Wake Up Wall Street (SPY) (QQQ): Employment looks like it will see the Fed stay the path

Here is what you need to know on Friday, September 2:

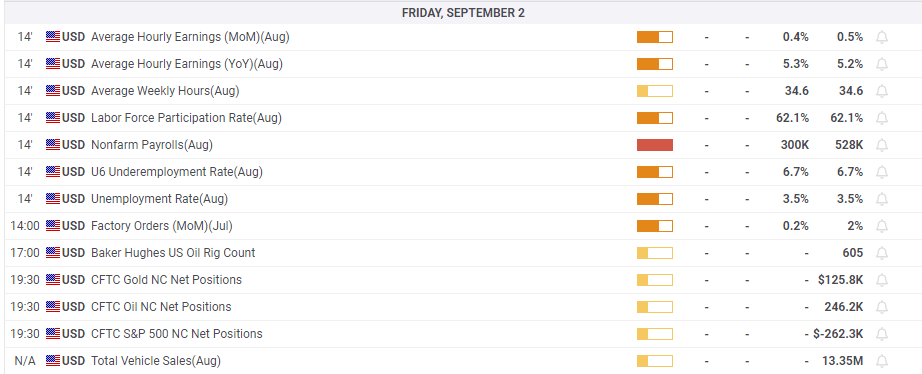

We type with the employment data just out and to be honest, it is proving a bit more boring than I thought. I was expecting fireworks, but what we got is a bit of food for both camps.

The unemployment rate is up, a point for bears and doves, but the actual number of new jobs is still high. Remember, while commentators are focusing on what this means for the September Fed meeting, the more important data is in the bond market. The 10 and 20-year yields are outpacing the front end of the curve as the Fed has been banging the table that rates need to stay higher for longer. Interestingly, the White House has also been banging this drum. All that means the Fed may only hike by 50 basis point, but if bond yields keep rising that will still mean equities will come under valuation pressure.

The immediate reaction was stocks up, dollar down, and this could continue based on pure profit-taking and position closing ahead of the weekend. So far this to me looks like it leaves the door open for higher yields and a 75 bps move in September, so this sets up next week for a report from this week. Stay tuned!

The dollar index is at 109.3 now, having weakened initially. The yield curve is steepening. Gold is at $1,707, Bitcoin trades at $20,200, and oil sits at $89.

European markets are higher Dax +2%, FTSE +1% and Eurostoxx +0.5%.

US futures are higher: Dow, S&P, and Nasdaq are all +0.5%

Wall Street top news (SPY)(QQQ)

US employment rate rises to 3.7%, nonfarm +315k.

G7 to cap the price of Russian oil.

Eurozone PPI up 37.9% year on year oopps!

Starbucks (SBX) gets a new CEO.

Lululemon (LULU) issues strong guidance as earnings beat.

BYD continues to be sold by Berkshire.

Broadcom (AVGO) is also the same as above with strong earnings and guidance.

Pager Duty (PD) is up on strong earnings.

Amazon (AMZN) wins another union case as NLB says Staten Island should be upheld.

Equinor (EQNR) exits Russia.

Meta (META) signs with Qualcomm for chips for Quest VR devices.

Ryanair (RYAAY) flies record passengers for August.

Upgrades and downgrades

Economic releases

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.