Walmart Earnings Preview: Q4 results expected on Thursday

- Walmart earnings on Thursday are top focus of Dow Jones traders this week.

- Wall Street expects $0.65 in adjusted EPS for Q4.

- WMT stock has risen 85% over the past year.

- Revenue is expected to reach $179 billion in Q4.

Walmart (WMT) is among the major concerns offering earnings results this week and the foremost among Dow Jones Industrial Average (DJIA) components. In the week shortened by Monday’s Presidents’ Day holiday, Walmart will release results for the fiscal fourth quarter ending in January on Thursday morning.

Besides the Federal Reserve (Fed) Minutes on Wednesday, the Philadelphia Fed Manufacturing Survey on Thursday or S&P Global PMIs slated for Friday, Walmart by itself will be watched by many in the market for its broad picture of the United States (US) economy. As the nation’s largest retailer, a lot of data can be gleaned from quarterly results concerning the general state of the US consumer, who many economists believe sits at the base of the entire global economy.

Walmart earnings

Analysts are so far mixed in the leadup to Walmart results. While nine analysts have raised their earnings per share (EPS) estimate for the quarter, 18 have cut their own in the past 90 days.

The current consensus on Wall Street has Arkansas’ finest earning $0.65 in adjusted EPS on revenue of $179 billion. This would amount to an 8% annual increase in EPS and a 4% annual increase in revenue.

Considering how well Walmart stock has performed over the past year, it is a tall order to expect a large rally in the share price. WMT stock is already up 15% this year and has gained 85% over the past 12 months. The company’s acquisition of smart TV maker Vizio has impressed the market thus far, and EPS is expected to continue growing in the 10% to 12% range/

Walmart's management recently announced that it is eliminating certain positions and even closing down whole offices in Hoboken, New Jersey and North Carolina as it focuses on consolidating its management in Bentonville, Arkansas, Sunnyvale, California and Bellevue, Washington. The move is viewed as a cost-cutting effort.

On Thursday, analysts will likely want further color on Walmart’s Canada operations. In light of threatened 25% tariffs from the Trump administration against Canadian imports, Canadians have begun an ad-hoc boycott of US products and businesses. The market will want to know if Walmart Canada is feeling the pain since the superstore chain is planning on opening dozens of new locations across Canada over the next several years and spending $4.5 billion in order to do so.

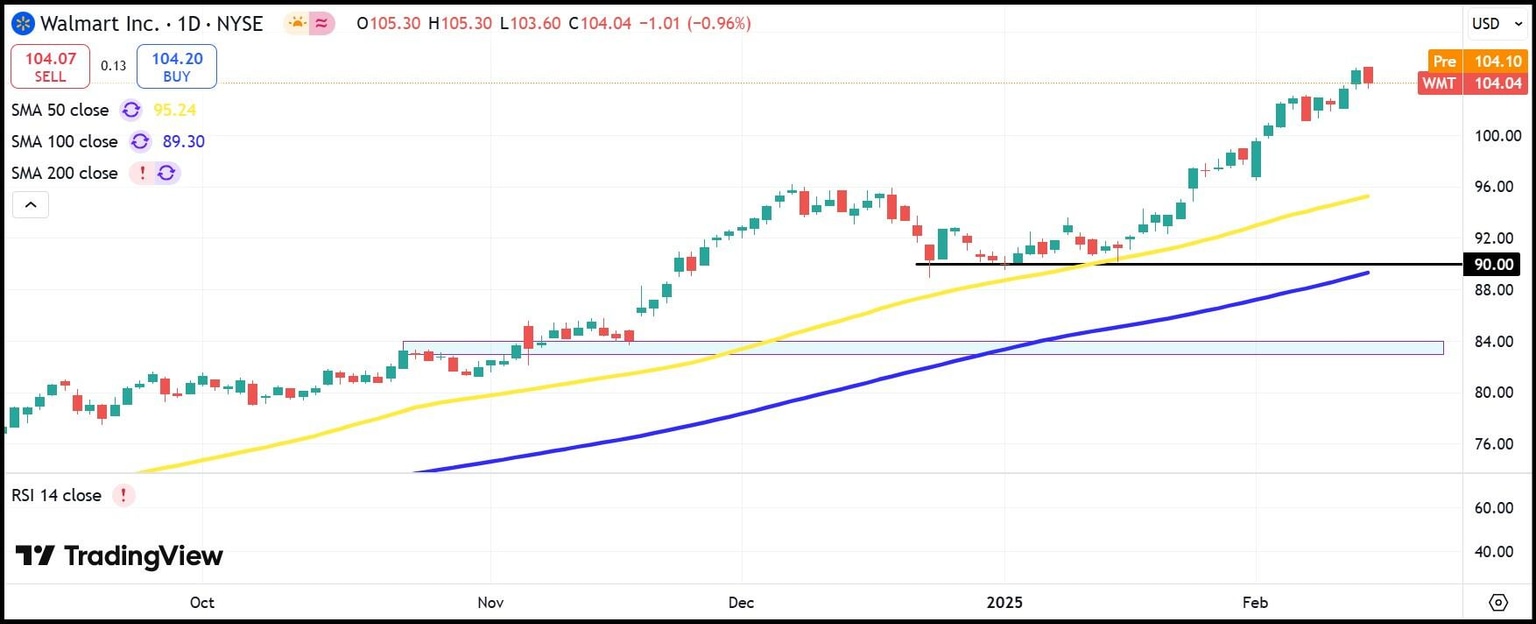

Walmart stock chart

Walmart shares have risen so steadily over the past year that it would make sense that the stock price consolidates at a lower level no matter which way the results turn. Walmart is currently trading near $104 per share, which provides it with a forward price-to-earnings ratio of about 42. This makes it quite richly-valued compared to its five-year historical average of 25.

As a shareholder, I'm tempted to take profits here before the earnings come in on Thursday.

Support near the 100-day Simple Moving Average at $90 coincides with historical support seen there in December and January. Besides that range, further support in the space between $83 and $84 from last October and November provides further downside protection.

WMT daily stock chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Clay Webster

FXStreet

Clay Webster grew up in the US outside Buffalo, New York and Lancaster, Pennsylvania. He began investing after college following the 2008 financial crisis.