Wake Up Wall Street (SPY) (QQQ): Russia-Ukraine worries keep risk off and volatility on

Here is what you need to know on Monday, February 28:

Equity and indeed global financial markets remain spooked by a ramping up of rhetoric over the weekend as the Russia-Ukraine conflict threatens to spill out into another episode of the Cuban Missle Crisis. For younger readers, this was as close as the globe has gotten to a nuclear armageddon as Russia and the US faced off over missile deployments in 1962 Cuba.

Risk assets this morning are significantly lower as Russia put its nuclear deterrent forces on high alert. European equities are down in the region of 2% to 3%. Bond yields continue to fall as the threat of recession continues to increase, especially in Europe which is highly reliant on Russia for gas supplies. Gas prices in Europe are up 60% in two days. This has led to bets on an ECB rate hike this year diminishing. Russia hiked its interest rate to defend the collapsing Ruble, which fell to an all-time low versus the surging, safe-haven dollar. All eyes turn to the Chinese now to see how they manage the situation.

Barely do we write this piece when fresh geopolitical news comes out to change things. The most significant headlines are likely to come from talks between Russia and Ukraine taking place today at the Belarus border. Ukraine has asked to join the EU pronto, but the EU responds that this is not a quick process. The IEA has agreed to release 70 million barrels of oil this week, according to the WSJ.

Oil is currently at $96, up 4%, while European gas prices are up nearly 30% today. The dollar is at 1.1186 versus the euro, while the Dollar Index reaches 97.03 and looks likely to make a yearly high. Gold is at $1,908, and Bitcoin is at $38,000.

European markets are lower: Eurostoxx -3%, Dax -1.8% and FTSE -2%.

US futures are also lower: Dow, Nasdaq and S&P are all down 1.2%.

Wall Street Stock News (SPY) (QQQ)

IEA to release up to 70 million barrels of oil this week, according to WSJ.

Ukraine-Russia talk underway at Belarus border.

Ukraine asks to join EU immediately.

Russia puts nuclear deterrent forces on high alert.

Ruble falls to record low versus dollar, Russia central bank hikes rates to 20%.

Western central banks cut Russian Central Bank access to foreign currency reserves.

Berkshire Hathaway (BRK) reports record profit.

BP to sell 20% stake in Rosneft, shares fall 7%.

First Horizon (FHN) surges on being acquired by Toronto Dominion (TD).

Lucid Group (LCID) earnings out after the close today.

Renewable Energy Group (REGI) to be bought by Chevron (CVX).

Zoom Video (ZM) earnings out after the close.

Smile Direct (SDC) earnings out after the close.

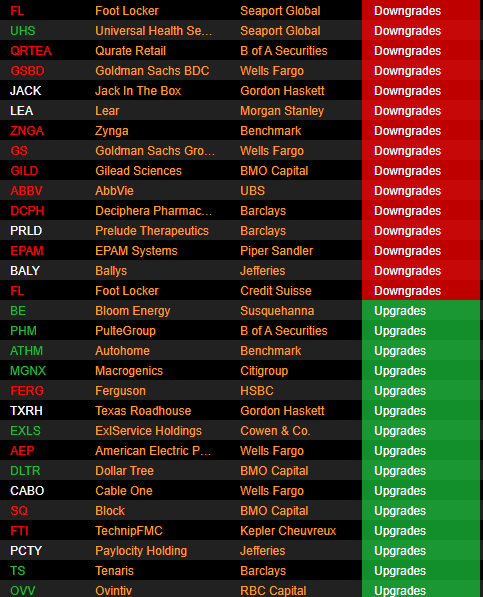

Upgrades and Downgrades

Source: Benzinga Pro

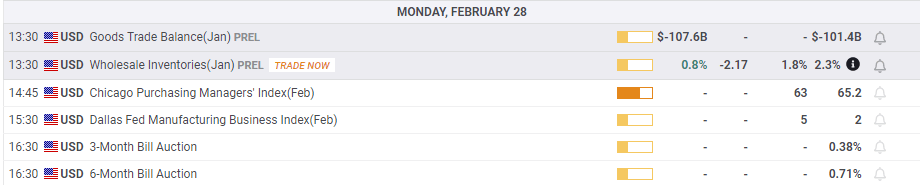

Economic releases

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.