Japan’s Tokyo CPI inflation eases to 2.6% YoY in August

The headline Tokyo Consumer Price Index (CPI) for August rose 2.6% YoY as compared to 2.9% in the previous month, the Statistics Bureau of Japan showed on Friday.

Additionally, Tokyo CPI ex Fresh Food climbed 2.5% YoY in August against 2.5% expected and down from 2.9% in the prior month. The Tokyo CPI ex Fresh Food, Energy rose 3.0% YoY in August, compared to the previous reading of 3.1%.

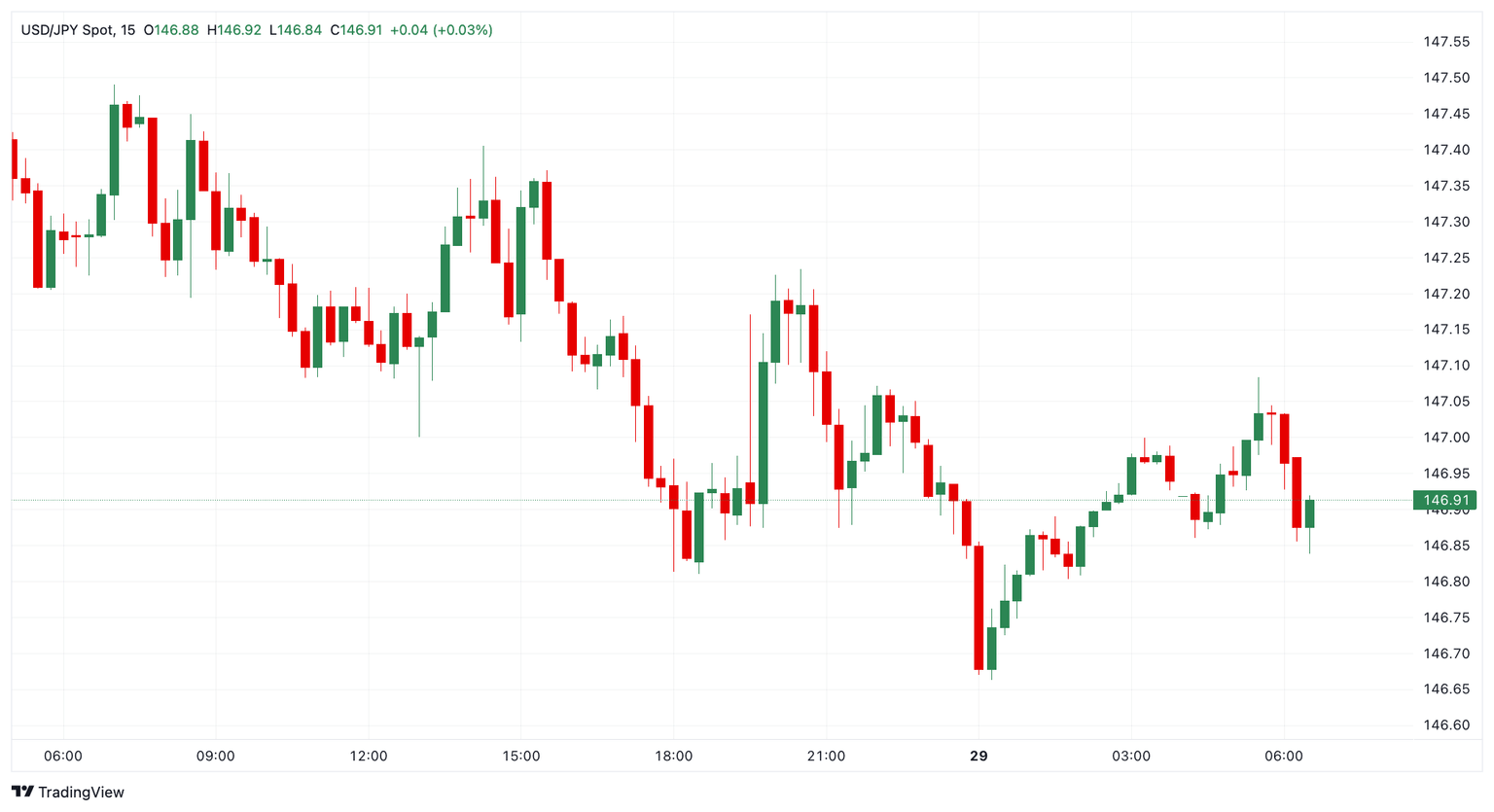

USD/JPY reaction to the Tokyo Consumer Price Index data

As of writing, the USD/JPY pair was down 0.05% on the day at 146.85.

