rather than forcing an opinion.

Author

Lawton Ho

Verified Investing

A marketing expert sharing his journey to mastering the charts.