Japanese Yen Price This week

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies this week. Japanese Yen was the weakest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.37% | 0.07% | 0.04% | -0.53% | -0.57% | -0.25% | 0.03% | |

| EUR | -0.37% | -0.30% | -0.39% | -0.90% | -0.87% | -0.62% | -0.34% | |

| GBP | -0.07% | 0.30% | -0.24% | -0.60% | -0.63% | -0.31% | -0.04% | |

| JPY | -0.04% | 0.39% | 0.24% | -0.51% | -0.58% | -0.22% | 0.11% | |

| CAD | 0.53% | 0.90% | 0.60% | 0.51% | -0.03% | 0.31% | 0.56% | |

| AUD | 0.57% | 0.87% | 0.63% | 0.58% | 0.03% | 0.32% | 0.59% | |

| NZD | 0.25% | 0.62% | 0.31% | 0.22% | -0.31% | -0.32% | 0.28% | |

| CHF | -0.03% | 0.34% | 0.04% | -0.11% | -0.56% | -0.59% | -0.28% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

This section below was published at 21:45 GMT as a preview of the Japan’s Tokyo Consumer Price Index (CPI) data.

Tokyo CPI inflation Overview

The Tokyo Consumer Price Index (CPI) inflation print, due at the tail end of the Thursday market session at 23:30 GMT, will give markets the latest peek at how Japanese inflation is ticking away under the hood. The Tokyo-focused CPI release on Thursday leads the national CPI figures by a couple of weeks, and serves as an advance bellwether of how Japanese inflation is reacting, or not reacting, to Bank of Japan (BoJ) monetary policy.

The BoJ has been trapped in a hyper-easy monetary policy stance for decades, with Japan’s main reference rate stuck below 1% since September 1995. With the BoJ struggling for almost a third of a century to re-ignite Japanese inflation, overly-cautious central bank policymakers are looking for clear signs that inflation will rise enough to warrant defensive interest rate hikes.

August’s headline Tokyo CPI, which is expected to ease to 2.5% YoY, last came in at 2.9%, with core-core Tokyo CPI (headline CPI inflation minus food and energy prices) last clocking in at 3.1%.

How could Tokyo CPI inflation affect USD/JPY?

Japanese inflation metrics have taken on a key role in Yen markets, as JPY bidders look for signs that the BoJ will finally be knocked off of its low-rate stance. As noted by MarketPulse’s Kenny Fisher: “The BoJ has stressed that it is on a path of normalization of monetary policy and plans to raise interest rates. However, the BoJ hasn't hiked rates since January and doesn't appear to be in any rush.

At the current trajectory, interest rate markets aren't expecting BoJ interest rates to move above 0.75% until March 2026 at the earliest. USD/JPY is still stuck in a multi-month consolidation phase, albeit on the low end, and testing just below 147.00.

Economic Indicator

Tokyo CPI ex Food, Energy (YoY)

The Tokyo Consumer Price Index (CPI), released by the Statistics Bureau of Japan on a monthly basis, measures the price fluctuation of goods and services purchased by households in the Tokyo region. The index is widely considered as a leading indicator of Japan’s overall CPI as it is published weeks before the nationwide reading. The gauge excluding food and energy is widely used to measure underlying inflation trends as these two components are more volatile. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Japanese Yen (JPY), while a low reading is seen as bearish.

Read more.Next release: Mon Sep 29, 2025 23:30

Frequency: Monthly

Consensus: -

Previous: -

Source: Statistics Bureau of Japan

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.